If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts or Spotify.

Subscribe to this newsletter to stay up to date!

A Framework for Selecting Supercompounders…

This week we discussed a relatively simple framework for selecting investments.

Find (1) high quality companies that are (2) generating 5% free cash yield and (3) increasing free cash flow by 10% or more each year. This gets you to a 15% growth rate, which, holding all else constant should double your investment in 5 years.

The definition of High Quality Company is rather amorphous. Some practitioners refer to it as competitive advantage, or moat. But at the end of the day, there is something about the business that enables it to command higher prices and higher margins than would be competitors. We could spend a month, or even a year covering business models and competitive strategy. For those interested, here are a few resources I’ve enjoyed over the years…

Stratechery - a blog about tech and strategy

Competition is for Losers - a recording of a Stanford class taught by guest lecturer and renowned investor, Peter Thiel

The Innovators Dilemma - and practically anything written by Clayton Christensen.

Generating a 5% free cash yield is a high bar, even in today’s market. When looking at different businesses, it is important to keep in mind how much debt a company has. Highly leveraged businesses often generate substantial free cash flow to the firm, but after debt service, not much is left for equity. Many companies will generate >5% free cash yield, but few are also able to accomplish #3…

Growing free cash flow 10% per year is no small feat. This step will require analyzing a businesses ability to scale.

Fitting Tesla into the framework…

Quality - love him or hate him, Elon has created a business that is vastly different than all other automakers. Tesla is easily 3-5 years ahead of other automakers when it comes to EVs. We’ve discussed Tesla the last few weeks so I’m not going to go into too much more detail here.

5% Free Cash Yield. Last week we established Tesla’s quarterly cash flow at $2.2b, or $8.8b on a run rate basis. $8.8b/$673.261 = 1.3% - a far cry from 5%. However, we also calculated the forward free cash flow assuming Tesla produced 2m units. This came to $25b. $25/$673.26 = 3.7%, so we are getting closer. Check out last week’s newsletter for the full breakdown.

>10% Free Cash Flow Growth. Growing cash flows generally involves scaling a business model. For Tesla, this involves scaling factories and building new factories. Elon has said that he believes Tesla will produce 20m cars per year. We don’t know the output of the Berlin and Texas factories, but they will likely be in the range of 500k to 1m cars each. If Tesla adds 1 new factory each year, they will easily increase cashflow by 10%. In fact, assuming that pace, growth wouldn’t dip below 10% until year 10. Now, these are pretty gross assumptions, but you get the point.

We will repeat this process on a bunch of companies over the next few weeks. If you have suggestions on companies to look at, feel free to send them my way.

Supplemental Data

1 SuperCompounders

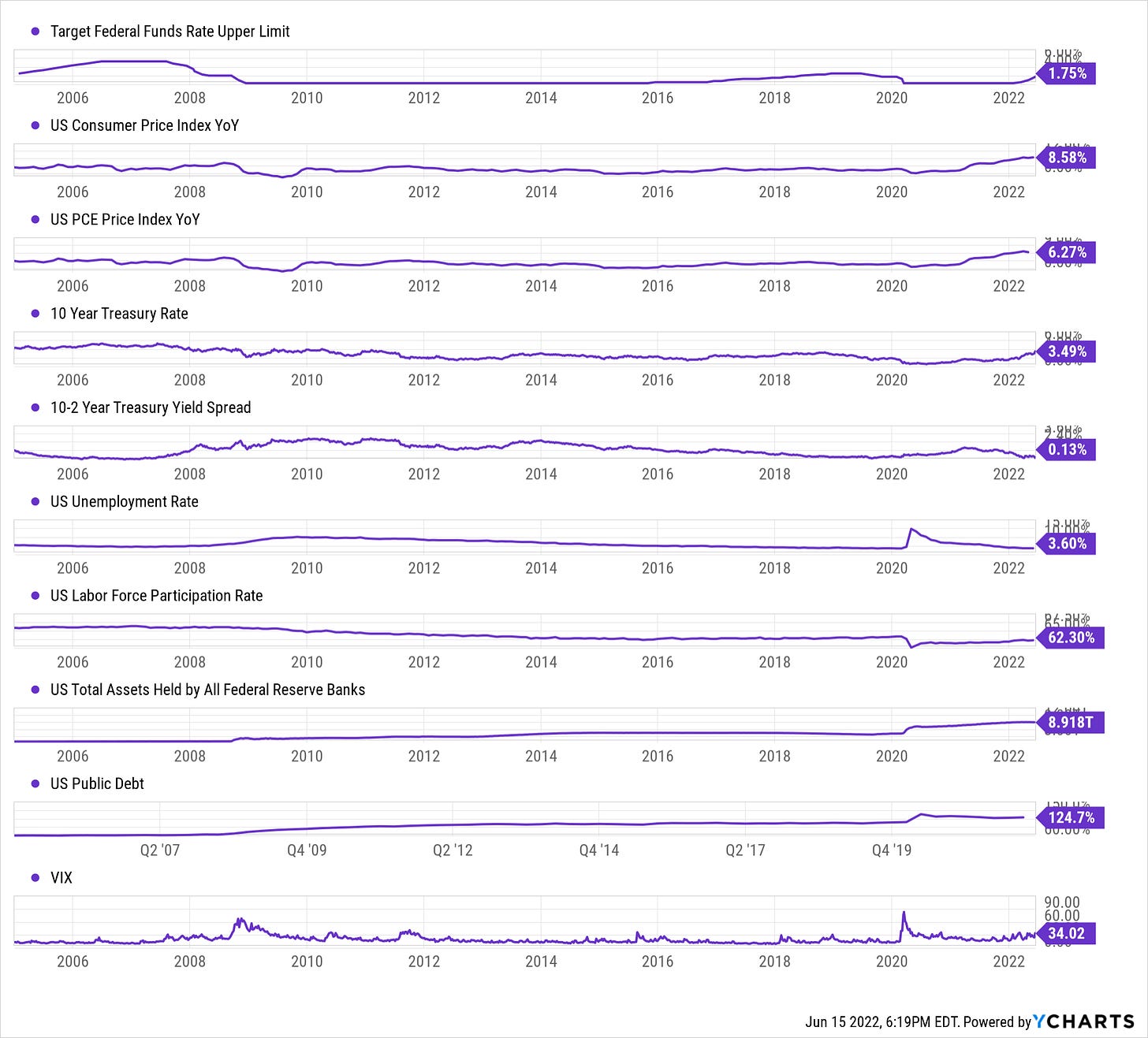

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

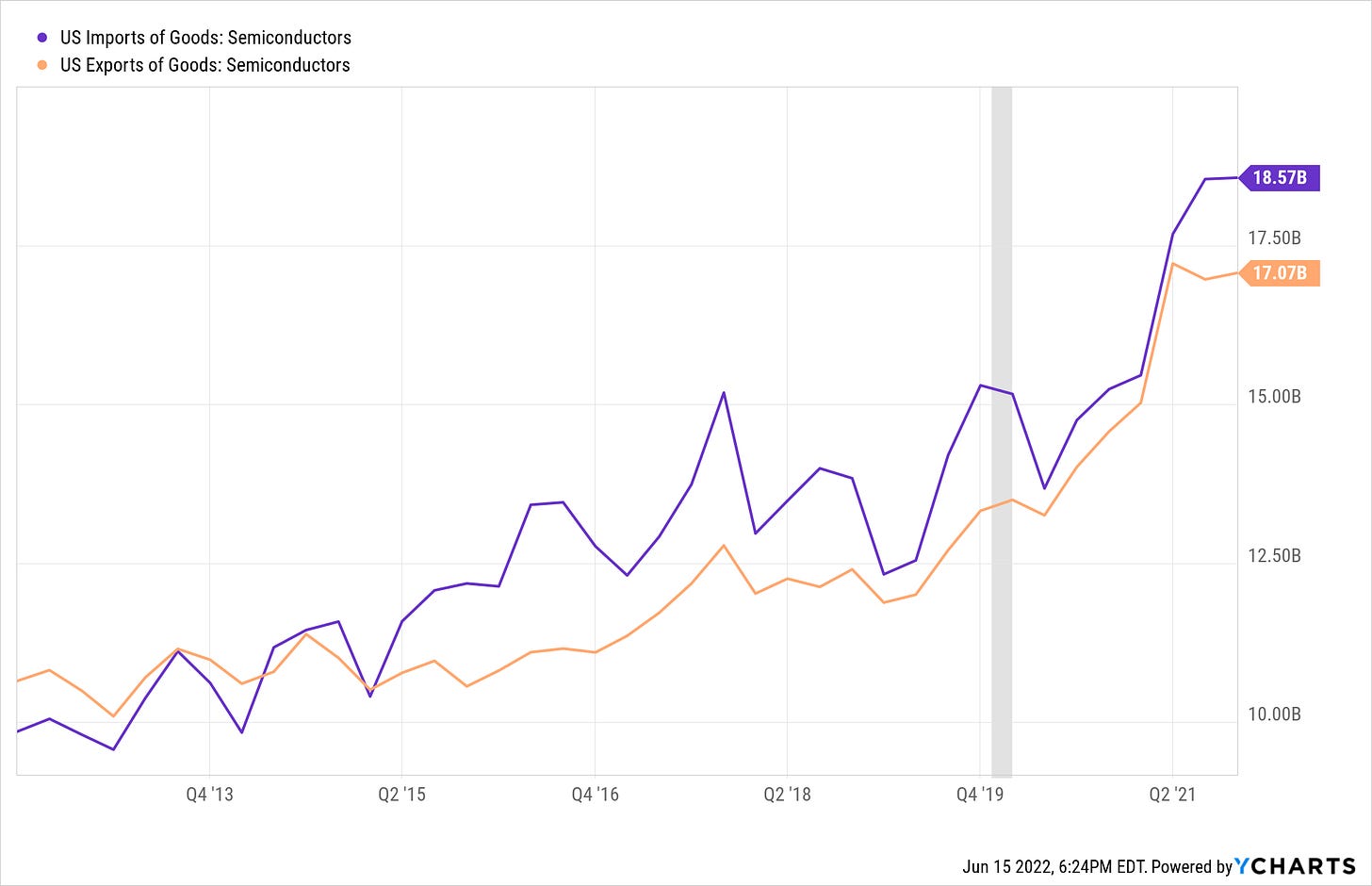

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Tesla Enterprise Value - June 14, 2022