If you are new, welcome! If you haven’t subscribed, join crew by subscribing here:

🎧 To listen to the podcast, click play button above or listen on Apple Podcasts, Spotify, or SoundCloud. Keep reading for supplemental data to accompany the podcast.

This newsletter is designed to complement the podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What are Telltales? post.

If you know someone who could benefit from Telltales, please share it by clicking here:

Weekly Email Format Updates

You will notice a slightly revised email format (beginning with episode 2023.22) - that’s because we’ve moved our podcast hosting from Soundcloud to Substack (the same company that hosts this newsletter). This change should not affect your normal listening routine. If you have any issues or questions, feel free to reach out directly.

Podcast Chapters

[00:01:20] Discussion on Oil Prices and World Economy

[00:06:08] Review of 20 Pager

[00:12:50] Google & Microsoft Earnings GOOG 0.00%↑ MSFT 0.00%↑ GOOGL 0.00%↑

[00:14:39] Discussion on Nvidia's Position, CUDA, AMD’s ROCm and AI Chips Demand NVDA 0.00%↑ TSM 0.00%↑ AMD 0.00%↑ INTC 0.00%↑

[00:21:45] Discussion on Biogen's Alzheimer's Treatment and Financial State BIIB 0.00%↑

Supplemental Data

0. The Memo

1. SuperCompounders

This is a list of all the companies covered in the memo. We calculate Total Return for each company assuming you had bought the stock at the average price during the first year of the IPO and reinvested the dividends. This is not a ranked list of our favorite investments, rather it is meant to provide additional insightful information on the companies we discuss each week (note: ‘Page’ references the page of the memo on which you can find the company). Naturally, it is harder to compound capital at a high rate (see IRR) over longer periods of time, so it is not surprising to see companies like MRNA 0.00%↑ near the top of the list with only ~4 years as a public company.

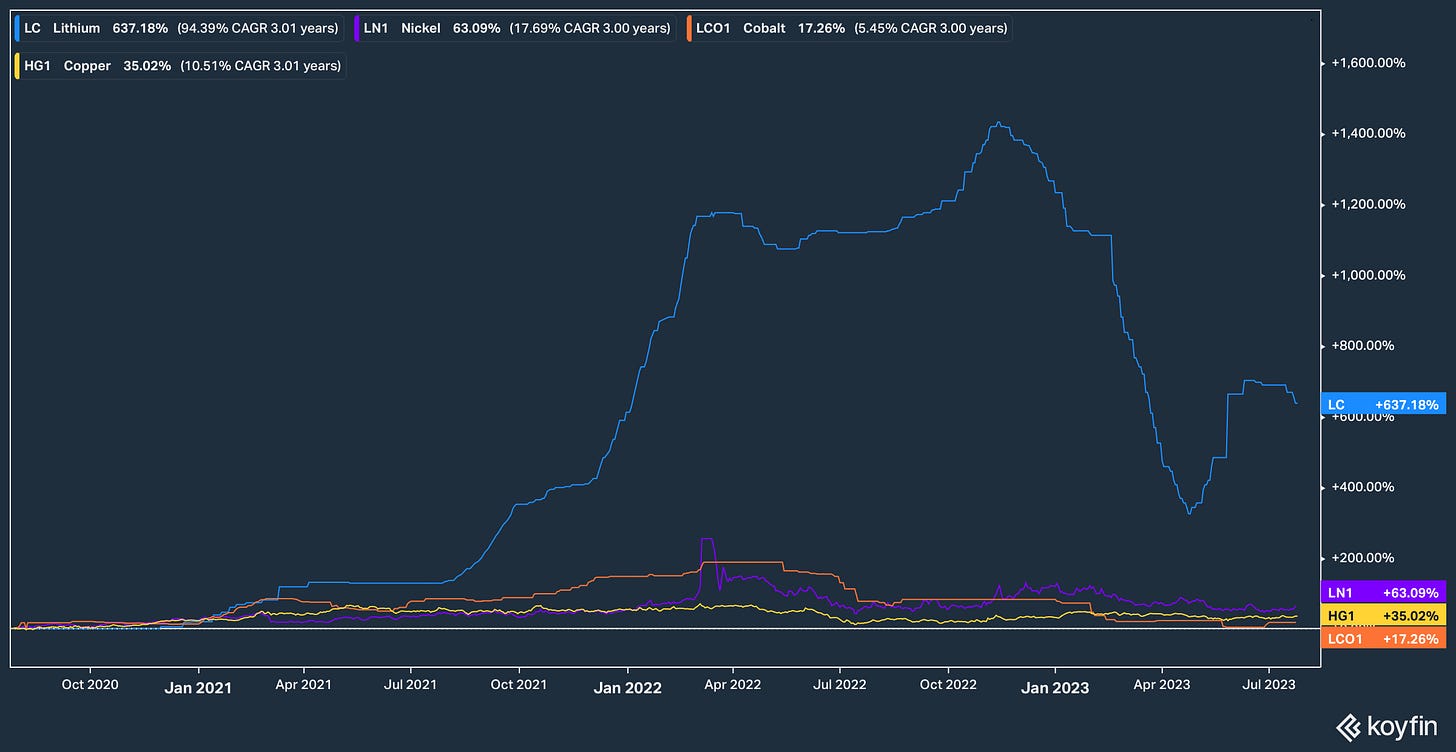

2. Macro

3. Energy

4. Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Share this post