If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

This week we continued our discussion on energy & tech. Frankly, there is no where near enough time to cover everything that is happening in this market, so if you are interest in digging in further check out the articles in the “Energy Tech” section for a teaser, then keep digging.

You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

Energy Tech continued…

EVs

There obviously has been a lot of coverage on EVs. I don’t want to rehash what is already out there, but I do want to point out a strategic complication that I think will play out over the next 10 years or so. Traditional automotive companies (those that are based around the internal combustion engine) will struggle to keep pace with all-electric new entrants.

Building and designing an EV, when compared to a traditional ICE vehicle, requires different types of expertise (i.e. software and electrical engineering), making the existing structure of the traditional auto makers a burden rather than an advantage. New entrants, will have more to gain and less to lose. They will take bigger chances, and while there will certainly be some failures, the winners will likely be some of the most powerful companies of the next century.

Furthermore, new entrants will pursue lighter weight, higher margin marketing and distribution models. Traditional auto manufacturers will have to figure out how to keep the dealer base happy in spite of the fact that new vehicles require less service, and therefore drive less revenue to the dealer base. I’d expect some level of consolidation of dealers, but this will be a major hurdle that the traditional manufacturers need to get right.

There are other reasons as well, and if you are interested in digging further, I highly recommend reading The Innovators Dilemma. It was written by Clayton Christensen, who is probably most highly acclaimed business strategy author, in 1997. At the end of the book, Clayton Christensen uses the electric vehicle market as an example industry that could get disrupted. I doubt anyone in this industry has not read the book. As an example, Volvo (Geely) followed Christensen’s advice and spun out its Polestar brand (all electric) into a separate company. The upcoming shakeout in the battle for the automotive market will be an exciting one to watch.

Batteries

Batteries can be 50% of total cost of production of EV and 2022 battery prices rising for first time since 90s. Therefore, EV manufacturers, and battery manufacturers should be pushing for maximum efficiency1. I interpret this to mean, achieve ‘good enough’ range with less metals.

As established last time, CATL is the leader and has left Panasonic, LG Chem, and others behind. LG Chem spun out its battery subsidiary LG Energy Solutions via IPO2 - I think it closed yesterday.

The trend of continually lower cost lithium ion batteries continues (not withstanding the expected higher pricing in ‘22), and until or unless there is a dramatically disruptive discovery, lithium will remain an important material in the production of EV batteries for the foreseeable future3. Companies will continue to push for more efficient manufacturing processes4.

It will take a long time for solid state tech to catch up, despite promises, maybe 10 years or more. In the interim, EV makers will be under pressure to maximize range and will be focusing on adopting “extra cell-technologies” that do a better job of squeezing the most range out of the available power5.

There is a clear desire to reduce or eliminate the amount of cobalt used in batteries. LFP (lithium iron phosphate) batteries provide promising, readily available alternatives6. BYD appears to be leading the way, with CATL and Tesla also committing to the technology7.

AI and machine learning are playing a role in accelerating the development of battery technologies8.

Farther out tech..

“Hybrid” batteries, utilizing supercapacitors present an exciting solution for EVs and other battery. applications. New form factors will have to be designed in order to be useful9.

Sodium Ion batteries are promising and accelerated research has paved a clear path for their use. CATL committed to the technology last year. It seems that the energy density limitations are real and this technology may be better suited for infrastructure scale batteries or shorter range or lower end applications10.

Metals and Mining

The challenges in the extraction and production of metals for batteries persist. Increased energy prices are forcing metal producers offline in Europe - partly due to geopolitical issues, but also due to misguided decision making, like shutting down nuclear in Germany. A planned Rio Tinto lithium mine in Serbia is causing protests (NIMBYism is a global phenomenon)11. As previously stated, Albemarle (ALB) is the leader here, but there is a lot of lithium out there and many companies are looking to secure supply. One example is General Motors, who partnered with Controlled Thermal Resources on a project at the Salton Sea in California. The site contains one of the largest sources of lithium brine and could potentially meet 40% of global demand for lithium12.

Supplemental Data

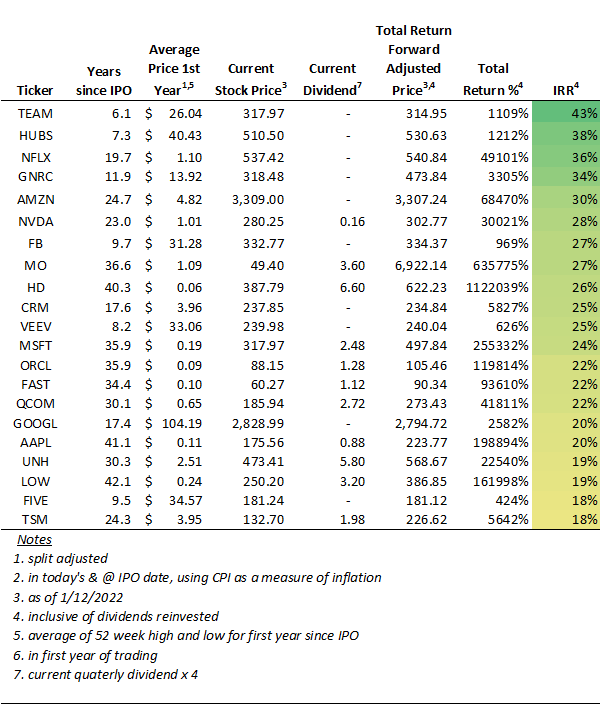

Supercompounders

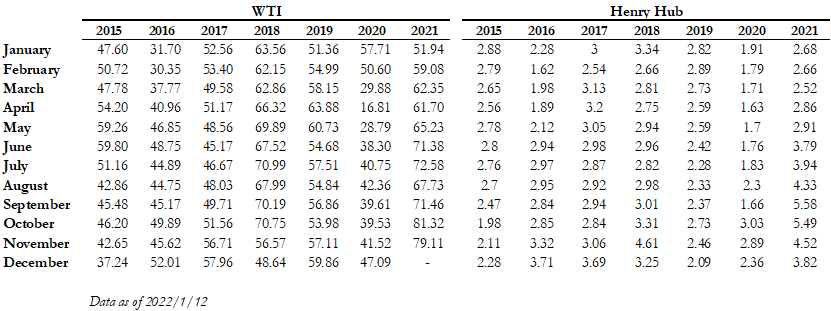

Energy Data

Macro

Tech

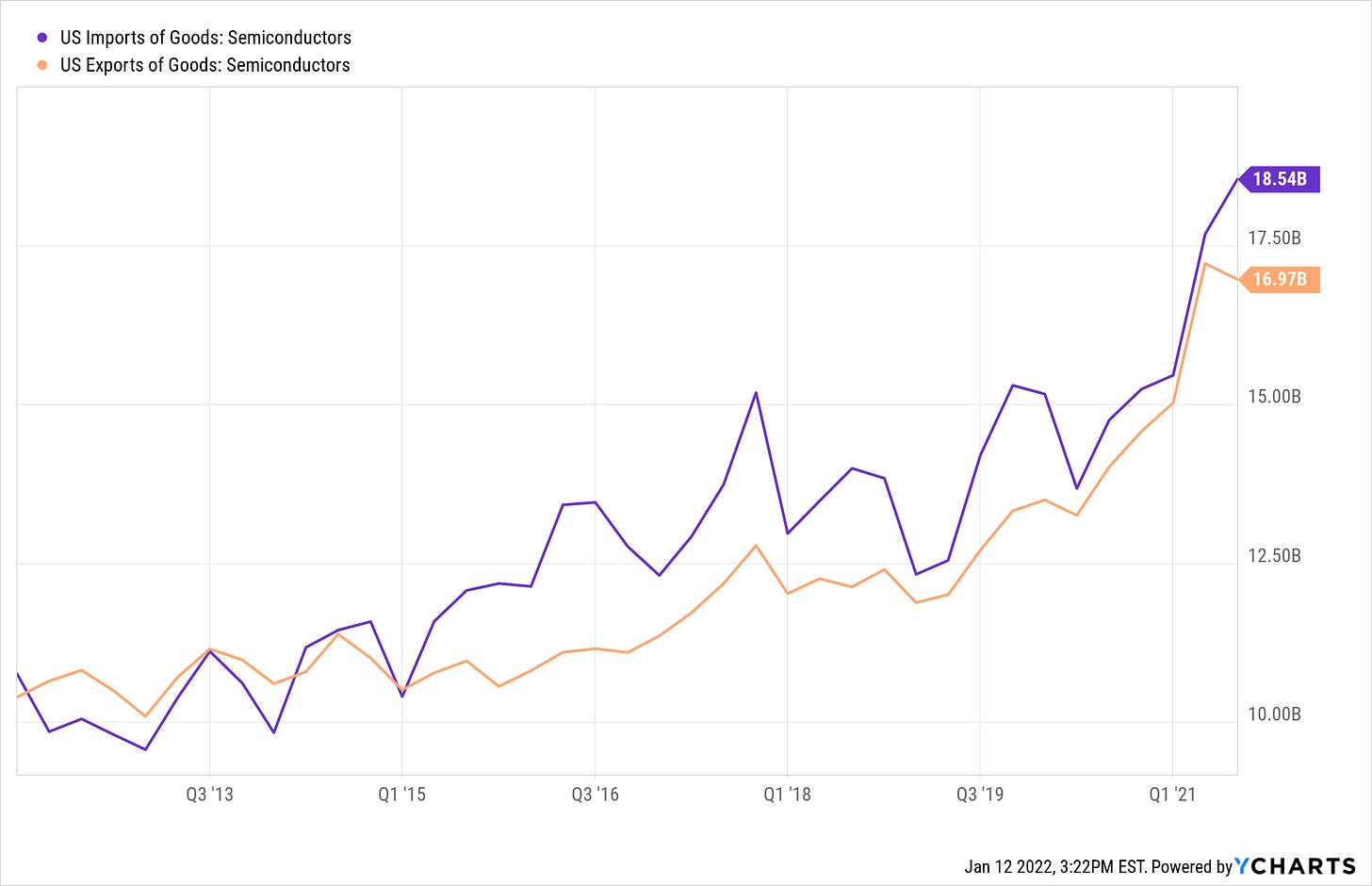

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

The founder of the chat app, Signal wrote an outstanding critical yet constructive perspective of web3. If you are still trying to figure out what is going on with web3 (i.e. you haven’t been ‘evangelized’) do give his article a read: My first impressions of web3

Cloud Multiples

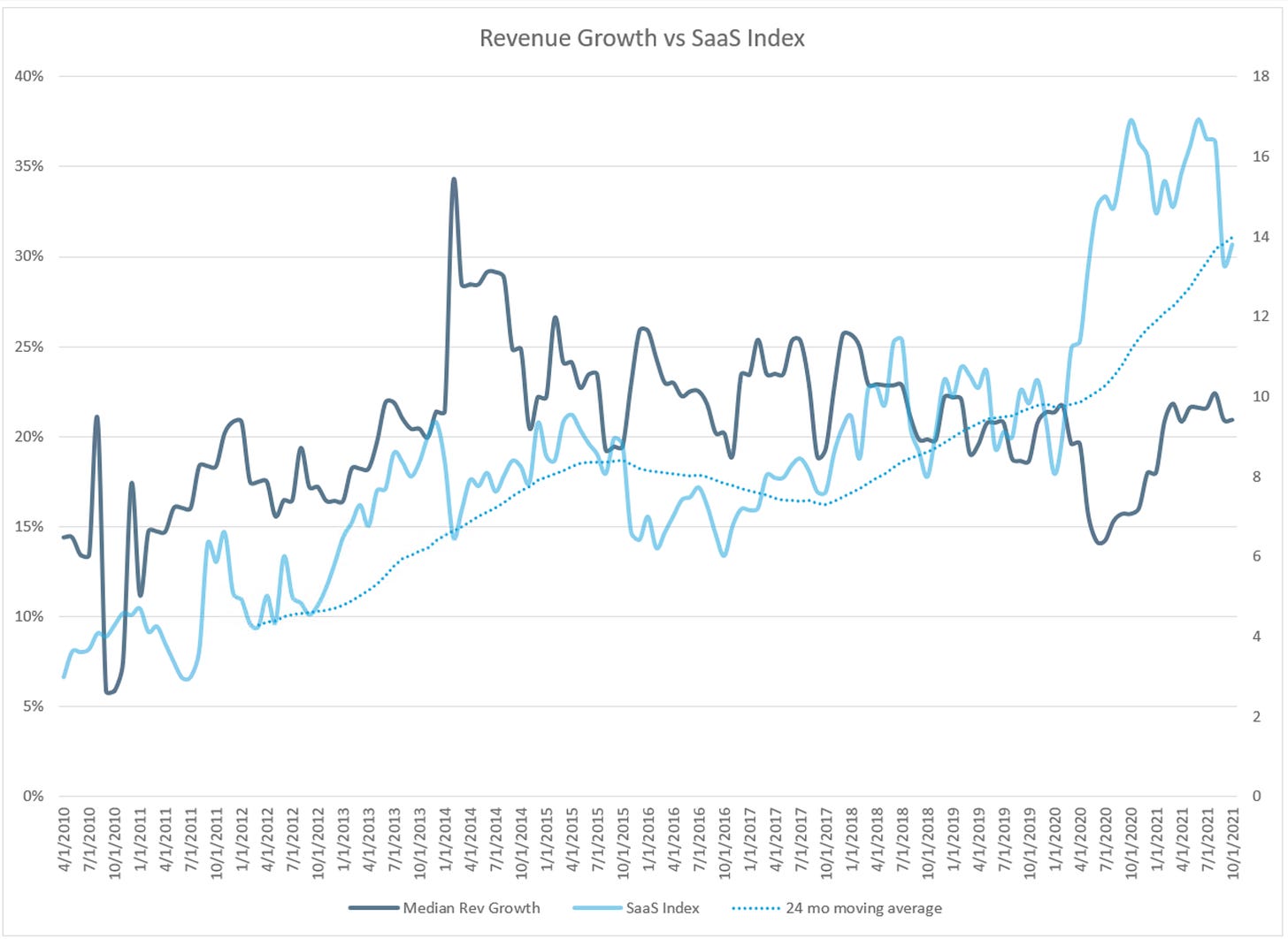

In case you were wondering if the forward growth estimates for the SaaS category as a whole had increased through covid, or the increase in the cloud multiples was simply margin expansion, I think the chart I made below will help.

I should note that the data I used to create this chart comes from SaaS Capital, and unlike Jamin Ball’s Clouded Judgement (below) data, the SaaS index is based on market cap, not enterprise value. Additionally, each ‘index’ contains a different set of companies, however there is quite a bit of overlap and I think reasonable comparisons can be made. The data from the chart is as of 12/31 and the index has come down a bit since then.

In the most recent edition of Clouded Judgement, Jamin elaborates…

This week was quite volatile for cloud software businesses. Over the last week only one cloud software company traded up. When looking at median multiples we’re now back to where we were pre-covid. The overall median multiple is 2% above pre-covid highs, 24% above where we were on Jan 1, 2020, and exactly at the previous peak in August 2019.

However, high growth software multiples are still elevated. Looking at high growth software median only - we are still 57% above pre-covid highs, 86% above where we were on Jan 1, 2020, and 24% above the previous peak in September 2019.

It is a little tricky to look at high growth and compare it to pre-covid because many of hte companies in that bucket now were not public pre-covid. This list includes Snowflake, Hashicorp, Gitlab, SentinelOne, Confluent, Asana, Monday.com, Zoominfo, Amplitude, Braze, UiPath, DigitalOcean, Qualtrics, Freshworks, JFrog. If I remove the recent IPOs from the high growth median bucket the high growth bucket has a median multiple of closer to 18x (it’s 22x with them). The 18x multiple would be a 27% premium to pre-covid highs for the same basket of high growth companies.

There’s nothing magical about the “pre-covid” level for multiples. I don’t mean to imply that pre-covid levels are the lowest we could fall in this current sell off. If we look back historically pre-covid levels were (at the time) near all time highs! We very certainly could continue falling well past pre-covid multiples. The 10 year is around 1.7% today. In the Fall of 2018 it was closer to 3%, and median SaaS multiples were closer to 7x then.

The case of high growth companies remaining elevated I would suppose is actually due to the increase in mean growth rate among the ‘high growth’ category - due to the high number of recent IPOs which are likely to be higher growing than the median company. Check out the latest article here:

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.