If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Subscribe to this newsletter to stay up to date!

This week we discussed Microsoft. Check out E2227 for the breakdown of the Microsoft valuation. Since results were approximately in line, my perspective doesn’t change.

This week I also mentioned Howard Mark’s new memo. Howard Marks is not only a great investor, but is also great at articulating his ideas. The memo he released this week is called “I Beg to Differ”. TLDR;

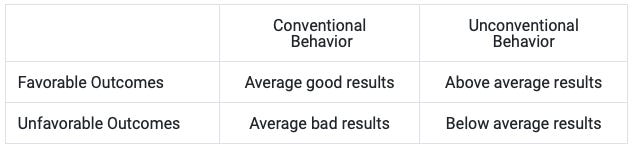

Marks presents a 2x2 matrix on investment results which he initially wrote about in a 2006 memo called “Dare to Be Great”.

Passive Indexing (i.e. conventional behavior) and Active Management (unconventional behavior1).

By focusing on the very long term, Active Managers can have a distinct advantage vs short term focused investors.

Many investors (both institutions and individuals) are relatively insulated from the risk of sudden withdrawals and therefore can (and should!) focus on the long term.

Supplemental Data

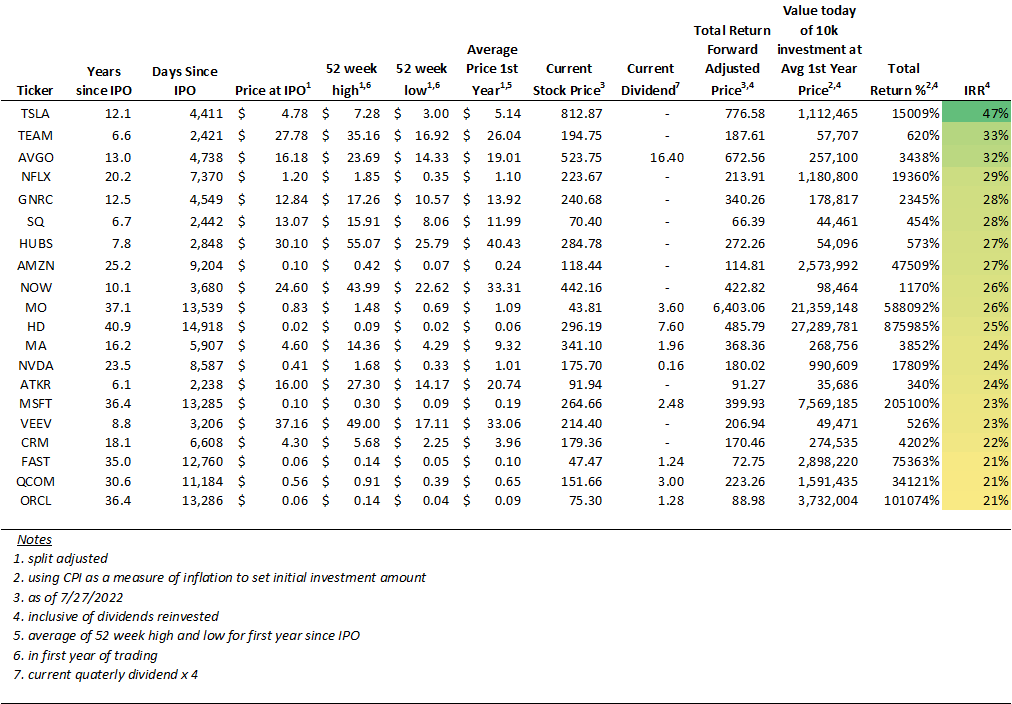

1 SuperCompounders

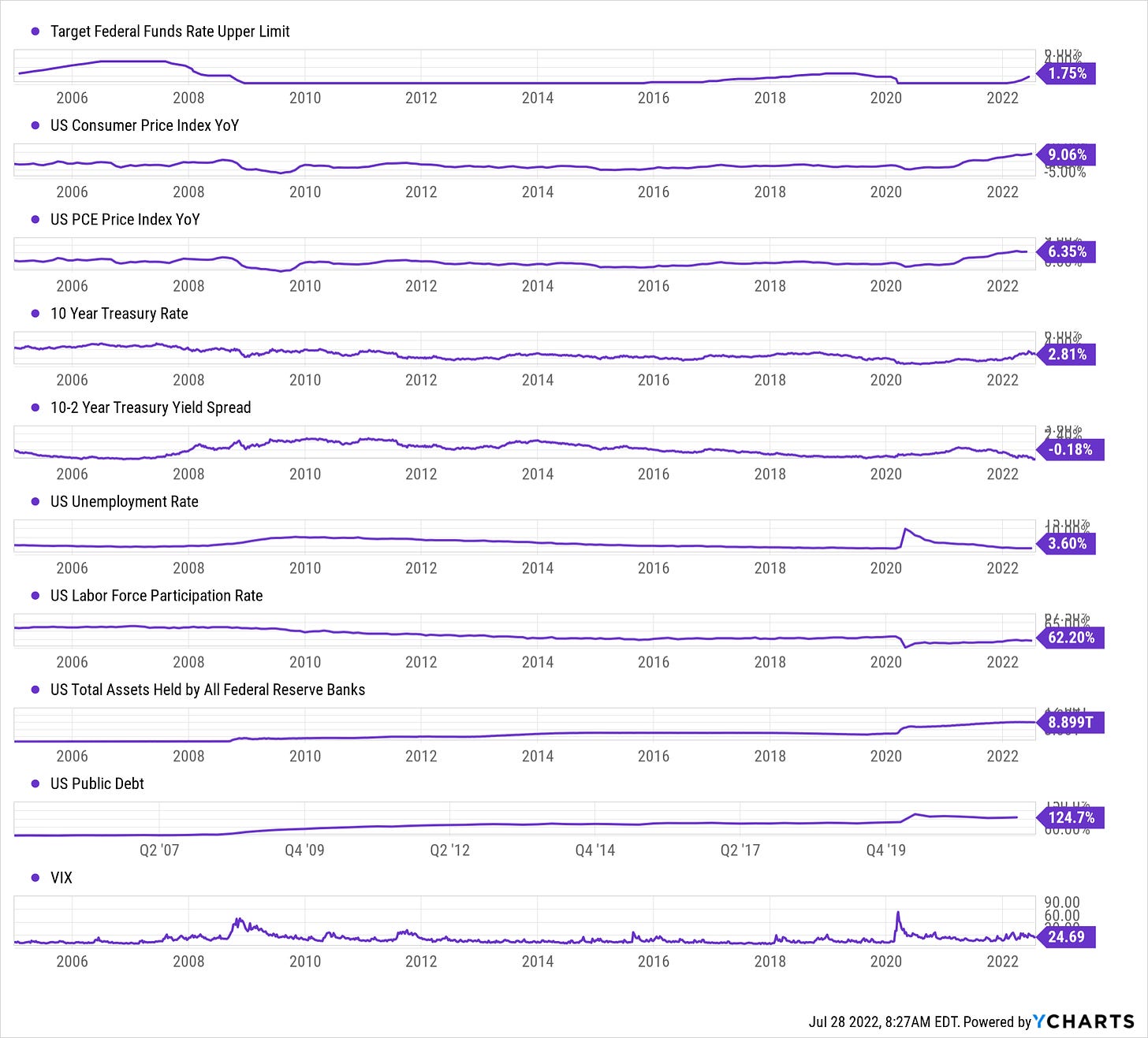

2 Macro

3 Energy

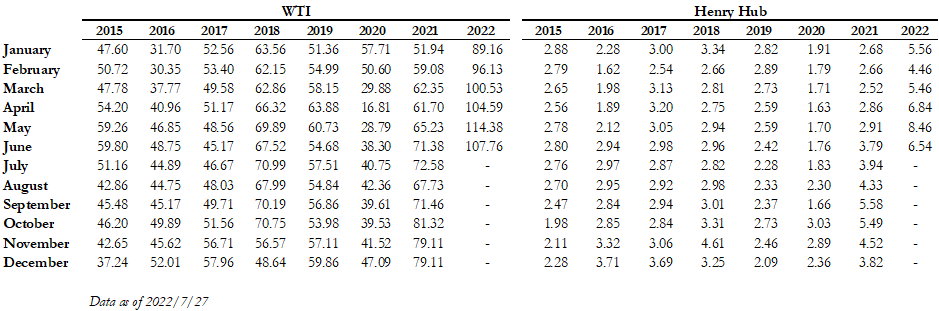

3.1 Oil & Gas

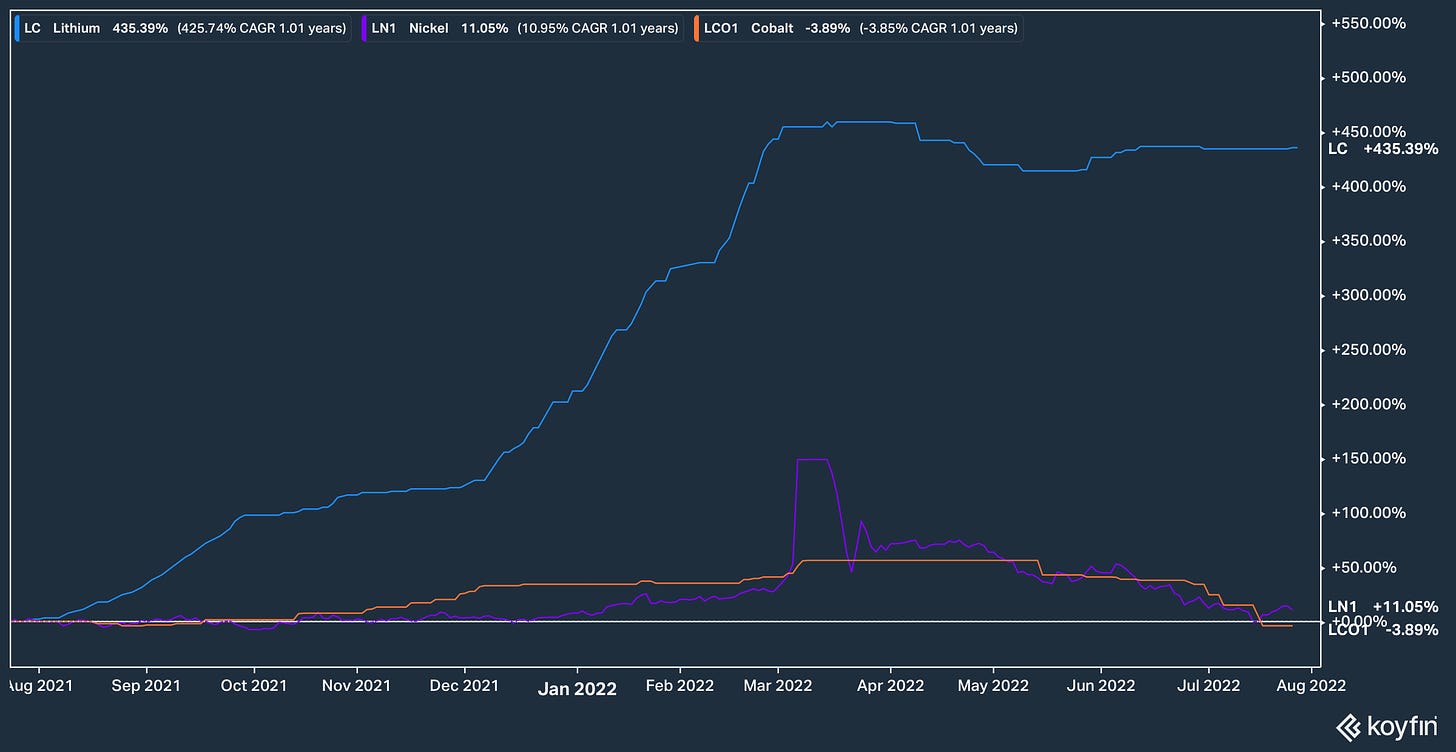

3.2 Metals Powered

4 Tech

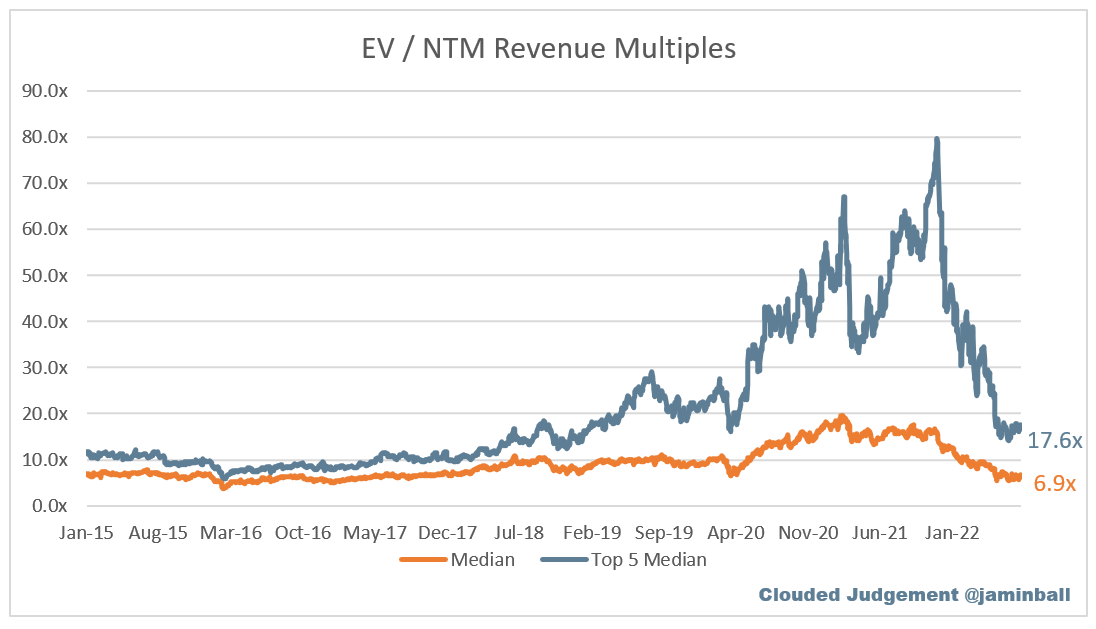

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

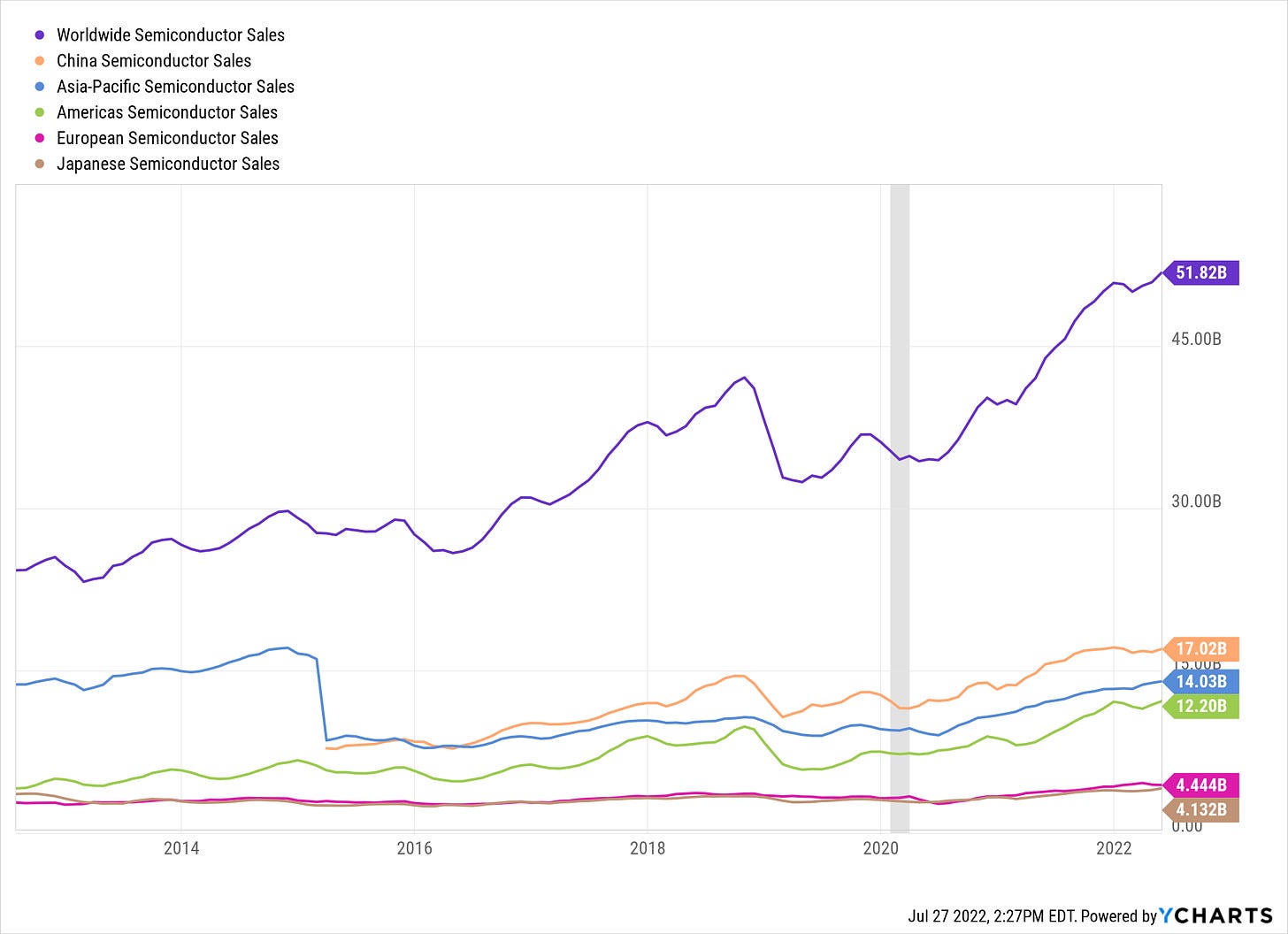

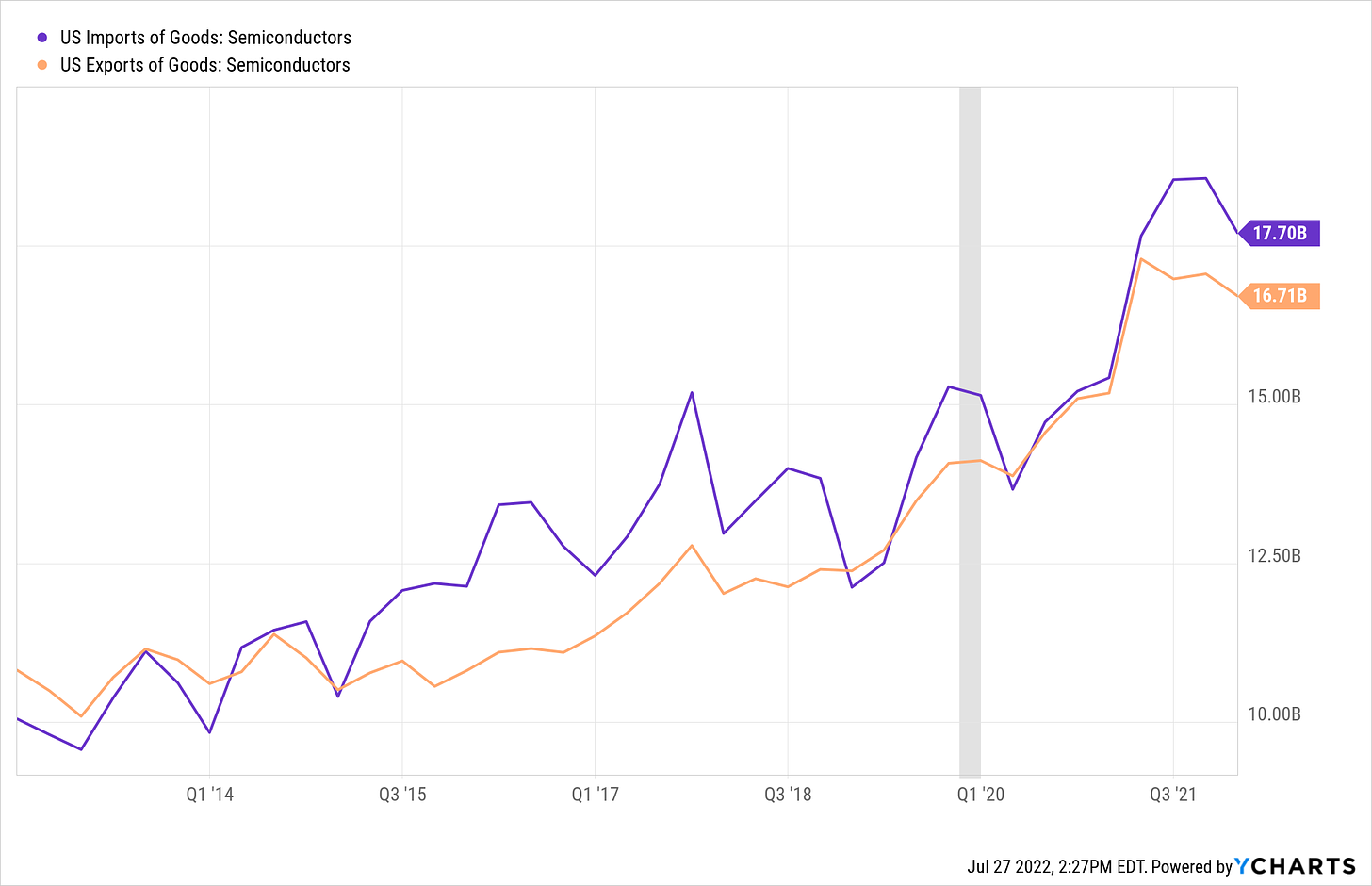

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

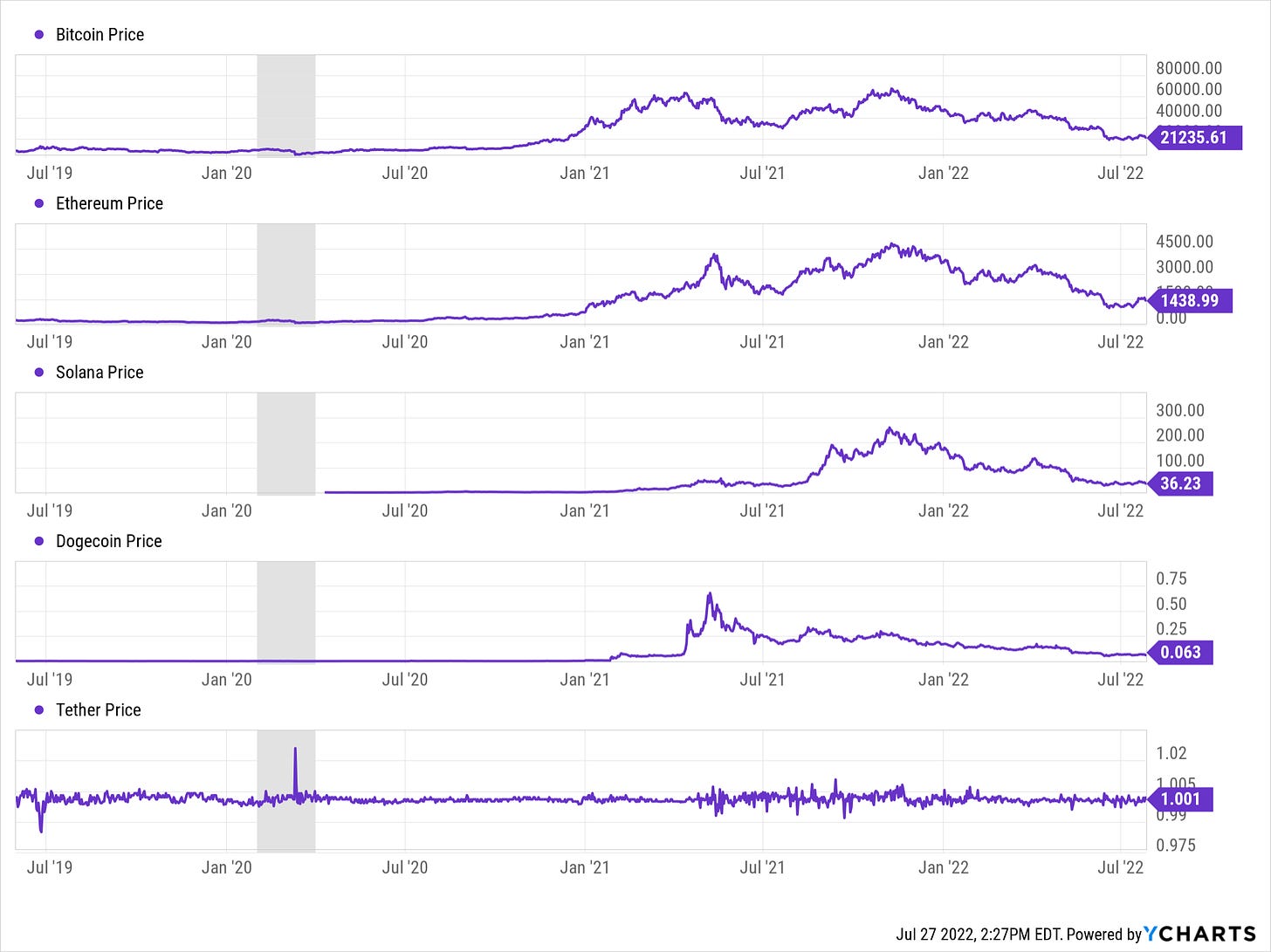

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Note that many active managers in public markets are closet indexers, so choose your active manager carefully