E2232 - August 10, 2022

Taiwan Semiconductor is going to get their money. Spotify still seems $$$.

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Subscribe to this newsletter to stay up to date!

E2232 notes…

Oil

US gasoline consumption is off 10% on a trailing 4 weeks basis

Refineries are shifting production to make more distillate (heating oil, diesel, and jet fuel) which has a higher crack spread (~$20 vs $30)

Looking forward, gasoline demand may get weaker

250 million cars in US, 320 million people

120 million households with 2 cars, the upper end of this group is likely to have one electric car, drawing down the total gasoline demand

Rest of world will probably be more inclined to have more electric vehicles (ex, Europe, China, India)

Natural Gas

Predicted spot price after 2023 to be $4.50 avg, up considerably from pre covid levels

This makes big difference to cashflows; but nat gas investors are getting used to $6 gas

If getting into winter gas price drops to $5-6, there may be a buying opportunity.

Marcellus and Haynesville fields have the best economics

Macro

Inflation energy bill - doesn’t make too much difference to energy business

Fed & Interest rates - the media is focused on Fed funds rate, but we think more focus should be applied to quantitive tightening (QT). If you are interested digging in further, check out this podcast:

Chip Stocks - here’s a list of relevant articles based on our discussion of chips today…

Intel 7nm uses EUV, China’s SMIC accomplished this with DUV, reportedly, copying TSMC process

Shopify

Still expensive at $40 / share

At a 3% expected free cash yield (assuming a 10% net income margin1 on 2023 FY revenue and adding back 2x 1H depreciation and stock based comp), you can get to ~$15 / share + another $2-3 in cash and investments (some of which have been quite volatile).

Supplemental Data

1 SuperCompounders

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

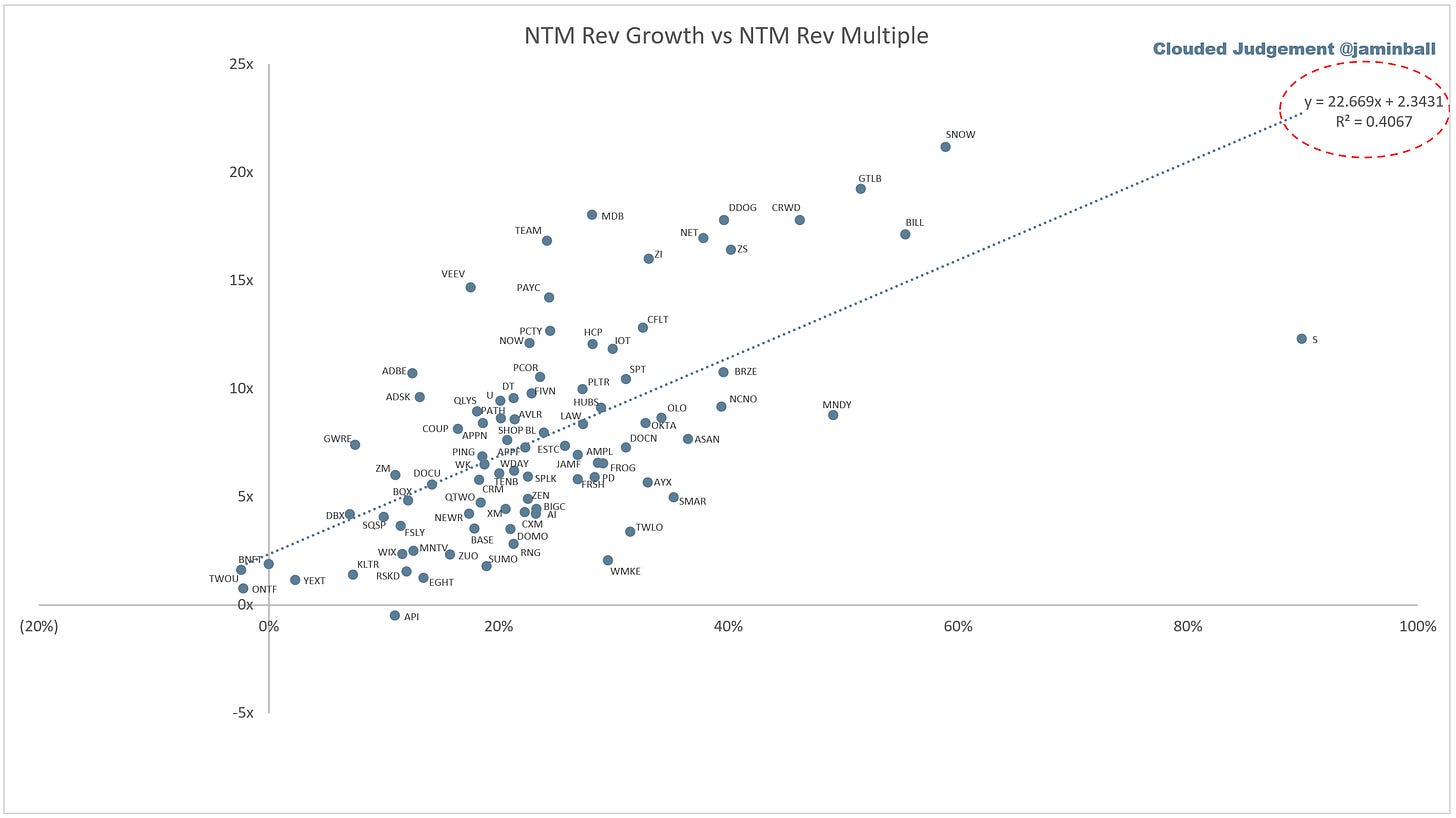

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Note that this would be quite difficult to accomplish this year given the cuts that are happening, but represents expectations about a steady state operation.