If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

Intel’s big gamble

This week we discussed Intel and Pat Gelsinger’s turnaround plan. Leading up to Gelsinger being named as CEO, the company had backed itself against a wall. It had failed to keep pace with its own standard (Moore’s Law) due to the company’s failure to keep pace with manufacturing technology. As a result, Intel has been eclipsed by rivals AMD (in x86 chip design) and Taiwan Semiconductor (as a fab). While profits and cashflows at Intel still appear quite good, one has to remember that all of their existing fabs are fully depreciated. Their chips are substandard (though quite impressively close to AMD in spite of being significantly far behind on process technology). All that is to say that Intel is facing its biggest challenge ever.

The board chose Pat Gelsinger for the turnaround because he is literally the only person that could be entrusted with such a risky turnaround plan. A more logical, less talented executive would likely have split off the design and fab businesses - much the way that AMD split off its fab, Global Foundries. Nonetheless, here we are with Gelsinger leading the charge to rescue Intel. So, the first question one must ask, is can he do it. I think that answer is yes - but there is a lot of execution risk. Intel has fantastic design talent, a very strong enterprise sales organization, and a talented lobbying apparatus.

The second question is, should I own this company? My personal opinion is that the next 2-3 years will be extraordinarily painful for the company. I think that right now there is too much execution risk in the plan and current investors are treating it as a ‘value play’. Today, I think it is more of a ‘value trap’. I could be wrong, but here’s how I see it playing out. Existing shareholders are used to fat, growing dividends and high profit margins. I think they will get impatient as it will take 3-5 years to get things back on track. In the interim, Intel’s financial results won’t look like those of years past. If everything goes swimmingly, that dividend won’t get cut, but if it does, look out below.

All that said, I think Gelsinger is the right person for the job. If you want to understand Gelsinger better, check out this video…

If you don’t have time to watch the video, I’ll piece together some of the key elements brought together by Ben Thompson of Stratechery. First of all, he is a brilliant engineer…

Gelsinger joined Intel straight out of high school, and worked on the team developing the 286 processor while studying electrical engineering at Stanford; he was the 4th lead for the 386 while completing his Masters1.

Remember that these advancements in processors were significant, and one of Intel’s strengths at the time was the integration of their manufacturing capabilities with their design capabilities. Gelsigner also had clear vision as to what would move the company forward. In particular was the internal fight at Intel as to which RISC or CISC should be the path for the future of the company. Ben Thompson explains2…

One of the ways I seek to understand companies, particularly founders, is to go back to a critical decision made in their formative years; those decisions, when successful, become core to a company’s culture and way of understanding the world. Gelsinger was not Intel’s founder, but I strongly suspect this framework applies here as well, especially once you understand that this debate went beyond teacher versus student: much of Intel was convinced that RISC was the future; in fact, one of the major reasons why Andy Grove put the 25 year-old Gelsinger in charge of the 486 was because Gelsinger quit over the fact the company was set to move away from CISC, and Grove both wanted to keep him and agreed with him. In other words, if you want to understand how Gelsinger sees the world today, you have to go back to RISC v. CISC. That means that those three tenets are critical to understand:

RISC was theoretically better, but the gap was overstated.

Moore’s Law will erase that gap rapidly.

It takes a long time to recreate software ecosystems, which means software compatibility is a major advantage.

Those were the threats then, but now the threat is ARM and AMD. Here’s Ben’s updated perspective on Gelsinger’s 486 tenants…

Now go back to Gelsinger’s three tenets and update them for the ARM and AMD threats:

ARM has for years been better than x86 in terms of performance-per-watt, which is critical for mobile, but also increasingly important in ever more massive and densely packed data centers; that noted, the gap is probably overstated.

Intel’s manufacturing for its x86 chips is worse than TSMC’s manufacturing for ARM chips, which increases the gap in performance-per-watt.

AMD can take advantage of the pre-existing software ecosystem.

Now you can see why Intel is in such a danger zone, and why drastic action is so necessary. In fact, the danger is even greater: I haven’t even gotten into the realities of chip fabrication, where the massive amounts of fixed costs mean that the line between which a fab is extremely profitable versus a contributor to bankruptcy is very thin (I did get into these economic realities in last year’s Intel Problems).

Gelsinger’s tenets also explain the strategy that I laid out on Tuesday:

Intel is not abandoning x86; it remains the biggest differentiator the company has.

Intel appears to be shifting some amount of fabrication for its fastest chips to TSMC’s most cutting edge 3nm process. This puts the company back on the bleeding edge of Moore’s Law (and ahead of AMD).

Intel is making its x86 IP available to chip designers who use Intel Foundry Services so that they can design custom chips that retain full software compatibility with their current infrastructure.

Intel released earnings this week and we are starting to see some of the problems emerge, for example the Data Center Group, which accounts for ~40% of their profits has been losing market share AND is down year over year, which is incredibly bad given that cloud spending is on fire.

Intel and Gelsinger have a long road ahead of them. Comparatively, I think Microsoft turnaround was similarly challenging, though had far less execution risk than the Intel plan. We will continue watching as things progress.

Supplemental Data

Supercompounders

Macro

Energy

Tech

Cloud Multiples

Check out the most recent edition of Clouded Judgement for the latest SaaS multiples. Ball covers the volatility in cloud in last Friday’s edition below…

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

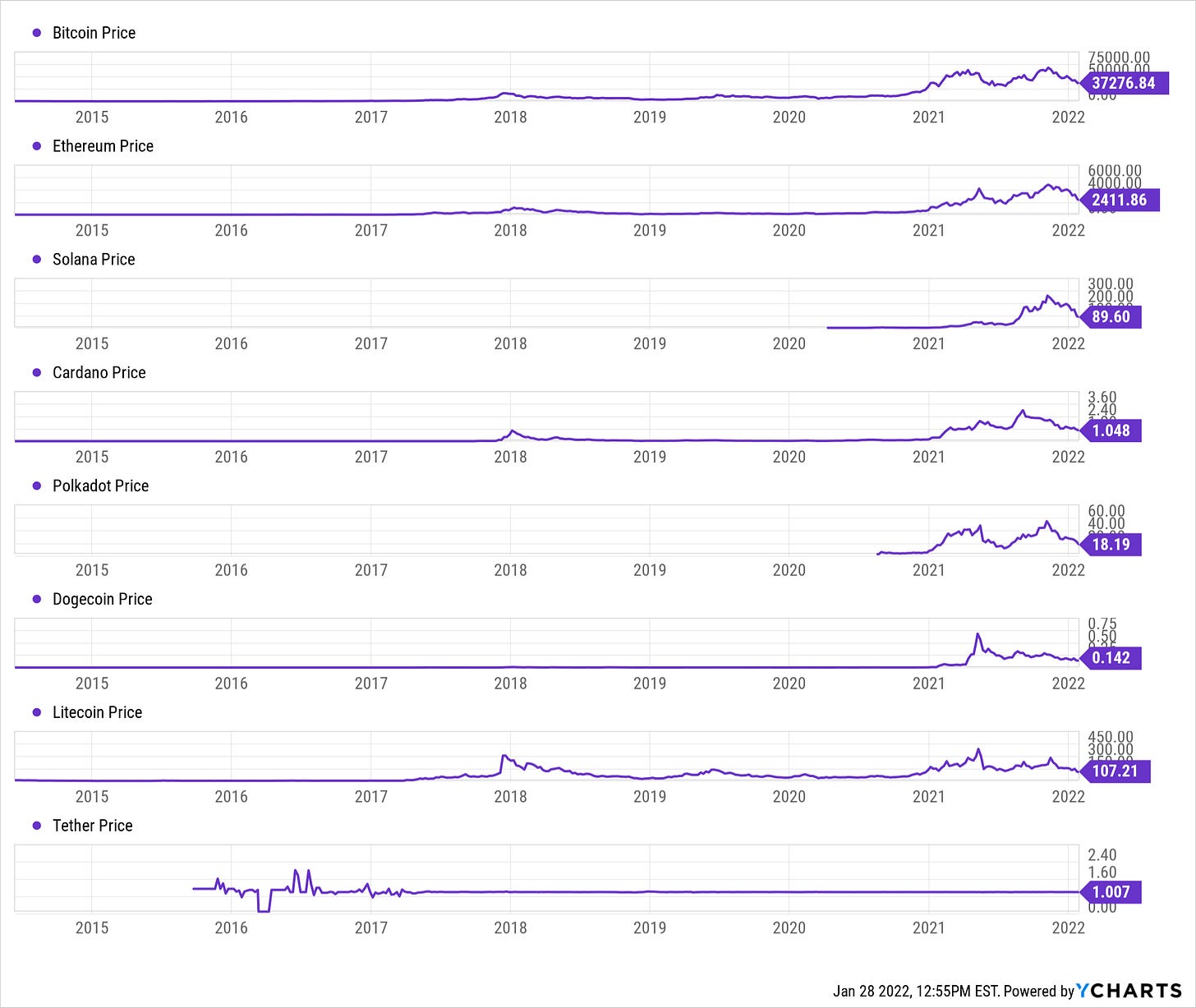

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.