This edition of the debrief is coming a little late - my apologies. We were on vacation without reliable internet coverage, and it was great :).

The energy/macro discussion from the last episode was really interesting and is worth reviewing. During the second half of the call, we discussed two recent IPOs and their deferred revenues, which we will dig into more detail today.

If you have yet to listen to this week's podcast, you can subscribe on Apple Podcasts, Spotify and SoundCloud, or you can listen to it right here…

In last week's debrief we did some light data analysis on the 913 IPOs that occurred over the last 12 months on the major US exchanges (as of 8/14/2021). On this week’s episode of Telltales we dug deeper on two of those companies: AirBnB and Roblox. Interestingly, both have deferred revenue components which are important to asses when analyzing their cash flows.

Deferred Revenue

Deferred revenue can be an important factor when assessing a company's cash flows. In some cases, it can be a huge advantage, essentially providing free growth financing to the company; in others, it can be quite dangerous. Before we go further, here's a definition of deferred revnue from investopedia:

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. The company that receives the prepayment records the amount as deferred revenue, a liability, on its balance sheet.

For both AirBnB and Roblox, I will share excerpts from our internal research at Top Mark Capital, and discuss their deferred revenues.

Unless you’ve been living under a rock for the last 5 years, you’ve probably stayed in, and at least heard of AirBnB. The company now has 4 million listings worldwide – that's more than the top five hotel brands combined. However, AirBnB doesn’t own or operate properties. It is simply a booking agency, a true marketplace. They connect hosts (property owners) with guests (renters) for short term, hotel like rentals. The business model existed long before AirBnB, but the company was able to aggregate far more demand than any other booking agency and has since established AirBnB as the common lexicon for ‘renting a place to stay other than a hotel room’.

AirBnB, like nearly all hospitality companies, had a disastrous 2020. The company was bleeding cash due to cancellations and made the tough decision to lay off 25% of its full time workforce (1800 jobs). Furthermore, the company committed $250 million to lessen the impact of cancellations that arose during the initial outbreak of COVID - I will cover this in more detail later, but the point is that they went above and beyond for their hosts and guests.

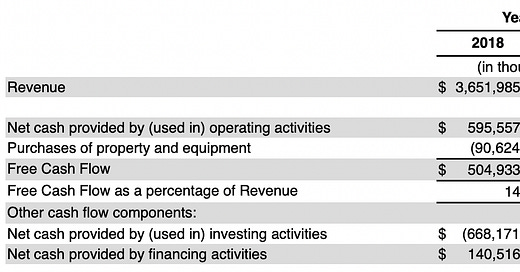

When reviewing the S-11 and most recent 10k2, I was surprised to see that the revenue is distinctively diversified - no one city makes up more than 1.1% of the total revenue. I was also surprised to see that the company was cash flow positive in 2017, 2018, and 2019.

2020, understandably, was autrocious as free cash flow came in at negative $667 million, or -20% of revenue, of which ~40% was due to a decrease in unearned fees (aka deferred revenue, we will use the terms interchangably throughout the rest of the article), which we will dig into further in a moment.

For the first half of 2021, cash flow is looking much better. For Q1 and Q2, free cash flow as a % of revenue is 55%3 and 35%4 respectively (or $487 million and $784 million, respectively).

There are two questions we will aim to answer with the rest of our discussion on Airbnb.

Will the company return to positive cash flows in the short term?

Can we view the impact of COVID-19 on the balance sheet a 'one off', or is it a persistent risk to the business model?

1. How long will it take for AirBnB to become positive cash flow positive?

To assess this question, we want to know if and when cash flows will turn positive and how much, as a % of revenue, to expect in the future. Upon inspection of the cash flow statements in the 2021 Q1 and Q2 10-Qs, we find huge increases in deferred revenue (AirBnB calles them unearned fees)... ~$538 million in each quarter. The notes to the financial statements provide more details on this unearned revenue...

Our costs are relatively fixed across quarters or vary in line with the volume of transactions, and we historically achieve our highest GBV in the first and second quarters of the year with comparatively lower check-ins. As a result, increases in unearned fees make our Free Cash Flow and Free Cash Flow as a percentage of revenue the highest in the first two quarters of the year. We typically see a slight decline in GBV and a peak in check-ins in the third quarter, which results in a decrease in unearned fees and lower sequential level of Free Cash Flow, and a greater decline in GBV in the fourth quarter, where Free Cash Flow is typically negative.

This tells us that in Q3, we should expect a large drawdown in unearned fees, potentially resulting in negative free cash flow. It also tells us that the company will recognize a lot of revenue in Q3 - analysts are expecting revenues of $2.044 billion.

Interestingly, the 2021 increase in unearned revenue is higher than in past reported quarters by a factor of 10. This large increase raises additional questions worth considering, including...

Are AirBnB guests booking travel farther out due to COVID-19 induced pent up travel demand?

Did AirBnB change its terms? Are they collecting payment sooner than they were before?

Ultimately, is the growth in unearned fees a sustainable source of financing for the business?

I think we will see a strong bounce back in cash flow as travel 'resumes' globally. This bodes well for 2021, which will likely result in net positive free cash flow. However, much of this growth in cash flow is due to the deferred revenue component, which will not accelerate indefinitely, rather it will become more tied to revenue growth over time.

2. Can we view the impact of COVID-19 on AirBnB’s balance sheet a 'one off', or is it a persistent risk to the business model?

Question 2 is more about the fragility of AirBnB's business model. In the first quarter of 2020, AirBnB met an executioner called COVID-19 that was carrying a gun loaded with bullets called unearned fees and a hand grenade called amounts payable to customers.

Amounts payable to customers, which we have yet to cover in this discussion, does not impact free cash flow (it is a financing, not an operating cash flow), but it certainly affected the viability of the AirBnB business model. Where unearned fees reflects the portion of the revenue that the company expects to recognize as income. These amounds payable to customers include the payments made by guests that had yet to be disbursed to hosts. When COVID hit, guests cancelled trips and AirBnB had to return that cash to the guests.

Ultimately, AirBnB survived because it was able to raise close to $2 billion in debt in Q2 of 2020[4-2], which enabled them to refund their guests and buy the company time. Fortunately, travel (and bookings) resumed, and the public market appetite for tech looked favorable enabling an oversubscribed IPO. Since then, the debt issued in Q2 of 2020 was repaid, which suggests that the debt had strong warrant coverage and strings attached that pursueded the company to IPO when it did. I don't have a refernce for this intel, but if my memory serves me well, the warrants were priced at ~$38 per share (it currently trades at ~$146).

Roblox is building a human co-experience platform that enables shared experiences among billions of users. In other words, they are building a metaverse, a term often used to describe the concept of persistent, shared, 3D virtual spaces in a virtual universe.

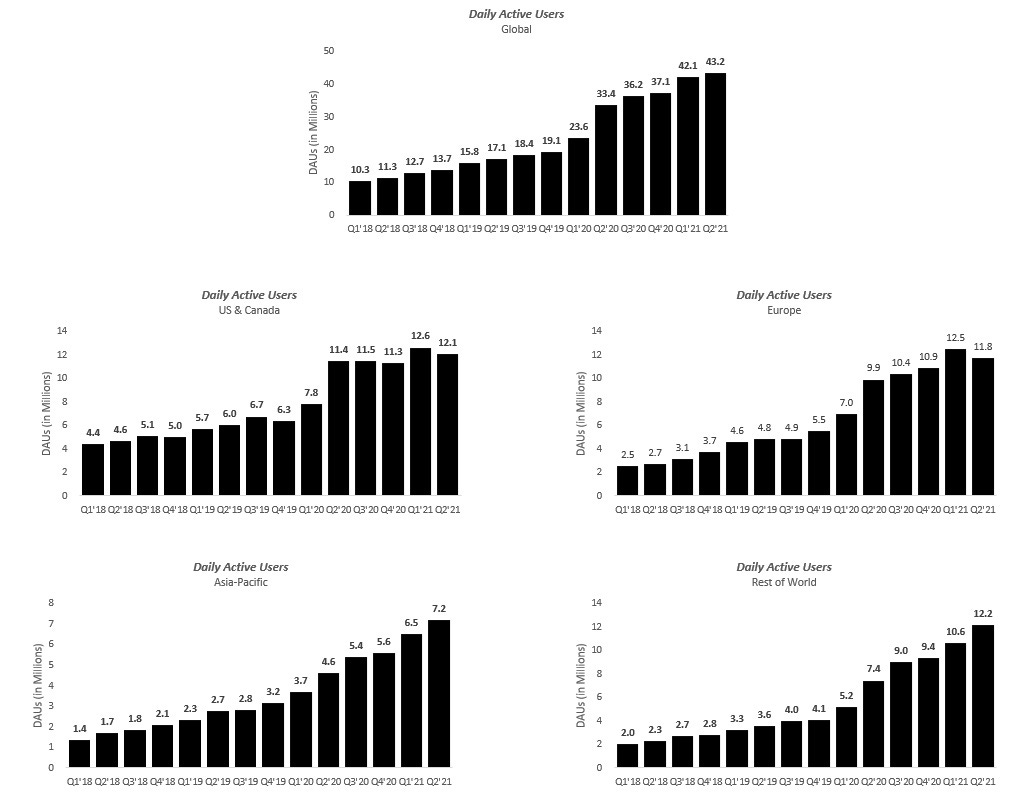

36.2 million people from around the world come to Roblox every day to connect with friends, play, learn, communicate, and explore all in 3D digital worlds that are entirely user-generated. They company bosts nearly 7 million active developers5 as of their S-1 filing.

Growth is driven by two, reenforcing effects: content and social.

User-generated content, built by the Roblox community of developers and creators, attracts users to the platform. The more users on the platform, the higher the engagement and the more attractive Roblox becomes to developers and creators. As users increase, more Robux (the Roblox digital currency) are spent, incentivizing new and existing developers and creators to design increasingly engaging content.

The Roblox platform is inherently social - users typically play with friends. This inspires them to invite more friends, who in turn, invite their friends, driving organic growth.

Growth at the company has been impressive - daily active users have quadroupled since 20186.

This growth has translated into free cash flow - the company has produced consistent, positive cash flow each year.

When digging deeper into Roblox's cash flow, we find, as with AirBnB, that deferred revenue is a significant driver of free cash flows. As with AirBnB, we want to question the quality and durabilty of cash flow, and specificly this deferred revenue component is an important piece of the puzzle. To fully understand the nature of deferred revenue at Roblox, we consult the company's prospectus7.

Proceeds from the sale of Robux are initially recorded in deferred revenue and recognized as revenues as a user purchases and uses virtual items.

This means that when a user converts dollars or pesos or euros to Robux, the company records deferred revenue.

it also says...

Proceeds from the sale of virtual items are initially recorded in deferred revenue and recognized as revenues over the estimated period of time the virtual items are available on the Roblox Platform (estimated to be the average lifetime of a paying user) or as the virtual items are consumed.

This means that when a user purchases an item within the Roblox metaverse using Robux, the company recognizes revenue over a performance period (23 months, as stated in the MD&A section). This is because a digital asset has a presumed life span over which Roblox must perform in order to earn the revenue. This is very similar to SaaS businesses that collect fees upfront for subscriptions that are recogized over many months. This can be a sustainable source of free cash flow on which to finance the growth of a business.

Like AirBnB, Roblox has a large amount of free cash flow driven by deferred revenue that investors will need to understand. Some questions that come to mind include...

What portion of the deferred revenue is 'unspent' Robux vs spent on items and being recognized over a longer period?

AirBnB experienced a ‘run’ on deferred revenue and restricted cash in 2020 that brought the company to its knees. Is there a risk of a 'run' on the Robux bank? What might precipitate it?

Summary

Hopefully this was an informative (and not too boring) discussion on the free cash flows of two promising businesses that IPOed recently. For clarity, I don't currently have positions in either of these stocks. As always, my purpose here is to provoke thoughtful discussions about the quality of businesses, never to reccomend an investment, as that is highly personal and related to the aims and means of a given portfolio.

Until next time, stay healthy and stay informed.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.