E2137 Debrief

Today we discuss the future of work, project management, workflow, and two recent IPOs in the space: Asana & Monday.com

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to compliment our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the call/podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the following posts:

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

In last week’s debrief, we covered two health-tech companies: GoodRx and Doximity. On this week’s episode of Telltales we continued our discussion of recent IPOs with two SaaS companies that are re-shaping project and workflow management: Asana and Monday.com. Today’s debrief will provide an overview of each company and compare the two from a relative valuation perspective, but first we need to discuss broader trends at play, namely, the Digitization of Work.

Digitization Of Work

One of the broader trends in the market that I've been following, and ultimately benefited when the world went remote due to COVID-19, is the digitization of work.

In the early days, enterprise software was defined by specific needs of pre-existing hierarchal organizations. Today, software is enabling flatter, distributed and more efficient processes and hierarchies.

Today we will discuss two SaaS companies that held IPOs in the last 12 months with leading project/workflow management solutions. Before we dig in, we will discuss project management methodologies and how the evolution of these methodologies is shifting and creating new categories of software in this space, for example: workflow management and workflow automation. These topics are integral to understanding the direction of the future of work.

Waterfall Project Management

Waterfall project management originated in the construction and manufacturing industries - where one phase must be completed before another begins. Waterfall projects are broken down into linear and sequential stages, where every piece of the project relies on the completion of preceding deliverables. For example...

When building a house, one cannot (generally) start roofing before framing is complete. Electrical and plumbing work may be able to be completed simultaneously, but both must be complete before drywall installation.

Each stage must be completed before the next can begin and you cannot go back to a prior phase without restarting the entire process. As a result, waterfall project management requires thorough documentation of requirements before the project begins.

Waterfall project management is a great methodology for well defined projects with varying bandwidth requirements throughout the life of the process. Again, the home building analogy is a good one - the plan is well defined by the architect and the bandwidth of each trade (roofer, plumber, electrician, etc) is only needed for discrete intervals throughout the project.

Microsoft Project still dominates the waterfall project management software space, though there are many other players.

Agile Project Management

Agile is a collaborative, self-organizing, cross-functional approach to completing work and requirements. Unlike the linear nature of waterfall, Agile focuses on adaptive, simultaneous workflows. There are many 'sub-methodologies' to Agile, like Kanban and Scrum, but in essence they aim to solve the same things. Agile is dominant in software development settings, for reasons which will become apparent.

The Agile methodology is strong where waterfall is weak. For example, waterfall requires thorough documentation while Agile focuses on working product. While documentation is still required, Agile teams are empowered to respond to business requirements with creative solutions, rather than implement static development plans. This is extremely powerful for software development as the business often doesn’t know what features of the product will be valuable to the users until after the features are implemented.

In Agile projects, the team is relatively static and is composed of cross-functional skillsets. The team chooses what to work on during a particular time-boxed development cycle. At the end of each cycle (sometimes as short as 1 week) the team demonstrates their completed work - which could be as simple as demonstrating a particular product feature, like a user login process for a software application. This brings up another strength of Agile - it is capable of responding to changes to a plan. Again, this is well suited to software, where development of a particular feature can be stopped relatively easily and the team can shift focus on a new priority defined by the business. This is very different than construction, where adding an extra feature (like adding a bathroom) severely disrupts nearly every prior phase of the project.

One of the biggest downsides to Agile project management is that, unlike waterfall projects, it is difficult to estimate the time to complete an entire project. While some may see this as a problem, it is also a feature of the methodology and a distinction for the types of projects that are well suited to Agile methodologies.

Agile purists tend to prefer analog methods to manage projects - the most popular being sticky notes and a whiteboard - versus software defined tools like Monday.com or Asana. However, analog tools are not effective for large organizations and due to COVID-19 have become nearly obsolete. Some popular software tools used to manage Agile project management include, but are not limited to: Atlassian Jira, Asana, Monday.com, SmartSheet, Wrike, Trello, and ClickUp.

Workflow Management & Automation

Workflow management is the act of overseeing a process from start to finish. The Agile software tools mentioned above are increasingly utilized for processes outside of their origin market, software development. Today, departments ranging from operations to marketing to finance and beyond are adopting tools like Atlassian Jira, Asana, Monday.com, SmartSheet, Wrike, Trello, and ClickUp to manage their workflows.

If structured properly, these tools give business leaders data and insight into their organizations. Furthermore, some of these tools have added specific features for workflow management that are reshaping entire businesses in the same way CRM re-shaped sales organizations. Most departments have no way to track, evaluate or replicate the things they’re doing right—or avoid repeating the things they’re doing wrong. Records are paper-based, and knowledge exists only in people’s heads, which means it walks out the door at the end of every business day. Workflow management aims to solve these problems.

Workflow Automation takes this one step further and applies the principles and technologies of marketing automation to business administration. Automations, when implemented properly, can make departments more efficient and enable entirely new business processes. Building a software defined businesses is a luxury normally endowed on venture backed startups, but with new software tools like Monday.com, SmartSheet, Wrike, Trello, and ClickUp, regular businesses can accomplish automation without spending a fortune on custom software development and maintenance.

Market Incumbents

Microsoft Project is the incumbent, preferred tool for waterfall project management. Atlassian, along with a few others have been quietly building empires in this space by focusing on Agile project and workflow management. SmartSheet is another newer entry. The following chart compares three companies with the 'super compounders' we discussed in the E2132 Debrief.

Recent IPOs

The rest of this article with focus in on two recent IPOs in the project & workflow management & automation software category. Namely: Asana and Monday.com.

Asana is a project management software system for businesses of all sizes. As one of the first completely cloud-based project management programs, Asana was already a popular choice when it IPOed on September 30, 2020. The company’s SaaS solution includes features for task management, collaboration, document management, workflow management, project portfolio management, and more.

Asana, like most project management solutions, lets you visualize task progress in multiple views including lists, calendars, Kanban boards, and Gantt charts. It offers an extensive list of integrations (>100) that enable more efficient workflows and broader workflow management. Furthermore, Asana also offers basic automation functionality that is capable of triggering workflows, automatically assigning tasks, and adjusting due dates based on dependencies.

Asana, like most SaaS companies, charges per seat, and offers a free 'Basic' plan that accelerates customer acquisition and ultimately makes it easier for the company’s sales teams to pursue larger accounts via land and expand strategies (bottom-up sales strategy).

According to the S1, the company is focused on driving Business and Enterprise customers with annual spend > $50,000. As such, the sales team has shifted from low touch to high touch direct sales, hence the rapidly increasing sales and marketing spend.

For more information on Asana, check out the following documents

Monday IPOed on June 10, 2021. Like Asana, Monday.com tracks tasks, visualizes progress, eases collaboration, increases visibility, stores documents, and everything else you’d expect from a PM program.

Monday visualizes task progress in one interface, so you don’t have to switch back and forth between big-picture versus granular views of project statuses. Navigating within this interface, you can view projects as Gantt charts, Kanban boards, timelines, and more.

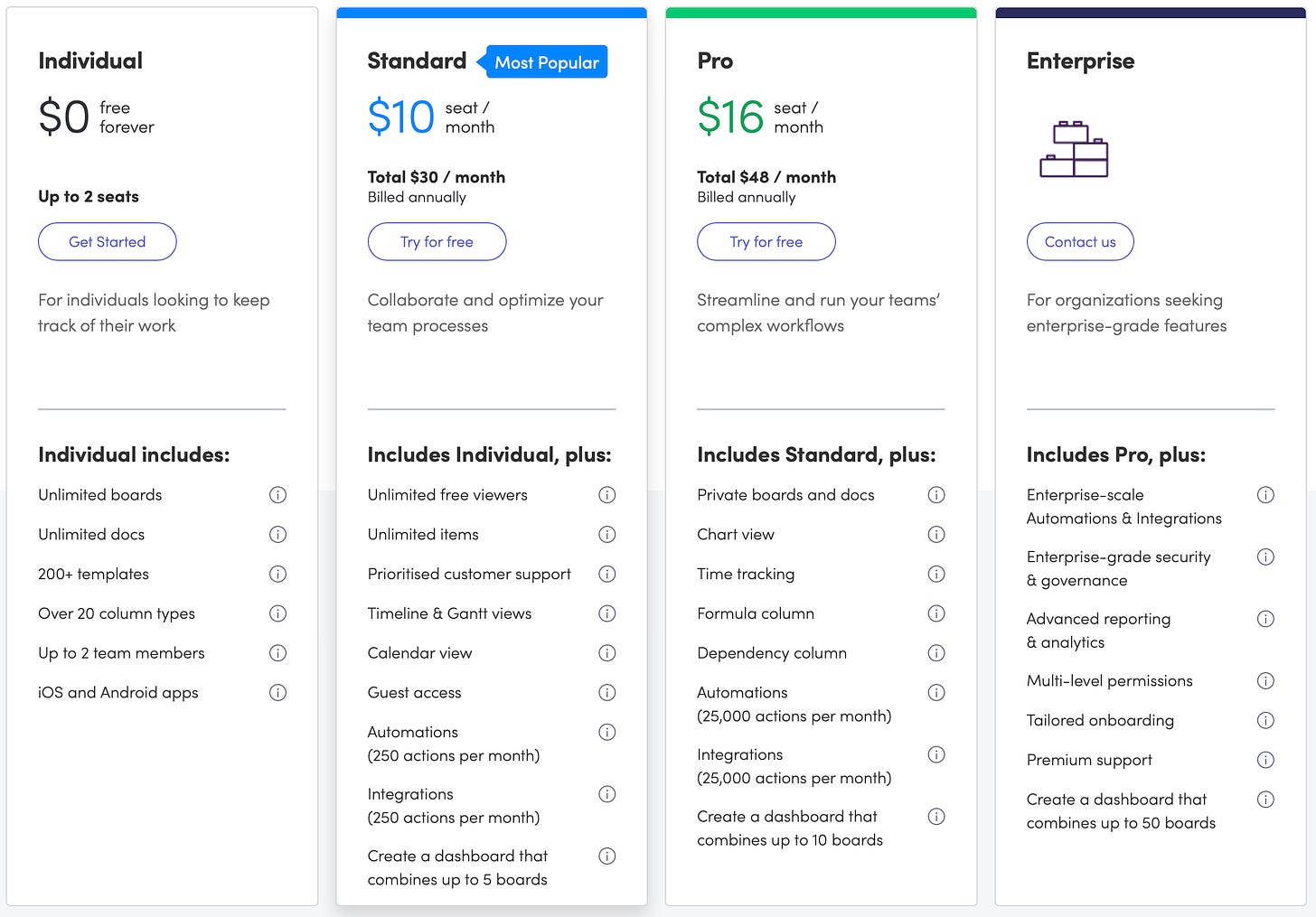

Monday, like Asana, offers workflow automation features as well and their pricing plans are very similar to those of Asana. Like Asana, Monday’s self serve tiers of pricing are key drivers of enterprise sales.

Again, like Asana, Monday is focused on growing the number of customers with > $50,000 in annual spend. From the prospectus:

Our ability to successfully move upmarket is demonstrated by the consistent growth in the number of our enterprise customers. We have grown the number of enterprise customers on our platform, which we define as customers with more than $50,000 in ARR, by 247% from 2019 to 2020 and by 219% from March 31, 2020 to March 31, 2021. The ARR from such enterprise customers grew by 297% from 2019 to 2020 and by 261% in the three months ended March 31, 2021 compared to the same period in 2020, outpacing our overall ARR growth as a company.

For more information on Monday, check out the Monday.com prospectus (I recommend reading it alongside Asana’s)

Asana vs Monday.com

If you remember our E2135 Debrief, we covered C3.ai and Palantir, both of which are marketing themselves as an operating system for business. Ultimately, I think Monday.com and Asana are going after a similar market with a bottom up sales approach vs the top-down nature of C3 and Palantir. In general, I think the bottom-up SaaS approach tends to generate more predictable, sustainable revenues.

If you’ve been following along the last few weeks, you’ll remember the following chart and table. These were originally provided by Jamin Ball, author of Clouded Judgement (which I highly recommend reading for updates on SaaS relative valuations). I’ve provided them again, although this time I reproduced the charts with my own data (as of 9/14/2021).