If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

Elon offers to buy Twitter

After acquiring a 9% stake in the company last week, Elon offered to buy the rest of Twitter this morning. I wrote about Elon’s motivations for acquiring a stake in Twitter last week (E2214). Specifically…

Now, if Elon is in fact attempting to use his money and power to promote free speech on Twitter, I don’t think it is completely borne of altruism. Elon likely gets more value from Twitter than anyone else in the world. As such he has the most consumer surplus, and therefore the most economic interest in Twitter’s ability to continue as a going concern.

Now that we know Elon intends to take Twitter private, we can think through the ways he might consider creating value for himself and the world.

Elon will addressing company culture, structural issues, and conflicting incentives that currently interfere with free speech principles

Elon will ensure that Twitter remains a good place for him to engage with the world, protecting his ability to generate ‘consumer surplus’ from the product

Over time, Elon will donate the company to not-for-profit / trust of some sort, that will essentially act as utility, for the benefit of the public. Coincidentally, this will obviously provide a much needed future tax break for Elon, but also provide some level of assurance that his vision for free speech is maintained for posterity

Or, in short…

The concept of social media as a public utility is not a new one - in fact, back in 2017 a group of shareholders proposed converting Twitter into a co-op. While unsuccessful, the concept undergirds the sentiment that information wants to be free, and the for-profit nature of a public corporation is often at odds with those principles. This was extremely acute during the 2020 election cycle as big brands reduced advertising spend on social media platforms due to chaos during the election cycle. This affected Twitter far more than Facebook as most of Twitter’s advertising spend is ‘top of funnel’ awareness advertising, while Facebook’s advertising solution provides options for the full range of advertising, most importantly, conversion. As a result when big advertisers pulled back, it affected Twitter more than it affected Facebook. As a result, Twitter was under far more pressure to kowtow to external pressures that collided with both companies CEO’s publicly stated adherence to free speech. Both companies attempted to balance these conflicting perspectives, though few stakeholders have been satisfied with the results.

Where this goes from here? Time will tell…

Supplemental Data

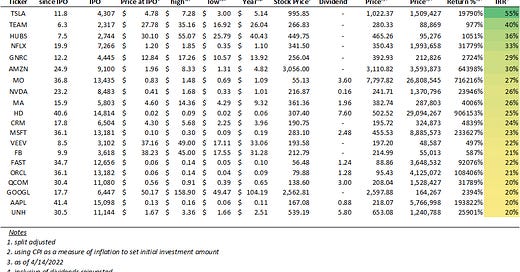

1 SuperCompounders

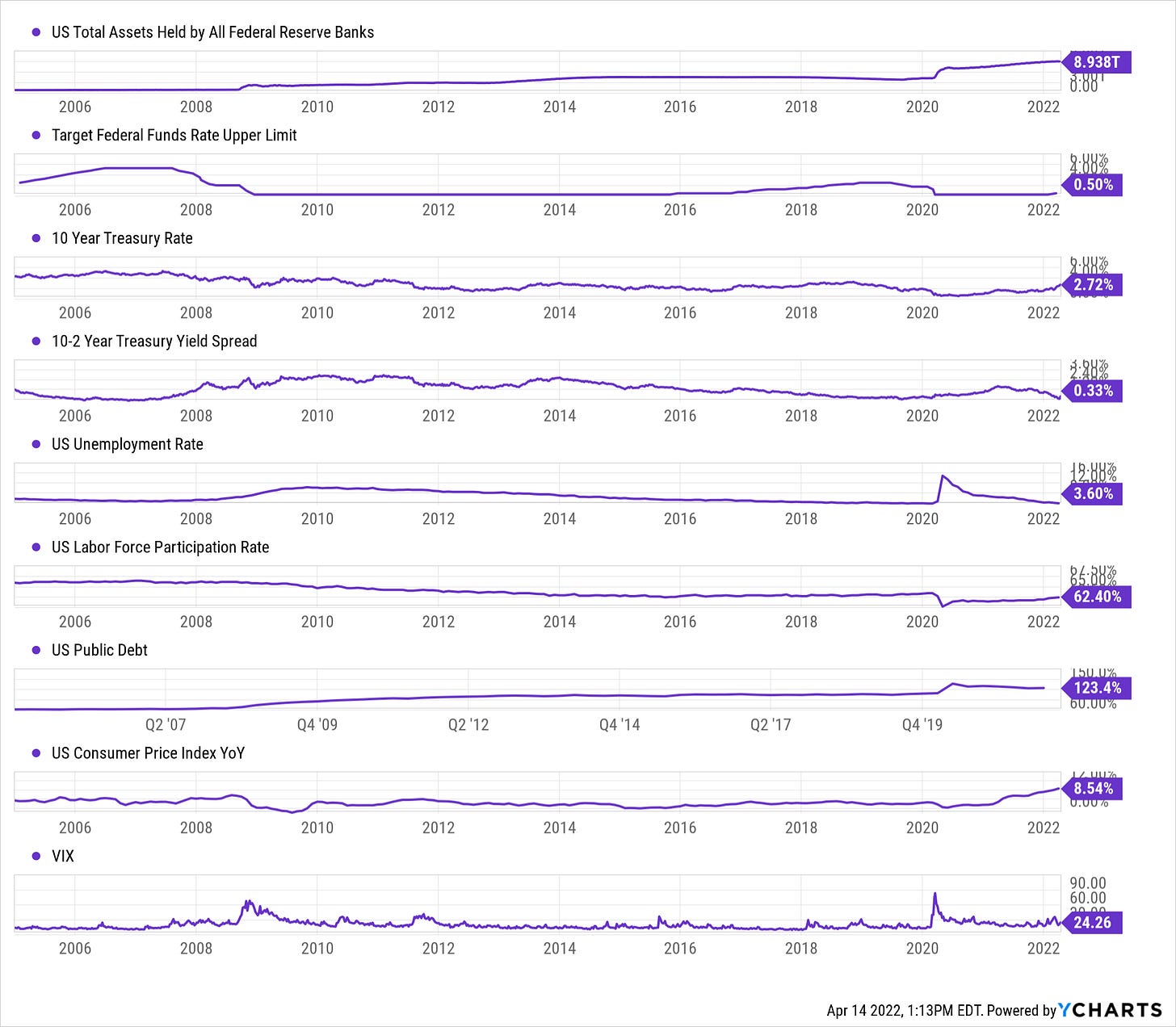

2 Macro

3 Energy

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples. Also check out this article, where Jamin Ball analyzes Q4 2021 earnings.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.