Happy New Year! If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

This week we kick off a new multi-week series on energy & tech. Yes, those are topics we cover every week, but for this series we will be discussing the overlap of energy and tech. We will dig in to electric vehicles, batteries, and other crossover areas.

Keep reading for articles and data relevant to this week as well as the supplemental data I provide every week. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

On Energy & Tech

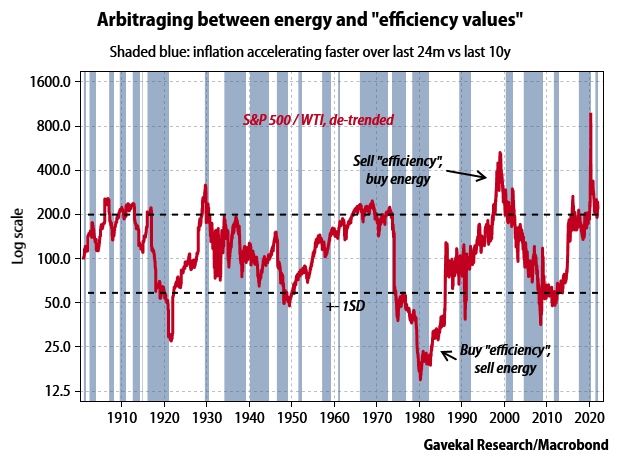

Charles Gave, of Gavekal Research, published another research article this week that built on the article he published, and we discussed back on episode 2148, where he proposed that the S&P 500 has become the global store of value. In this article, he builds on that thesis and proposes that oil could be viewed as a ‘store of value’ and develops a framework for looking at markets today. He makes the following assumptions…

Most economic activity is nothing but energy transformed.

Economic value derives from two main sources: “scarcity” (e.g gold, jewels and paintings) and “efficiency” (e.g. tools and machines).

Energy is unusual in that it has value first because it is scarce, but also because it can dramatically boost efficiency.

US stock market returns are probably the best measure to sum up efficiency values deployable in the future.

Recent monetary experiments adopted in the eurozone, Japan, Switzerland and the US have undermined the world’s main currencies’ ability to be “standards of value” (see Teaching An Old Dog New Tricks).

With this in mind, the S&P 500 could be seen as a gauge as to how efficient we are at converting energy into production capital. By looking at the ratio of the S&P 500 to the WTI crude price, we have a new lens by which to view the current market.

By de-trending the data, he computes the following chart.

… and draws the following conclusion…

In short, bull markets start when energy is plentiful and cheap, while bear markets occur when investors expect energy to stay cheap forever. Put another way, if the capitalist system can transform energy by creating more valued products without raising prices, it is deemed a bull market. Conversely, if energy prices start to rise faster than the system can add value (i.e. faster than the rise in the S&P), the system must raise prices to cover energy costs. In this case, inflation creeps in, demand falls and a bear market unfolds, causing profits in energy-intensive industries to collapse.

Hunt and I discussed this article, and one of the points that could be made is that maybe WTI, the price of crude oil, is not the right measure as to the value of energy. Certainly, it is not the only energy source, and there is a significant amount of effort and technology being invested in moving our energy consumption away from hydrocarbon based fuels.

This sent us down the path of discussing the transition to EVs and infrastructure scale batteries and ultimately seeded the podcast/conversation we recorded on Wednesday. For now I’ll include some supplemental data, including some of the companies and commodities we discussed today, but I anticipate moving it into its own section as a regular part of our supplemental data…

Battery Technology

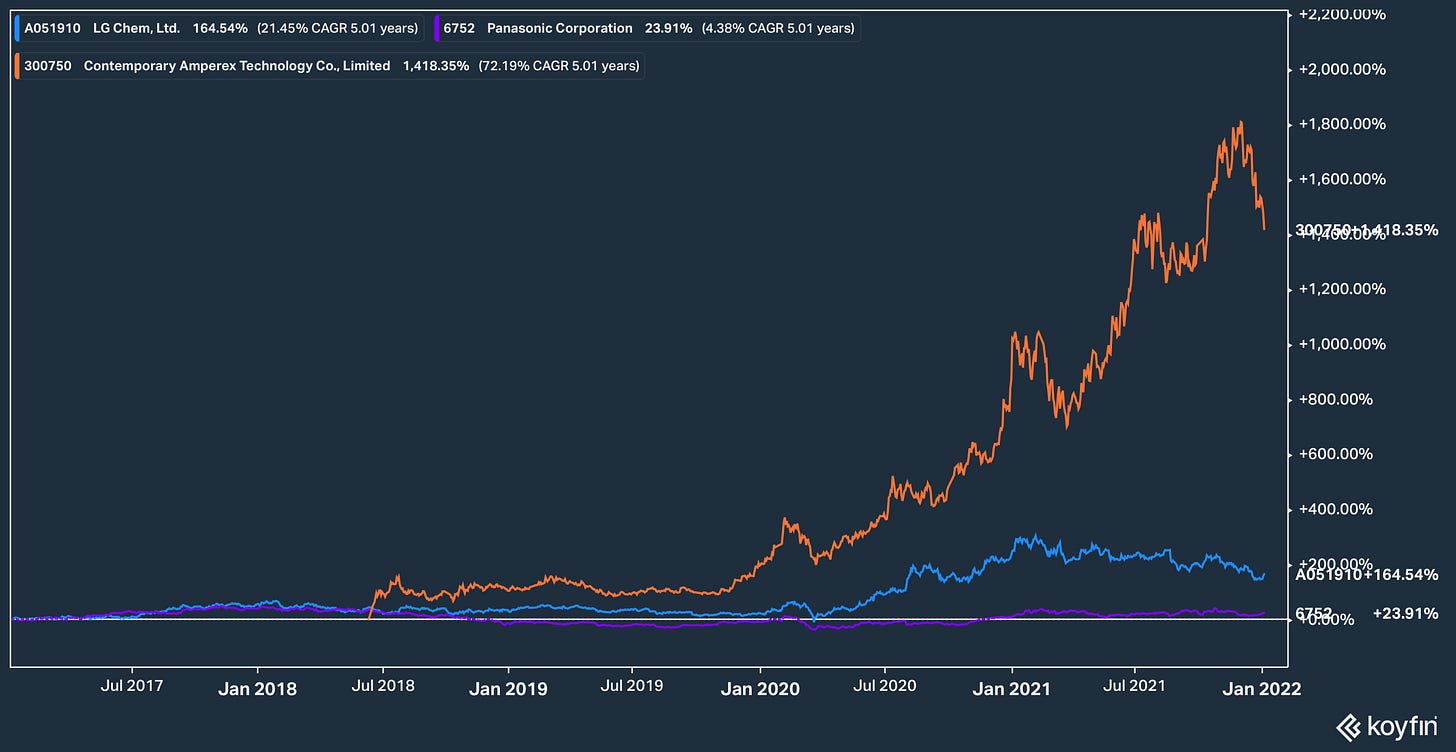

We briefly discussed battery three companies

Panasonic (TSE: 6752), a Japanese conglomerate

LG Chem (KOSE: A051910), the largest Korean chemicals company

Contemporary Amperex Technology Limited (SZSE: 300750) , aka CATL, a Chinese battery manufacturer that specializes in the manufacturing of lithium-ion batteries

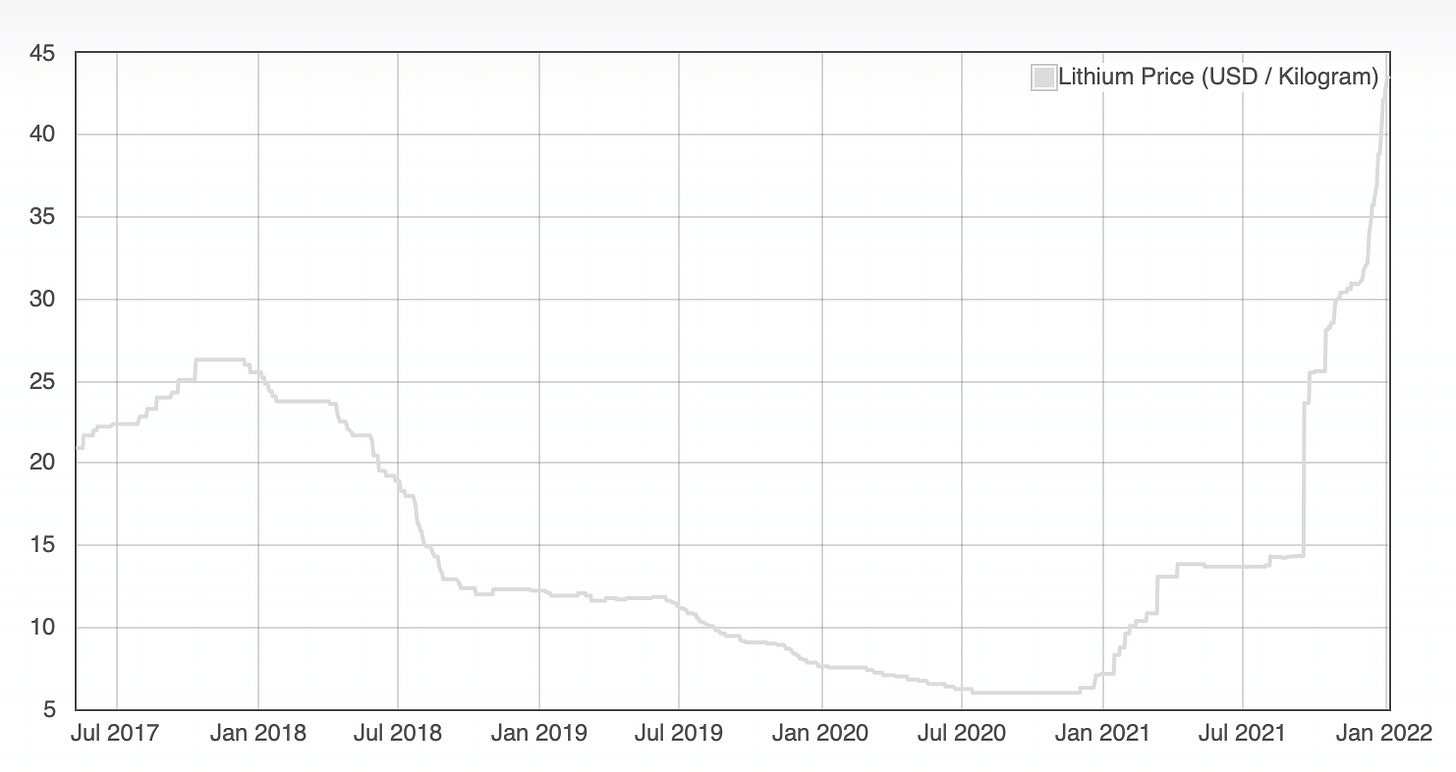

Lithium

The volatility of lithium pricing can be seen in the 5 year chart below.

Albemarle Corporation (ALB) is a chemical manufacturing company that derives 36.6% of revenues from lithium1.

Cobalt

Cobalt, like lithium is quite volatile, and appears correlated to lithium.

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

Supplemental Data

Supercompounders

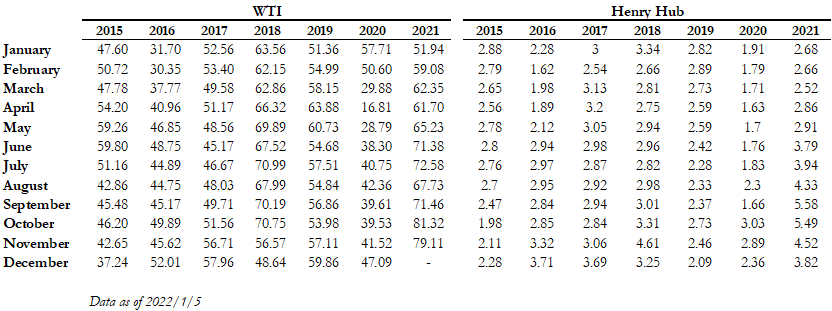

Energy Data

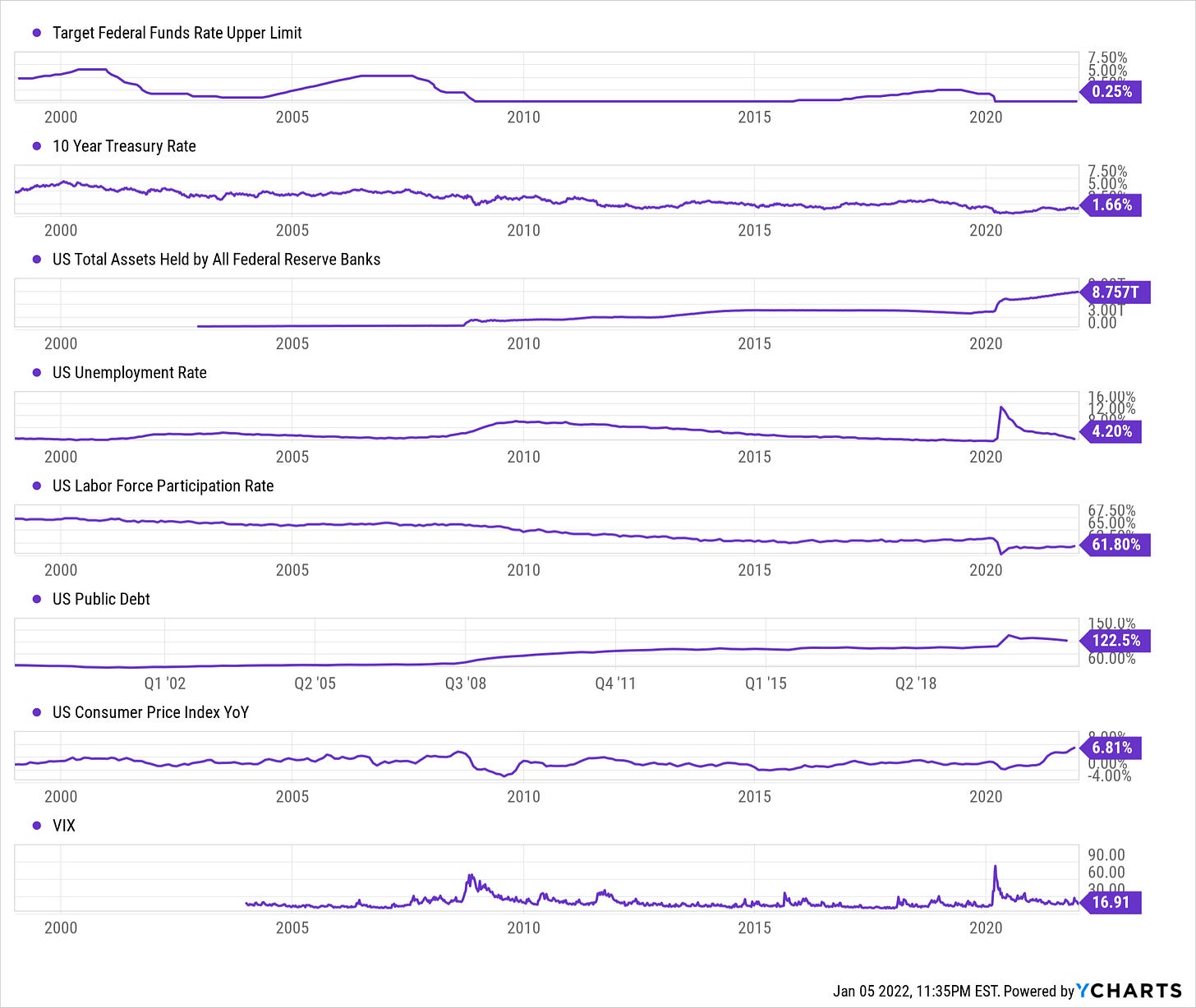

Macro

Tech

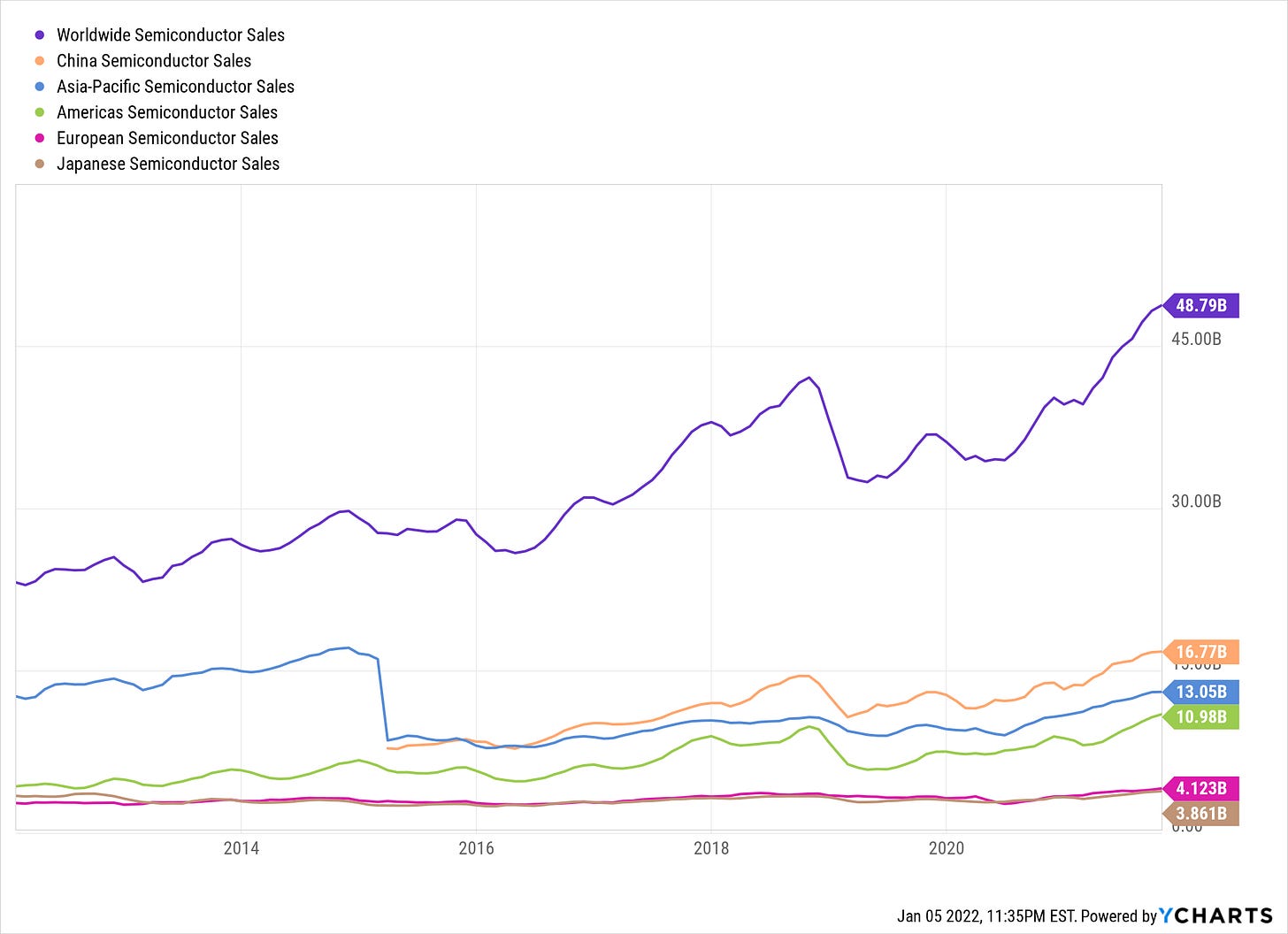

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

Cloud Multiples

Check out the most recent edition of Clouded Judgement for the latest SaaS multiples…

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.