Telltales is designed to enable you develop your ability to think critically and independently about investments. The podcast and this substack do not provide ‘stock tips’ nor financial advice.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

In last week’s debrief, we covered two SaaS companies: Palantir and C3.ai. On this week’s episode of Telltales we continued with the IPO theme and discussed two health-tech companies: GoodRx and Doximity. Today’s debrief will provide an overview of each company and compare the two from a relative valuation perspective.

Before we dig into GoodRx, we need to have a high level understanding of the prescription drug industry. Here’s a simplified description…

Anyone who has had to fill a prescription is aware that the consumer facing side of the prescription drug industry is plagued with a lack of transparency and huge discrepancies in the way drugs are priced.

The pricing process roughly works as follows: first, the manufacturer (in this case a pharma company like Johnson & Johnson) sets a list price. This is essentially the official price of the medication.

The manufacturer then sells the drug to a wholesaler, normally at a discount of 2 percent to 5 percent to list price. Next, the wholesaler sets a so-called average wholesale price (AWP), which is the list price plus a markup of around 20 percent.

The pharmacy buys the drug from the wholesalers and then sets the usual and customary price (U&C), which is the full retail price for the drug (the one customers end up paying). The U&C price can vary extensively, depending on what price the pharmacy ultimately deems appropriate. The patient has a number of ways in which he can pay for the drug: a cash price, a discounted price (offered via coupons), a co-pay, a co-insurance pay, or via a coupon offered by the manufacturer.

So what does Good RX do?

GoodRx claims to reduce the cost of virtually every generic and brand prescription by more than 70% off the list price, resulting in a price that’s often less than a typical insurance co-pay. So far, GoodRX has saved Americans an estimated $20 billion. They do this by providing coupon codes to consumers which they use when they buy their prescriptions from local pharmacies.

Before we can understand how GoodRx makes money, we need to understand the Pharmacy Benefit Manager (PBM for short)...

PBMs are hired by health plans to interface with drug manufacturers and process prescription-related claims. In short, PBMs are the connectors between payers and drug companies, working to facilitate the best possible health outcomes at the best possible costs by reducing spend and increasing access to medication. The PBM also facilitates Rebate programs (key to GoodRx). Under a Rebate Program, PBMs negotiate with pharmaceutical companies to determine the level of rebates the company will offer for certain drugs — rebates are paid to the PBM.

90 % of GoodRx's income comes from coupon codes. When a consumer uses a GoodRx code to fill a prescription, they save money compared to the price at that pharmacy, and GoodRx receives fees from partners, primarily PBMs.

Further Reading:

- Q2 2021 earnings slides

- letter to shareholders q2 2021

- S-1

Doximity is a digital platform for U.S. medical professionals - think “Linkedin for physicians”. It's mission is to help every physician be more productive and provide better care for their patients.

Doximitiy monetizes it's platform by enabling pharmaceutical and health systems to get the right content, services, and peer connections to the right medical professionals through a variety of modules. Customers include all of the top 20 pharmaceutical manufacturers, and the company claims ROIs, of 10:1. Health system customers include all of the top 20 hospitals and health systems, and have generally realized median ROIs greater than 13:1. Hiring Solutions provide digital recruiting capabilities to health systems and medical recruiting firms. Doximity offers these services via subscription model, which accounts for 93% of revenue.

Interesting facts (from the S-1, and Q1 2022 earnings call)

- 80% of physicians already use the Doximity platform

- Go-to-market strategy is a land and expand model where they focus on one bluechip line within top firms and use ROI results to cross sell and resell through the organization

- Net retention = 167%

- Spend very little on advertising due to network effects

- Sales & marketing expected to decrease, 25% or less of revenue.

- For fiscal year ending March 2021, revenues increased by 78%

- Doximity has been growing and profitable for many years

GoodRx vs Doximity

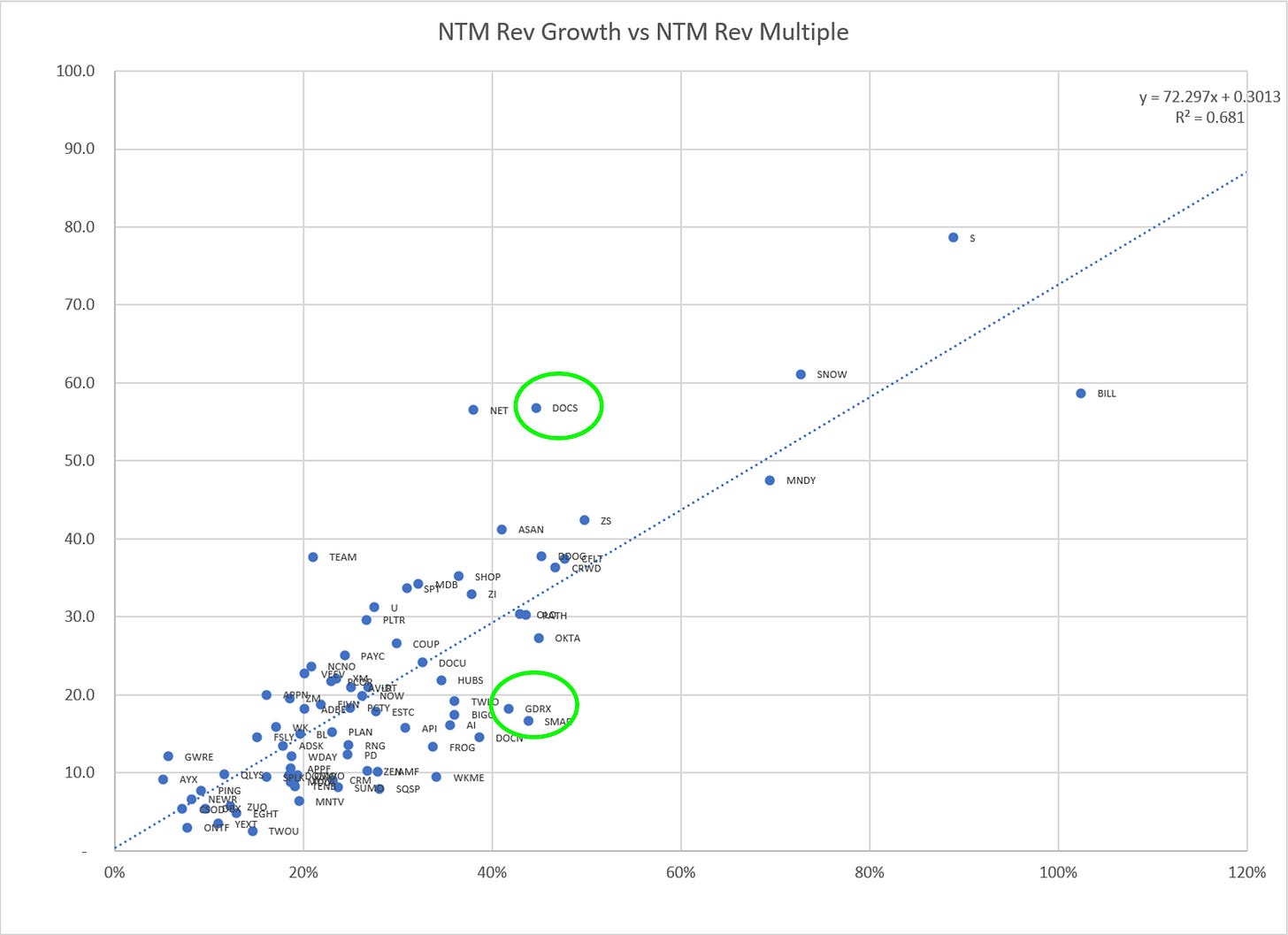

If you’ve been following along the last few weeks, you’ll remember the following chart and table. These were originally provided by Jamin Ball, author of Clouded Judgement (which I highly recommend reading for updates on SaaS relative valuations). I’ve provided them again, although this time I reproduced the charts with my own data and included Doximity and GoodRx, neither of which are included in the Clouded Judgement Analysis. Doximity is a slightly different business model than most SaaS companies, owing to the fact that it is a social network that happens to be monetized by by services that are billed as subscriptions. GoodRx is not really a good comp for the rest of these companies but I’ve included it for the sake of comparison.