If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, or Spotify.

Subscribe to this newsletter to stay up to date!

Tesla Valuation, the quick way

Let’s take a look at a ‘shortcut’ valuation for Tesla. As Hunt discussed today, one of our favorite methods is to find companies that are growing free cash flow at 15% each year at a valuation of <20x free cash flow.

At first glance, we can’t get there with Tesla. This is probably why I’ve ignored the company for so long. Last quarter, free cash flow was $2.2b, or $8.8b on a run rate basis1. 20 x $8.8b = $176b, which would equate to approximately $175 per share (~1b shares outstanding, ~0 debt). A far cry from today’s $725.

So let’s dig in a little more. I want to compute a forward cash flow based on a future level of output2. The following paragraphs will take you through a quick estimation of what cashflow we might expect if Tesla were to produce 2m cars per year3. Keep in mind this is a back-of-the-napkin valuation. The point being, if you can’t get there on the back of a napkin, why waste any more time - just move on to the next one.

NOTE: the numbers here are slightly different than those discussed on the call, mainly because I did a little more digging on the 10k and 10q to make sure my assumptions were reasonable

Revenue Automotive4 = 2m cars @ $47k each = $94b automotive revenue.

Gross Margin Automotive5 = $94b * 35% = $33b

Operating Expenses6 = $2b * 4 = $8b

Operating Profit = $33b - $8b = $25b

Net Income (NI) = Automotive + Other7 = $25b + $0 = $25b

Depreciation (DEPR)8 = $1b x 4 = $4b

Capital Expenditures (CAPEX)9 = $4b

Free Cash Flow (FCF)

Adj. Free Cash Flow = NI + DEPR - CAPEX = $25 + $4 - $4 = $25

Adj. Free Cash Flow Per share = $25b / 1b = $25 per share

20x Forward (2m car sales) Adj. FCF share = $25 x 20 = $500 / share

For the financial analysts in the crowd, I know I skipped a lot here. The point was to make the valuation simple.

So we have 2 valuations, the first at $175 per share and the second at $500 per share. I think we can say that if the share price were within that range (currently ~$725), we would be getting very very serious about investing. Since it’s not, it just means that we have a decision to make. Pass, or dig in deeper?

If you made it this far, you deserve a break. Check out the first 15 minutes or so of this interview with Antonio Gracias. His fund, Valor, backed Tesla in the early days and he served on the board of directors between 2007 and 2021.

Supplemental Data

1 SuperCompounders

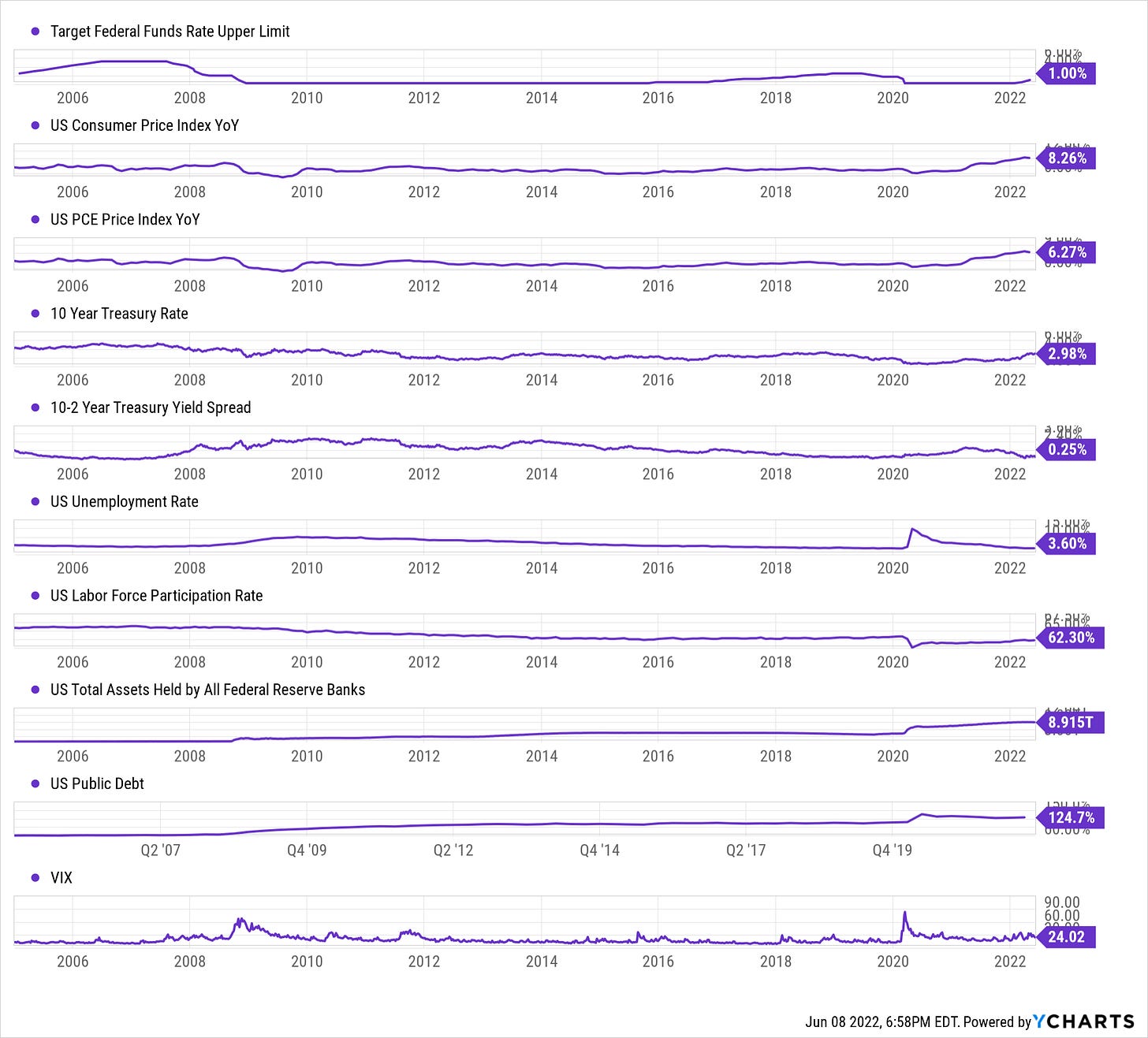

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

We talked about this on the pod at a high level, with very rough numbers. These assumptions are slightly different because I spent a tad more time making sure my assumptions were right.

Tesla has recently opened two new factories, Berlin and Texas, which will add to capacity dramatically. How much exactly, I don’t know. But I think it’s fair to say that they will each produce well over 600,000 cars per year. California is currently running 10-20% above capacity. Shanghai capacity was 450,000 units before investing in additional capacity that increases the workforce by 26%, so capacity there is probably closer to 600,000 as well. With just these locations at current capacities, it’s pretty likely that Tesla could get to 2.5-3 million units per year.

Some analysts have made a case for Tesla selling $2m cars in 2022. I think, given supply chain issues and the Shanghai factory shutdown, this may be a pretty big stretch - it would require perfect execution ramping Berlin and Texas.

In 2021, Tesla achieved $47b in automotive sales on ~1m car, or $47,000 per car. See page 37 of the latest 10k. Note, I’m not including all other revenue here because it has 0% gross margin.

The California factory is operating at ~20% gross margin 2. Shanghai is allegedly achieving 40%. I'd assume Berlin and Texas will do 35-40%. So let's just say they average 35%. That's probably a low bar given that last quarter they did 32.9% gross margin overall last quarter. See latest 10q. Other stats came from other analyst research.

On June 3rd, Elon emailed employees informing them that Tesla will cut 10% of salaried roles. With that in mind, I think it is fair to assume that Opex may remain flat at ~1.8bn / quarter, so 2b / quarter is probably an ok estimate. See latest 10q.

I’m lumping “services and other” in with “energy generation and storage”. These businesses operate at 0% or less gross margin, so we are just counting it as zero. See “Results of Operations” starting on page 37 of the latest 10k

Tesla had $880 in depreciation in Q1. This should be higher in future quarters, but maybe not much higher as most capex for these factories has leveled out, so lets call it $4b. See latest 10q.

I’m setting capex = depreciation. This is a high level assumption that is similar to Buffett’s “Owner Earnings”. Essentially I want to count capex it would take to replace the consumed value of the capital expenditure, but I don’t want to penalize the company for making investments, so long as they are likely to be profitable. See Buffett’s 1986 letter to shareholders.