In this week’s episode...

[00:40] Exhibit A-C: Oil, Gas, & Macro

Hunt discusses the unusual behavior of oil in the market, emphasizing its large surplus capacity. The scenario with natural gas is contrasted, noting its struggle due to the fact that supply continues to outpac demand. The conversation touches the broader fiscal landscape, including the challenges the U.S. government faces regarding deficit and security financing.

[03:53] Who can double cashflow in next 3-5 years?

The chapter delves into potential companies that could see significant progress in their free cash flow over the next 5 years. Tesla and NVIDIA are highlighted, while Celsius and Vertex are also discussed as having the possibility of significantly growing free cashflow. The focus is on understanding the growth prospects of these companies and the factors that might influence their financial trajectories.

[23:45] The Basis Trade

This chapter delves into macroeconomic factors, highlighting a concerning article from the Financial Times about the repo market's use by hedge funds in interest rate futures. For more on this, check out this FT article.

The Memo

Supplemental Data

1. SuperCompounders

This is a list of all the companies covered in the memo. We calculate Total Return for each company assuming you had bought the stock at the average price during the first year of the IPO and reinvested the dividends. This is not a ranked list of our favorite investments, rather it is meant to provide additional insightful information on the companies we discuss each week (note: ‘Page’ references the page of the memo on which you can find the company).

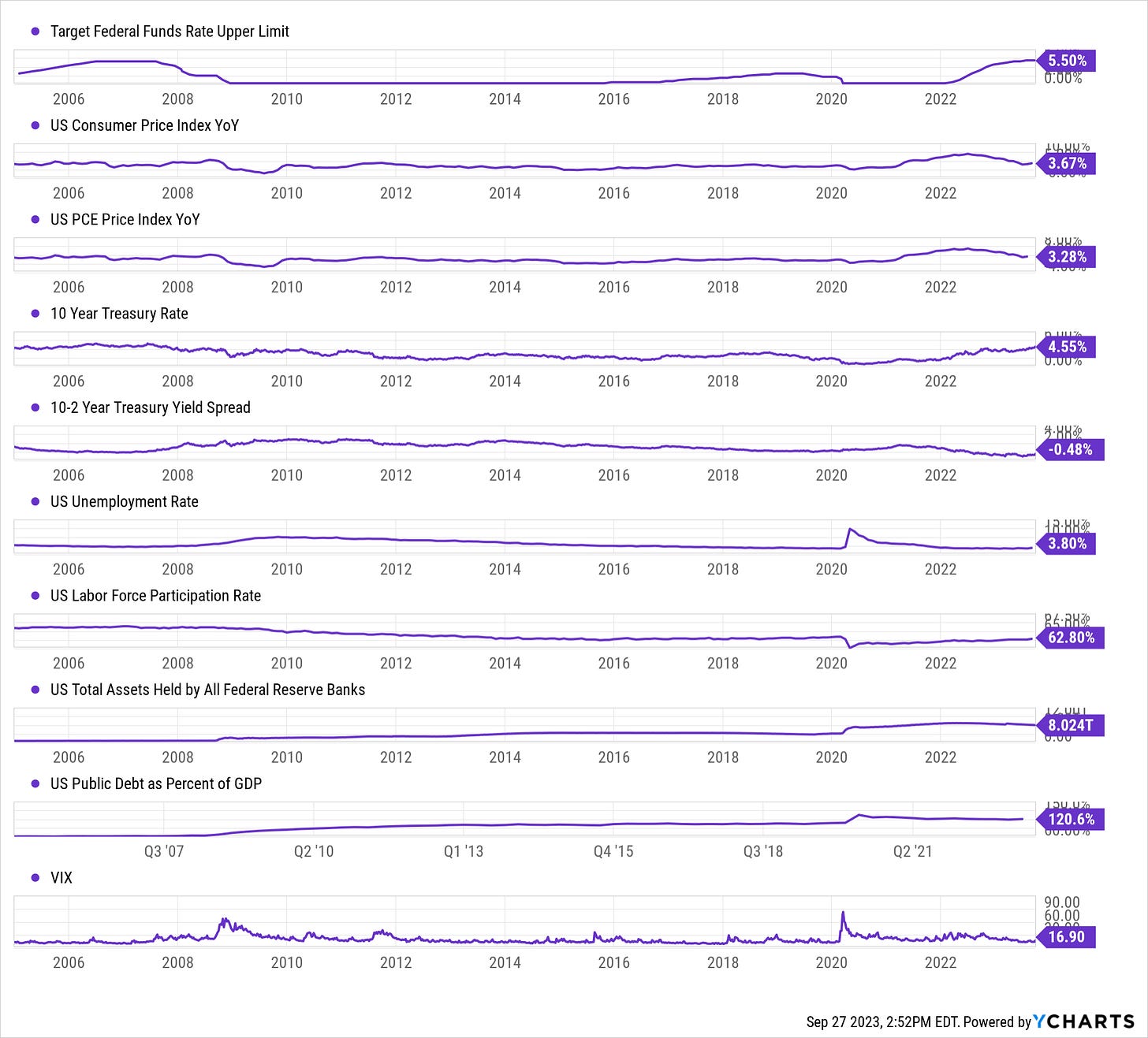

2. Macro

3. Energy

4. Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductor Industry Association Global Billings Report

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Share this post