If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Facebook valuation, ATT implications

On the call we recapped Tesla and Amazon, then took a high level look at Apple and Facebook. To understand Apple and Meta (aka Facebook), you need to understand App Tracking Transparency (ATT). Long story short, Apple is making it harder for advertisers to target and measure advertisements. This negatively affects Facebook particularly, because Facebook users depend on Apple and Google devices to utilize the app. As a result, the small businesses that use Facebook to reach their customers are finding it harder and more expensive to turn advertising spend into revenue.

There are many articles available on ATT, but this one by Eric Seufert will give you a good understanding of the implications from the digital advertisers perspective.

Before I get started, you’ll want to review the latest 10-K and 10-Q.

ATT is having clear effects on Facebook’s business. In Q1, gross margins were down to 78% from 81%. We are also seeing increased spending on AI technologies (both Capex and Opex) estimating Operating income will decrease from 40% to 30%. Applying these percentages to the average analyst revenue estimate for Facebook of $126B, you get Operating Income of $37.8B and Net Income of approximately $31B1. As we did with Tesla in E2223, we will assume depreciation = capex2. Share based compensation is ~$10B per year - adding that to NI, we have $41B in free cash flow. With 2.7B shares outstanding3, that comes to just over $15 / share. 20 x $15 = $300 / share. From this perspective, the current valuation ~$158 is attractive.

Now lets assume you don’t like that Zuckerberg is spending $10B per year on the meta verse. We can discount this from the valuation and see how it stacks up… Take our owner earnings approximation for free cash flow of $41B, subtract $10B as a metaverse penalty and you have $31B. $31B / 2.7B shares = ~$11.5 per share. 20 x 11.5 = $230 / share. Still less than the current share price of 158.

The current share price reflects a forward FCF multiple of ~14x.

So, back to our framework which we discussed last week, the next question we need to ask is…

Can Facebook can grow FCF at 10-15% per year?

We will dig in to this next week…

Supplemental Data

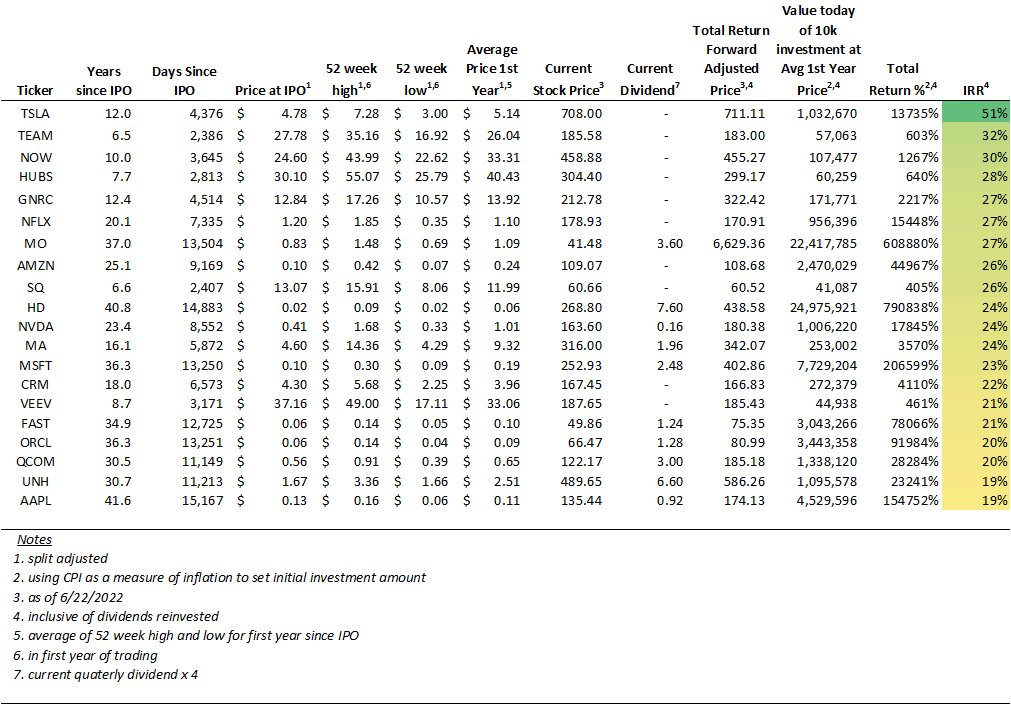

1 SuperCompounders

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Assumes 17% tax rate

I’m not certain this is a great assumption, given the fact that the AI investments, which involve building a custom Nvidia powered AI data center, are probably accelerated due to ATT. More thought is needed here. The company is expecting full year 2022 capex of $29-34B. In other words, traditionally measured free cash flow will likely be somewhere around $10B.

Facebook repurchased $9.3B in shares last quarter. We expect that they will continue buying at least enough to offset issuances from stock based compensation.