If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to compliment our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the call/podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the following posts:

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

In last week’s debrief, we covered two SaaS companies that are re-shaping project and workflow management: Asana and Monday.com. On this week’s episode we continued our discussion of recent IPOs with two consumer facing app companies: Bumble and Duolingo. Since we are talking about apps, we will start with an update on the Apple v Epic antitrust case and then review each of the companies.

Apple v Epic Update

Since we are talking about apps today, we should also cover the recent Apple v Epic case which was a big win for Apple. Essentially, Judge Gonzales Rodgers confirms that Apple is justified in requiring IAP for in-app purchases. However, the judge also issued an injunction banning Apple’s anti-steering provision. The injunction argues that Apple can’t stop a developer from telling users that they can go outside the app to another platform to acquire digital content.

My understanding is that Apple is entitled to charge a fee for use of the system in whatever way it deems fit. This could mean that Apple can charge a rake for all revenue generated in the app, whether that goes through the company’s payment processing system or not. Nonetheless, the most interesting intel I gleaned from all of this is that gaming constitutes majority of App Store revenue (around 75% of revenue, and 98% of in-app purchases).

Bumble

Today we will cover Bumble (BMBL), the IPO, and it’s current valuation.

What is Bumble?

Bumble operates two apps, Bumble and Badoo. We are a leader in the fast-growing online dating space, which has become increasingly popular over the last decade. We launched the Bumble app in 2014 to address antiquated gender norms and a lack of kindness and accountability on the internet. By placing women at the center – where women make the first move – we are building a platform that is designed to be safe and empowering for women, and in turn, provide a better environment for everyone. The Badoo app, launched in 2006, was one of the pioneers of web and mobile free-to-use dating products. Badoo’s mantra of “Date Honestly” extends our focus on building meaningful connections to everyone.

The founder of Bumble, Whitney Wolfe Herd, correctly identified something that other dating apps failed to properly grasp - women are, for lack of a better term, ‘the product’ and therefore should have a different user experience than males on the app.

How big is the market?

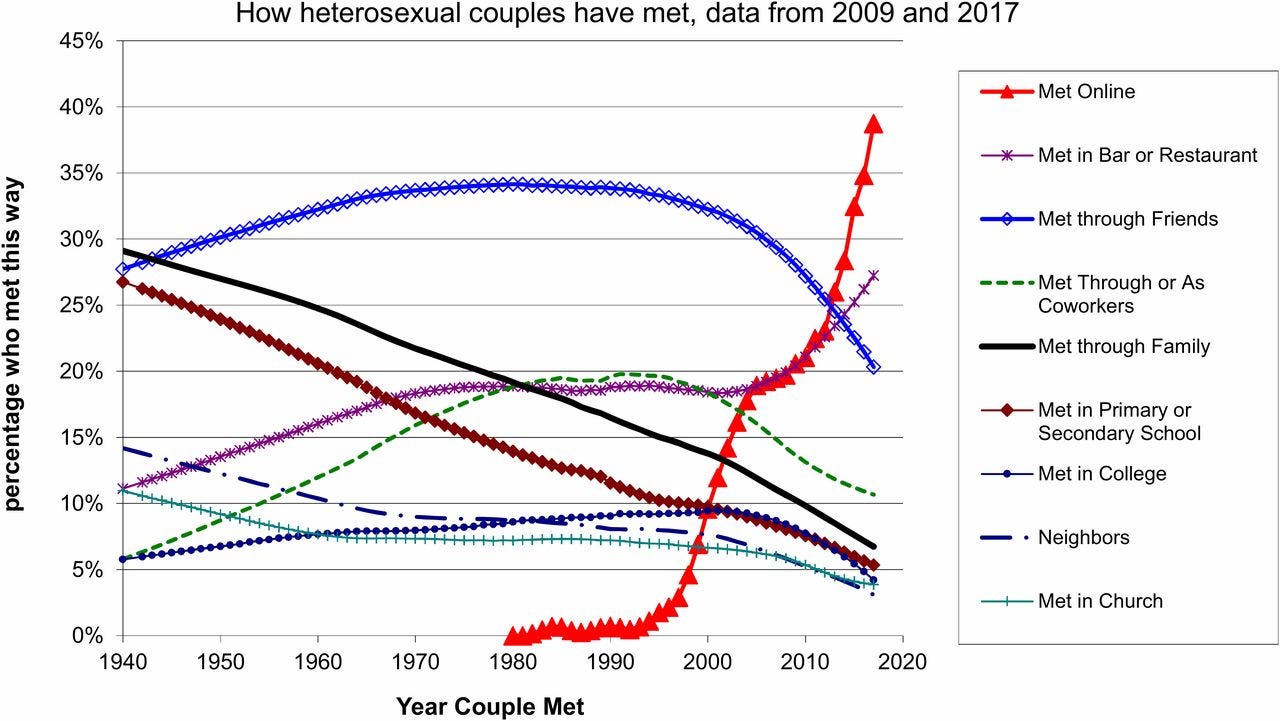

Online dating has rapidly increased in popularity and now is, by far, the most common way heterosexual couples meet2.

However, the market for online dating may be quite limited. According to OC&C Strategy Consultants (OC&C), referenced for industry projections in Bumble's S-1, the online dating market in 2020 in North American and globally is valued at $2 billion and $5.3 billion with growth rates of 11% and 13% through 2025, respectively. Interestingly, the combined enterprise value of Bumble and Match Group (MTCH) (the largest online dating company) equals roughly 10x the global 2020 market opportunity reported by OC&C.

The IPO

Bumble was founded by Whitney Wolfe Herd, former Tinder (now owned by Match Group, ticker MTCH) cofounder and vice president of marketing. She sued the company, alleging sexual harassment and wrongly stripping her of her cofounder title. Rather than mope about her unfortunate situation, she started Bumble with a product design innovation that makes it distinct from its rivals3.

The IPO, on February 11, 2021 was quite successful. From Forbes:

The $2.2 billion initial public offering of dating application Bumble on Thursday went off like so many before it. Bumble’s bankers upped its IPO price about 50% from an initial range to meet fierce demand for shares, but it didn’t tame the raging animal spirits of investors bidding up tech stock valuations into the stratosphere. Bumble shares skyrocketed 63% on its first day of trading, making founder and CEO Whitney Wolfe Herd, 31, the world’s youngest self-made woman billionaire.

Since the IPO, the stock is down 26%. However, it is still above the initial offering price.

The company’s largest shareholder, a Blackstone private equity fund, began offloading shares in the IPO and the company recently filed for an additional sale of 18 million shares of Blackstone’s stock via secondary offering4.

Risks and Valuation

I think that the biggest risks to Bumble revolve around the company’s ability to increase ARPUs (average revenue per user) in the dating market and maintain relevancy in light of new competition from the Match Group and other new entrants.

It also appears that part of the valuation is contingent on continued user growth, which I think will be dependent on successfully growing globally as it is already well saturated in North America. A wild-card would be the company’s ability to launch a successful new product outside of dating.

My personal perspective on dating apps is that there is a mismatch in incentives between the app company and its users. Success, for the user, means finding a relationship, which ought to mean that they stop paying for the subscription. The company, on the other hand, intends to increase the number of paying customers and the total lifetime value of the customer, which would be shortened if they became too ‘good’ at making connections.

The company has over 40m users and 2.9m of them are paying users. On a percentage basis, my understanding is that this is a relatively high % of paying users when compared to the Match Group. Enterprise value (EV) per user comes in somewhere around $150-$180 and EV per paying user ~$2,4005.

Duolingo (DUOL)

Duolingo is another consumer app, though it is focused on an entirely different segment - education. The company’s mission is to develop the best education in the world and make it universally available.

Duolingo launched in 2012 and has since become the leading mobile learning platform globally. With over 500 million downloads, the flagship Duolingo app has organically become the world’s most popular way to learn languages and the top-grossing app in the Education category on both Google Play and the Apple App Store.

Duolingo has developed two additional mobile first applications available in the Google and Apple app stores…

Duolingo English Test - an English language proficiency test currently accepted by over 3000 higher education institutions globally

Duolingo ABC - an app designed to teach early literacy skills to children between the age of 3 and 6

Ed-tech (education technology) is a notoriously hard space to build a company due to slow sales cycles with schools and universities. Language learning, on the other hand, can be quite lucrative.

Duolingo claims it’s core competencies include engineering, A/B testing, data analytics, product design, gamification, personalization, and assessment. It also claims that these are applicable not only to language learning but also to additional subjects, which lays the case for further growth into more markets.

The IPO

You may remember a company called Rosetta Stone that was publicly traded for over a decade, but shortly after a nearly 40% pop on the stock's first day of trading in 2009, its price sank and never meaningfully recovered. The company ultimately went private in 2020. Investors in Duolingo have warmed up to Ed-tech yet again; from Tech Crunch:

Duolingo’s IPO proves that public market investors can see the long-term value in a mission-driven, technology-powered education concern; the company’s IPO carries extra weight considering the historically few edtech companies that have listed.

Duolingo stock has been on a tear since the IPO in July - it is currently up 45% since its first day of trading.

Risks and Valuation

Duolingo has demonstrated that there is a large market for direct to consumer education services via apps. They have also demonstrated that gamification is an effective tool to keep learners engaged. While there are certainly other ed-tech companies out there, the company likely has a significant advantage over new entrants due to the data they have generated to date. Additionally, this data ought to give the company a leg up when entering new education markets.

One risk that recently surfaced that is not immediately quantifiable is Duolingo’s exposure to China. China recently cracked down on for-profit education companies and Duolingo was one of the apps banned from the App Stores6. The company does have an office in Beijing and probably generates a good amount of money from Chinese users looking to gain proficiency in English. The company does not break these numbers out separately, but we will likely have a better idea of the impact after the next earnings release which is expected to be on November 30, 2021.

Duolingo trades at an Enterprise Value (EV) of ~$190 per user7 and ~$4,2008 per paying user. When compared to Bumble, the valuation may seem high, but certainly represents Duolingo’s larger market opportunity and demonstrated ability to increase the % of paying users (see figure below).

EV = $7,240m and users last reported at 40m in the S-1

EV / User = $7,559m EV / 39.9m MAU = ~$190/user

EV / Paying User = $7,559m EV / 1.8m paid subscribers = ~$4,200/paying user