E2148 Debrief B: US Equities as a global store of value?

The valuation gap between the US and the rest of the world has continued to widen

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

We covered a lot of ground on the call this week, so instead of one, very long weekly email, I’m breaking it up into a few parts. This is the second post, and provides a summary of a research article that Hunt mentioned during the podcast. If you are looking for the supplemental data that I provide each week, you can access it here: E2148 Debrief A: Supplemental Data.

Reserve Currency & Store of Value

Charles Gave of Gavekal Research published a research article this week where he said…

… most of the market commentators I like and respect have argued that with US budget deficits continuing to expand, and with the Fed maintaining ridiculously low real interest rates and monetizing the record budget deficits like never before, either the US dollar or the US treasury market - or both - should start to crumble under the twin pressures. Yet, this has failed to happen. Moreover, contrary to most peoples exceptions, the valuation gap between the US and the rest of the world has continued to widen.

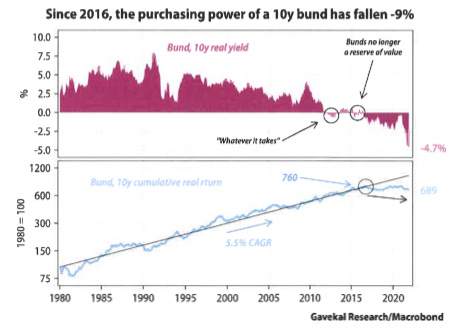

He suggests that the old monetary system (as described by Jacques Rueff in The Monetary Sin of the West) which started in 1960, where the US dollar was the global means of exchange and standard of value and the German Deutschmark (and later, Euro) was the global reserve of value ended in 2012.

In 2011, Mario Draghi took over at the ECB became famous for saying that he would be prepared to do "whatever it takes" to prevent the euro from failing. Gave demonstrates that while Draghi may have saved the euro, he ended the 72 year run of the Deutschmark/Euro being the worlds store of value.

As a result, the previous trend whereby the US current account deficit that previously flowed back to the US in the form of foreign central bank purchases of US treasuries at a ratio of 4:1 no longer holds.

So where did this money go? Grave eliminates Chinese government bonds, gold, and crypto as explanations and lands on an interesting conclusion: the US equity market has become the new reserve of value and the missing money has been pumped into equity markets via passive indexing. As a result the US equity market has doubled since 2012 and the US account deficit has continued to widen.

Grave suggests 2 paths that could stem from this realization.

We could see continued increases in US equity markets as a result of the expected continued widening of the US current account deficit, and the fortunes of poorer countries running current account deficits may be especially perilous - Turkey, Egypt, Algeria may wind up like Lebanon (bankrupt).

A bear market in US equities leads to a fall in the US dollar and a narrowing of the US current account deficit. Driving up energy prices and accelerating inflation.

I’m still noodling through my assessments on Grave’s perspectives here, but would love to hear your thoughts. Feel free to respond to this email, or in the comments below.

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.