E2241 - Micron - October 12, 2022

Special guest: Dylan Patel of SemiAnalysis joins us to discuss the recent China export controls, memory markets, and Micron

If you are new, welcome! If you haven’t subscribed, join our crew by subscribing here:

🎧 To listen to the podcast, click play button below or listen on Apple Podcasts, Spotify, or SoundCloud.

This newsletter is designed to complement the podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

If you know someone who could benefit from Telltales, please share it by clicking here:

This week we had a special guest - Dylan Patel, semiconductor analyst and producer of SemiAnalysis. Dylan kindly gifted us three 1 month subscriptions to his newsletter that I will send to the first three people that respond to this newsletter requesting it. I highly recommend checking out his article on the recent export restrictions (linked below). Thanks, and enjoy this week’s episode on Chips, China Export Restrictions, and Micron.

Micron

Micron Technology said on September 30th it was cutting its investment plans by 30% amid a fall in demand for PCs and smartphones and reducing investment in fabrication by 50% in the new fiscal year.

The memory markets are becoming more sophisticated - which means that the competitors may make more optimal decisions that improve profits for the whole group. As Vitaly pointed out above, Micron fairly explicitly stated that it expects the industry to curtail supply. It seemed to work. Kioxia cut NAND wafer production by 30% on September 30th (The Memory Guy). And Samsung is “maintaining consistent supplies rather than lowering output” (Mobile World Live).

Is Micron Cheap?

This is a tough question to answer because CAPEX currently eats all cashflow and we are moving into a period of declining volumes. That being said, there are some tailwinds with respect to removing YTMC as a would competitor (discussed in the podcast). One bit of information I will point out is that Tangible book value is $43.60 / share, about $10 below where the stock trades today.

Check out the attached sheet to see how Micron compares to the other chip stocks we’ve looked at recently…

Supplemental Data

1 SuperCompounders

2 Macro

Meeting minutes show Fed is committed to taming ‘unacceptably high’ inflation, no mention of ‘transient’ (WSJ, FT). US Jobs Report - 263,000 adds, unemployment rate 3.5% (FT, WSJ).

3 Energy

Germany considers Fracking (WSJ). U.S. Takes Aim at OPEC for Oil Production Cuts (WSJ). OPEC, Saudi says it’s cut is not about US (FT), rather OPEC is predicting significantly reduced oil demand (WSJ).

Volvo (Geely) expects to have 600kW charging tech by next year - 186 miles charge in 5 minutes (Medium).

4 Tech

FT interview with Elon Musk (FT)

Tesla semi deliveries start in December, 500 mile range, PepsiCo first customer (WSJ)

Robotics experts view on Tesla’s Optimus Robot (IEEE)

A former Facebook engineer wants to help you make your own cell network (the Verge)

Cloud Multiples

Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

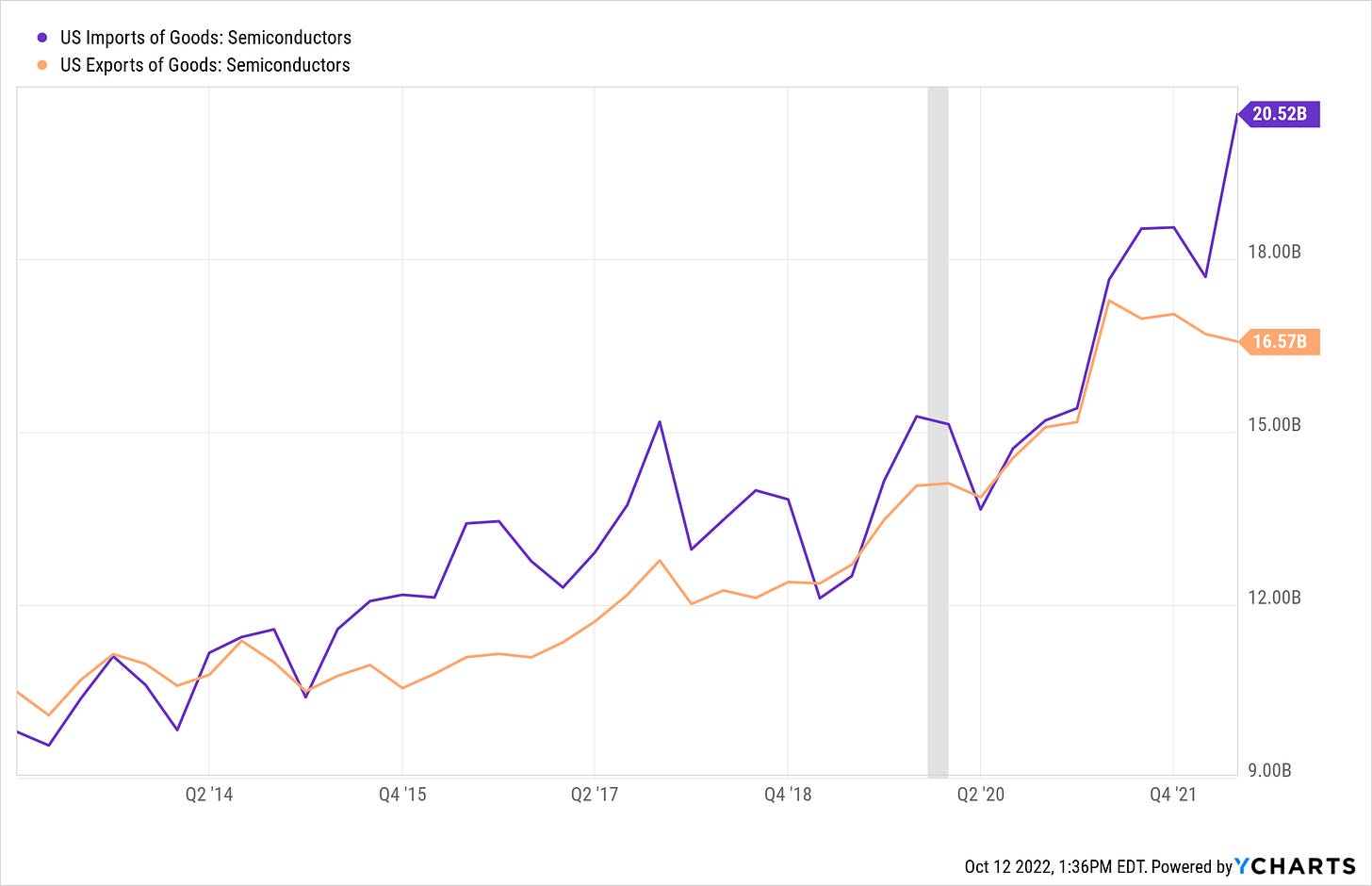

Semiconductors

Crypto

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.