E2214

Elon Musk, entrepreneur turned activist investor takes stake and board seat at Twitter + energy, tech, and more...

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

Elon Musk & Twitter

Elon Musk, one of Twitter’s most influential users has taken a 9% stake and a board seat at the flailing social media company. I say flailing because it has been a terrible investment for shareholders.

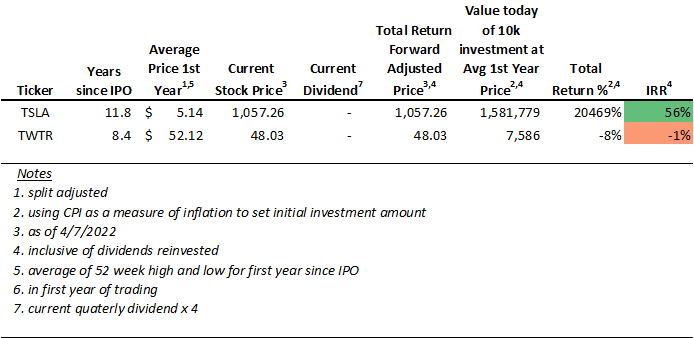

If you invested in Twitter at the average price during the first year after the IPO, you would be down 8%.

On the other hand, if you invested in Tesla you’d be sitting on an IRR of 56%! If you invested $7,690 ($10,000 today), your position would be worth over $1.5 million.

What’s wrong with Twitter?

In spite of the fact that Twitter has been a terrible investment, many people, like Elon, derive a lot of value from it. Imagine how much money Elon would have to spend on PR in order to garner the attention he receives via Twitter. The problem with Twitter is that it creates value, but doesn’t do a good job of capturing that value. In Econ 101 terms, the consumer surplus is too high.

So why would Elon want to invest in Twitter?

I have two hypotheses…

Elon has been publicly outspoken against Twitters efforts to censor free speech, going so far as to post this meme protraying Agrawal, then the newly named Twitter CEO, as Stalin (obviously known for his commitment to censorship). Former Twitter CEO Jack Dorsey was shown as Yezhov.

Now, if Elon is in fact attempting to use his money and power to promote free speech on Twitter, I don’t think it is completely borne of altruism. Elon likely gets more value from Twitter than anyone else in the world. As such he has the most consumer surplus, and therefore the most economic interest in Twitter’s ability to continue as a going concern. Another compounding factor is the fact that Twitter does a poor job of catering to power users, like Elon. The product team at Twitter, and we will get into this in more detail in my 2nd hypothesis, has been slow to release new features requested by users. One example is an ‘edit’ button, which Elon has been outspoken about. He launched a poll, which isn’t rendering properly, but the results were overwhelmingly in favor of the feature (>70%). Later that week, Twitter confirmed they were working on an edit button, and Elon posted this meme… clearly pointing out his opinion the torpid nature of the Twitter’s product development.

Power users require different functionality, and these features are more valuable to power users. As established earlier, these features are most valuable to Elon which makes him the perfect person to push for the change at the company.

A second reason Elon may have invested in Twitter is that he sees an opportunity to make a good return on his capital - maybe even better than Tesla. Twitter has been a terrible investment to date because the company never really found a business model. Despite user growth, monetization efforts have been disappointing - especially considering the success of social rivals Meta/Facebook (FB) and Linkedin (acquired by MSFT). In a blog post last week a former Twitter VP, Elad Gill, pointed out that there are lots of obvious product features that they were considering 10 years ago that have never been implemented and, to our knowledge, have not been tested. These include edit tweets, longer form content, better user controls, better onboarding, better spam filtering, business account support and integrated CRM… What new features has Twitter released in the last decade? Until very recently, just one… In 2017, the company increased the character limit for tweets from 140 to 280 characters. And, last year, the company launched “Twitter Blue”, a monthly subscription that a few features, like the ability to ‘undo’ a tweet, that were previously unavailable. In the case of social media, the ability to innovate on product features is a function of how quickly they test a feature. Facebook has a very advanced product testing and release system which you can read more about, here.

The mantra at Facebook was (still is?) “move fast and break things”. It appears that the mantra at Twitter is “don’t move, for fear we might break things”.

It is clear, based on the lack of product innovation, that Twitter is not iterating a the same pace as Facebook. Furthermore, the advertising features implemented by Twitter for advertisers pale in comparison to rival Facebook. All that is to say that there is a lot of low hanging fruit when it comes to monetizing twitter. Elon may have a view that his influence can help drive capital allocation more effectively at Twitter and ultimately drive significant value.

In reality, it’s probably a combination of both of these factors that has lured Elon into an activist investor role at Twitter.

Cyber Rodeo

In researching the above (on Twitter), I stumbled on this event, which happened last night at Tesla’s new gigafactory in Texas. It is nothing short of incredible. Fast forward to minute 37 in the video below to see how Tesla is changing automobile manufacturing.

Supplemental Data

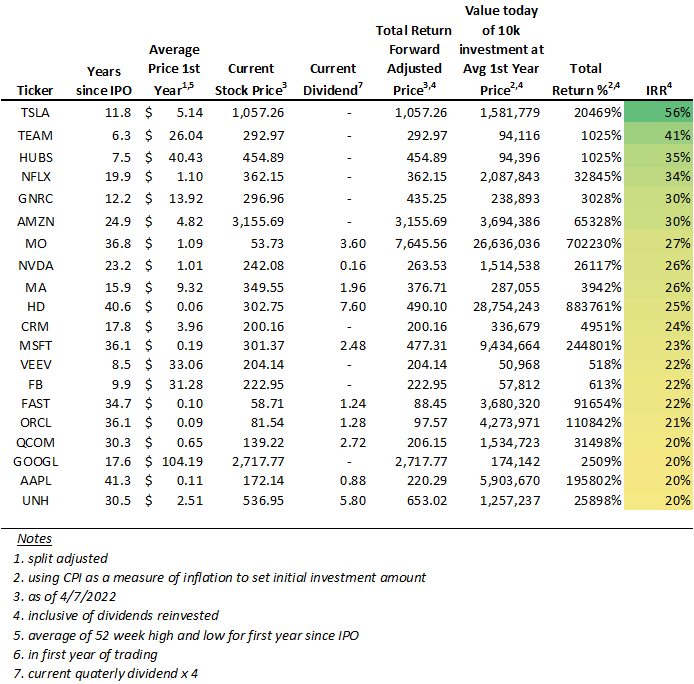

1 SuperCompounders

2 Macro

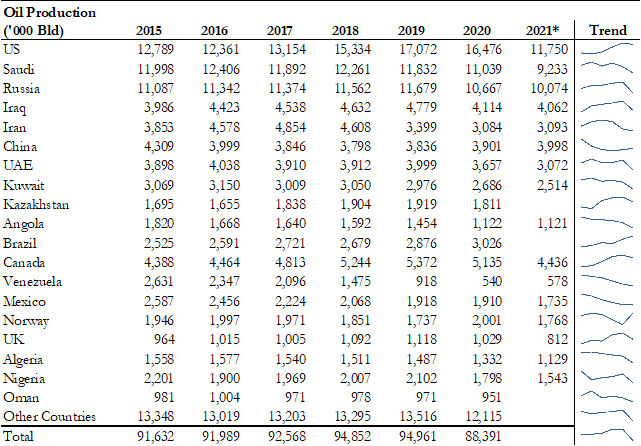

3 Energy

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.