If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Subscribe to this newsletter to stay up to date!

SemiCaps

This week we continued our discussion of SemiCaps (semiconductor capital equipment), specifically Lam Research (LRCX) and ASML (ASML). Below are the top five SemiCaps by revenue. I also show their % of industry WFE spending (Wafer Fab Equipment Spending) over the last few years1.

US Export Controls and China Tensions

This week we discussed China tensions at length and used Lam Research’s exposure to China as example as to how the government’s regulatory framework would have to change in order for it to affect Lam.

As of last night we have more visibility into what the government is thinking regarding export controls. Nvidia announced more bad news yesterday:

USG has imposed a new license requirement, effective immediately, for any future export to China (including Hong Kong) and Russia of the Company’s A100 and forthcoming H100 integrated circuits.

Furthermore…

The license requirement also includes any future NVIDIA integrated circuit achieving both peak performance and chip-to-chip I/O performance equal to or greater than thresholds that are roughly equivalent to the A100, as well as any system that includes those circuits.

Which essentially means, don’t try design around the license requirement.

So why are they doing this?

The USG indicated that the new license requirement will address the risk that the covered products may be used in, or diverted to, a ‘military end use’ or ‘military end user’ in China and Russia.

Artificial intelligence is becoming an increasingly important tool not just for business but also for military applications, so it’s not surprising that the government would expand existing export controls to include semiconductors use in military applications. It is vague and broad. Importantly, the current quarter, which had poor guidance already has an additional $400 million at risk.

The Company’s outlook for its third fiscal quarter provided on August 24, 2022 included approximately $400 million in potential sales to China which may be subject to the new license requirement

One would hope that China revenue is not slated for military applications.

AMD also received a similar note from the USG, but it does not see a material impact.

This clearly signals an increased appetite for the government to restrict access to products that could be used against the US and its allies. It is still a bigger stretch to go after YMTC, and ultimately Lam Research, but it is certainly not out of the question.

Supplemental Data

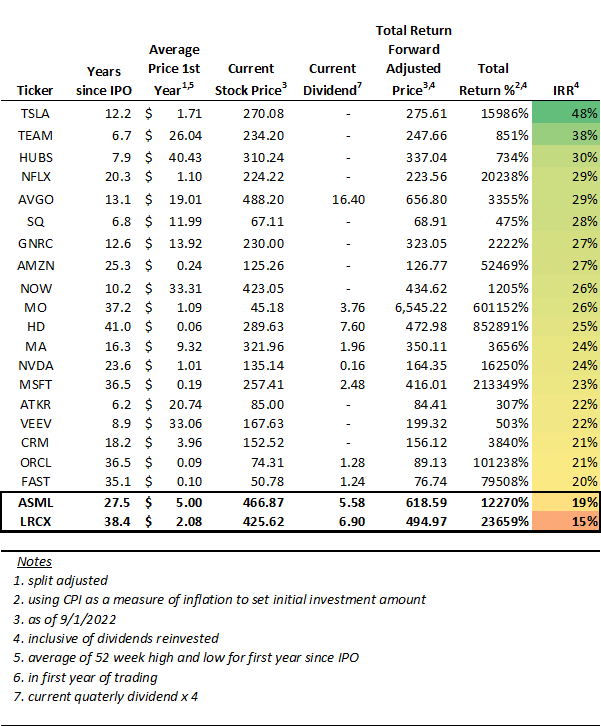

1 SuperCompounders

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

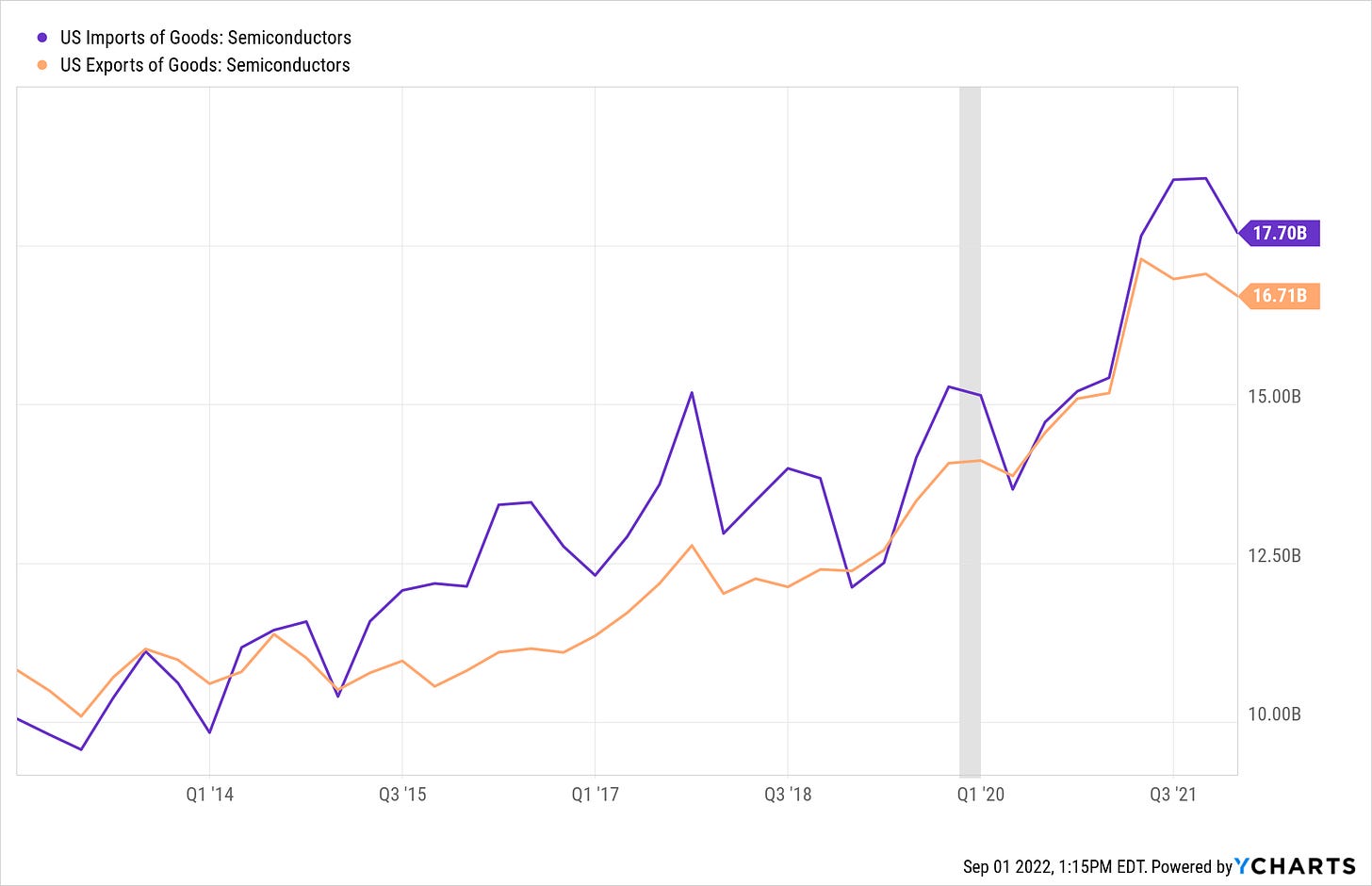

Bureau of Economic Analysis Semiconductor Import / Export

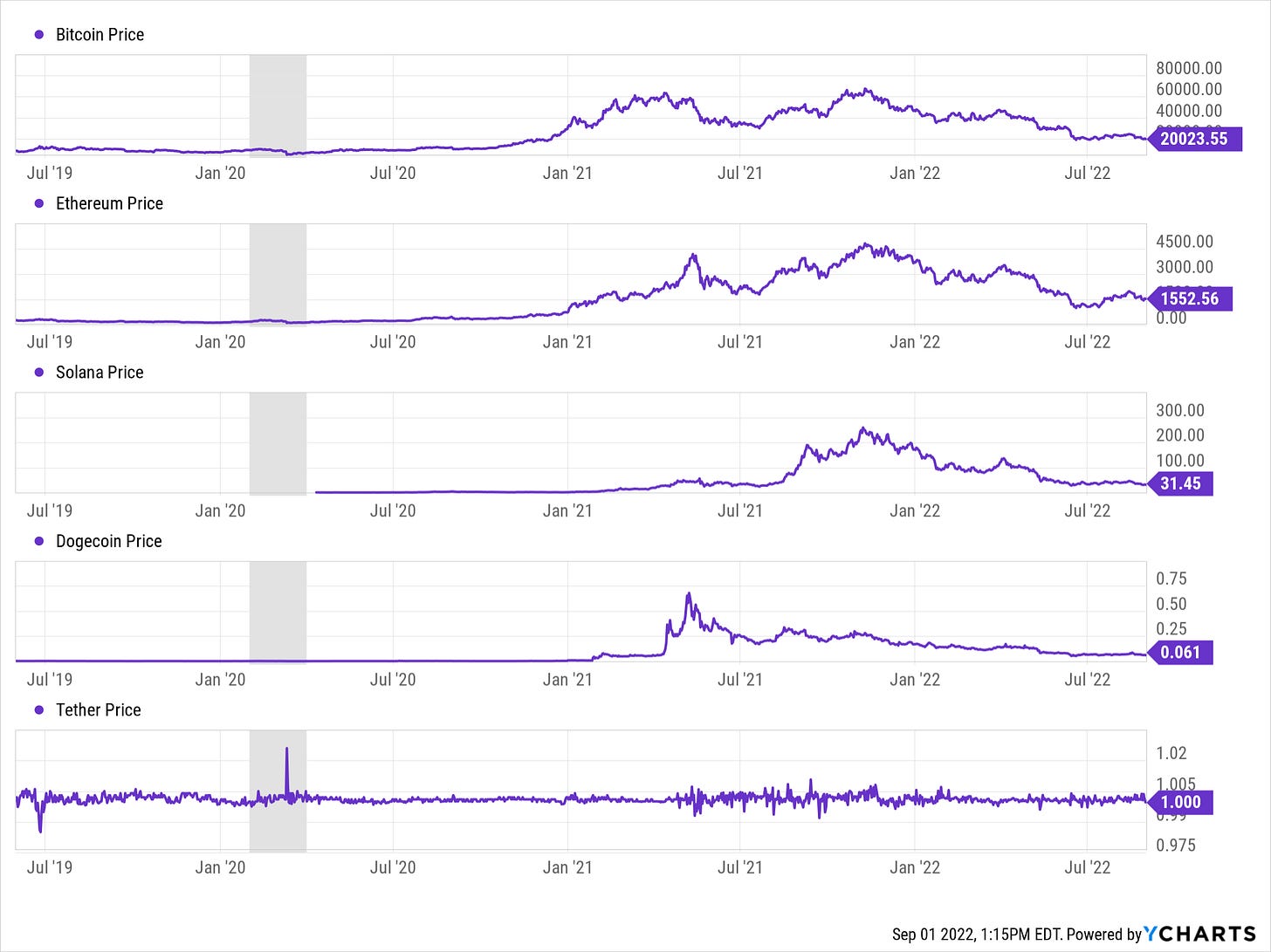

Cryptocurrency

Mentions: LRCX 0.00%↑ ASML 0.00%↑ MRVL 0.00%↑ AMAT 0.00%↑ NVDA 0.00%↑ AMD 0.00%↑

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Note, 2022 figures are estimates