E2242 - Qualcomm - October 19, 2022

Wrapping up our chip segment with Qualcomm. Next week: Netflix

If you are new, welcome! If you haven’t subscribed, join crew by subscribing here:

🎧 To listen to the podcast, click play button below or listen on Apple Podcasts, Spotify, or SoundCloud.

This newsletter is designed to complement the podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

If you know someone who could benefit from Telltales, please share it by clicking here:

Qualcomm

This week we discussed Qualcomm. You may not realize it, but you are a downstream customer of Qualcomm because they get royalties on practically every mobile phone in the world.

Qualcomm is known for pioneering CDMA technology. This CDMA technology, interestingly, had its roots in a patent that was donated to the US government by its authors (an actress1 and a musician2) during World War II. The patent was for a system which enabled sending encrypted messages to torpedoes to circumvent traditional methods of signal jamming - the concept, known as ‘frequency hopping’ broke the conventional mold of communicating over a single frequency. Ultimately, this patent was the genesis for spread spectrum technology and eventually CDMA, which Qualcomm invented and pioneered.

Qualcomm’s CDMA technology enabled low power, efficient, digital, and secure communication. It was easily an order of magnitude better than the existing technology, so the company quickly disrupted the industry. This expertise in digital signal transmission translated well to developing low power consumption chips for mobile phones, for which Qualcomm utilizes ARM architecture and is ARM’s largest customer. Interestingly, and as discussed on the podcast today, ARM is suing Qualcomm - read more on that from FT.

Today, Qualcomm’s business model boils down to collecting licensing royalties for the intellectual property portfolio which makes mobile communication possible and selling chipsets for use in mobile phones and other devices. As a result, nearly every mobile phone produced generates revenue for Qualcomm - even if it doesn’t have a Qualcomm chipset or modem.

Key Risks

Customer Concentration - Over time, the smartphone business has consolidated and as a result, Qualcomm is dependent on a relatively small number of customers which each make up a large percentage of their revenue. Back in 2019, Apple, Qualcomm’s largest customer, settled a dispute with Qualcomm over their modem licensing, but litigation continues.

China Risk - China has unilaterally renegotiated ARM licensing fees on behalf of the Chinese companies subject to them as recently as 2015. This could be one way in which China strikes back at the US in retaliation for the semiconductor sanctions discussed in previous weeks

Smartphone Market Growth - Qualcomm’s cashflow is highly indexed to global smartphone shipments which have plateaued over the past few years. New growth seems to be mostly indexed to new product developments.

Valuation

Other Market Data

Here is a comparison of the Qualcomm and some of the other companies we’ve discussed, and a few charts on the smartphone market….

Supplemental Data

1 SuperCompounders

2 Macro

China Abruptly Delays GDP Release During Communist Party Conference (WSJ)

3 Energy

3.1 Oil & Gas

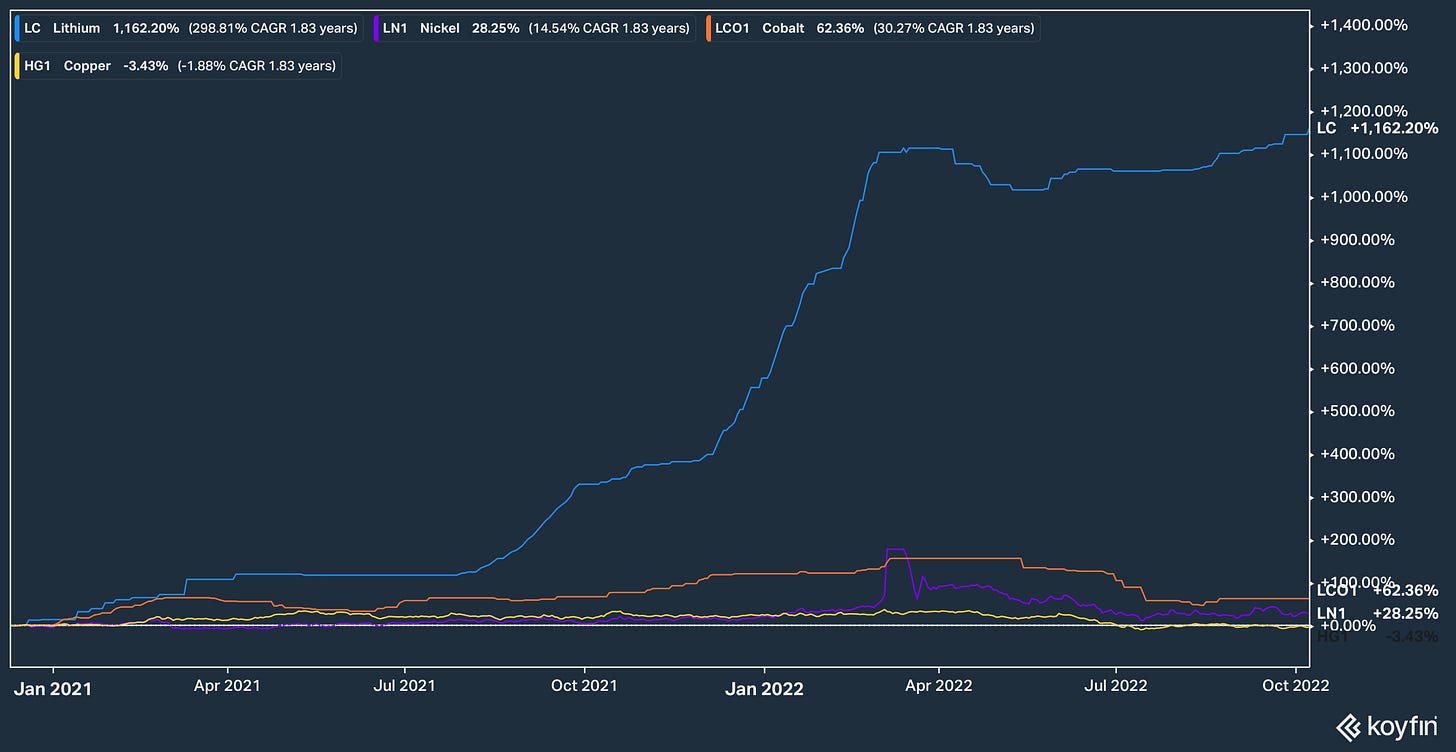

3.2 Metals Powered

4 Tech

Intel's Mobileye Reportedly Mulling Substantially Lower IPO Value (CNET)

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

The actress, Hedy Lamarr, according to IMDB, is regarded by as the most beautiful woman ever to appear in films. She is known for Samson and Delilah (1949), Dishonored Lady (1947) The Strange Woman (1946), Her Highness and the Bellboy (1945), and Ecstasy (1933) among others.

George Antheil was a composer and pianist. He wrote music for films, which is how he got connected to Hedy Lamarr, and numerous compositions ranging from symphonies to piano sonatas.