If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Subscribe to this newsletter to stay up to date!

Microsoft Free Cash Flow Valuation

Remember the two questions Hunt proposed for assessing a stock…

Can I buy the stock at a 5% free cash yield (i.e. 20x FCF / sh)?

Can the company grow free cash flow at 10-15% per year?

We will look at both of these questions today as it relates to Microsoft.

Can I buy the stock at a 5% free cash yield (i.e. 20x FCF / sh)?

Note: I’m using analyst estimates for FY221, rather than run-rate based on the previous quarter. Numbers in billions, except per share data.

Microsoft is expected to do $73 for FY22 (ended June 30, 2022).

Adding back non cash expenses, depreciation ($14) and stock based comp ($7.4), you get an adjusted cash from operations of $94.4

Normally we’d reduce this by capex, but in this case capex ($22.8) is greater than depreciation ($14), so we will reduce our adjusted free cash flow by depreciation instead. In other words, we are assuming the additional capex is invested in future growth. Adj. Free Cash Flow = $80.4

7.5 (billion) shares outstanding → 10.72 FCF per share.

At 20x FCF → $214.4 per share

Cash & Equivalents ($91) net of debt ($48) is $43, or 5.73 per share.

Adding cash to the 20x free cash value, you get a target price of $220.

Repeating this analysis on FY23 expected numbers, you get a value of $251

Microsoft is currently trading above these targets, but keep these in mind as companies report on Q3.

Can the company grow free cash flow at 10-15% per year?

This question probably warrants a longer discussion than we have time for here. Nonetheless, analysts are predicting 10%, 17%, and 17% for adj. Free cash growth for FY ‘23, ‘24, and ‘25 respectively2.

Supplemental Data

1 SuperCompounders

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

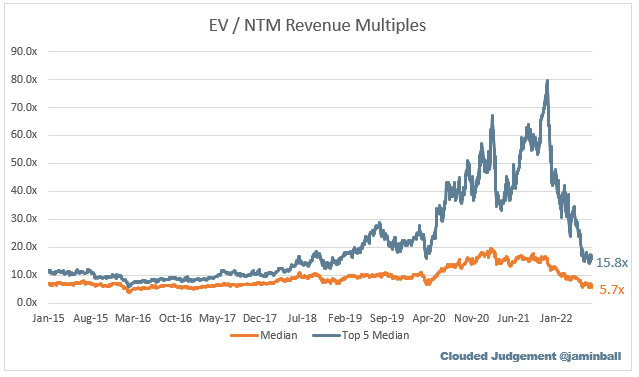

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Morgan Stanley Research update 6/7/22

calculated using the same method as above using Morgan Stanley Research update 6/7/22