If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Subscribe to this newsletter to stay up to date!

Advanced Micro Devices (AMD)

This week, our company of the week is Advanced Micro Devices (AMD). Some additional notes to accompany this week’s podcast are included here…

History

AMD was founded by Jerry Sanders and seven of his colleagues from Fairchild Semiconductor. AMD initially became a second source supplier of microchips. By 1975, AMD entered the microprocessor market with the Am9080, a reverse-engineered clone of the Intel 8080. Interestingly, this would lay the groundwork for a future relationship between the two companies.

X86 CPUs

AMD topped $100 million in sales in 1978, the same year that IBM introduce the first x86 microprocessors. IBM wanted Intel's x86 processors for its personal computer offering, but only under the condition that Intel also provide a second-source manufacturer - a sign of how nascent the industry was at the time. Jim Keller, one of the most famous chip designers of all time designed quite a few AMD chips and AMD’s success has largely been tied to the timing of the release of those designs. These include…

Athlon K7 - From August 1999 until January 2002, this initial K7 processor was the fastest x86 chip in the world

AMD K8 - Launched in late 2003, the Athlon 64 was the first consumer desktop CPU with a 64 bit architecture

AMD K12 - Keller returned to AMD from Apple to design the K12, which was to be AMD's first custom microarchitecture based on the ARMv8-A (AArch64) instruction. Unfortunately this product did not amount to much as it was a bit ahead of its time.

AMD Zen - The Zen series launched initially in 2017 and is the same architecture that is being produced today. It is largely responsible for bringing AMD back to relevancy in the x86 market

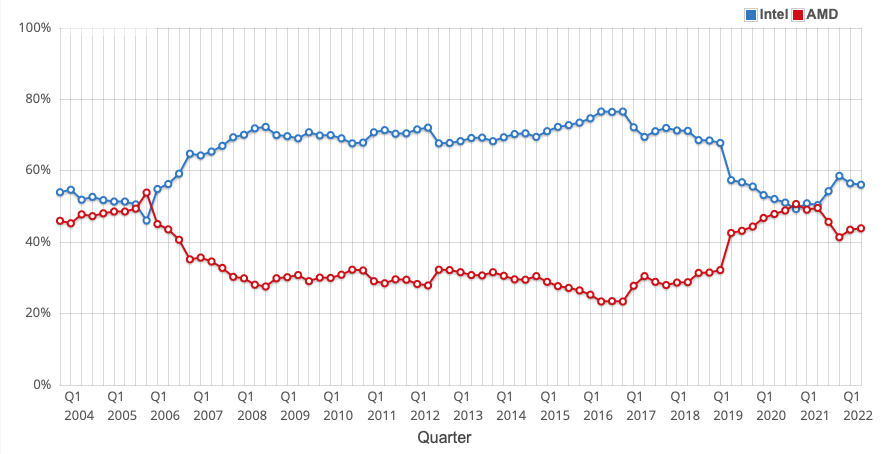

As you can see from the market share chart from PassMark Software, AMD rarely has achieved 50% market share and, in the past has very quickly fallen off when their designs lag those of Intel. In recent years, the combination of Intel falling behind, Taiwan Semiconductor being the only foundry operating on the leading edge, and the latest Jim Keller designed Zen architecture has enabled AMD to again regain a position of relevancy in the x86 market.

GPUs

In 2006, AMD announced its acquisition of the Canadian 3d graphics card company ATI Technologies. AMD paid approximately $5.4 billion in cash and stock for the company. In general, AMD GPUs have lagged those of Nvidia in spite of generally launching products on better process technology due to AMD’s close relationship with Taiwan Semiconductor. Furthermore, Nvidia’s CUDA software creates a moat that makes it the default choice for AI software application development. For more on this, see the keynote from Nvidia GTC below.

Nvidia GTC

Nvidia’s GTC conference was last week. Check out the keynote for a glimpse into the future of artificial intelligence software and hardware…

Supplemental Data

1 SuperCompounders

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

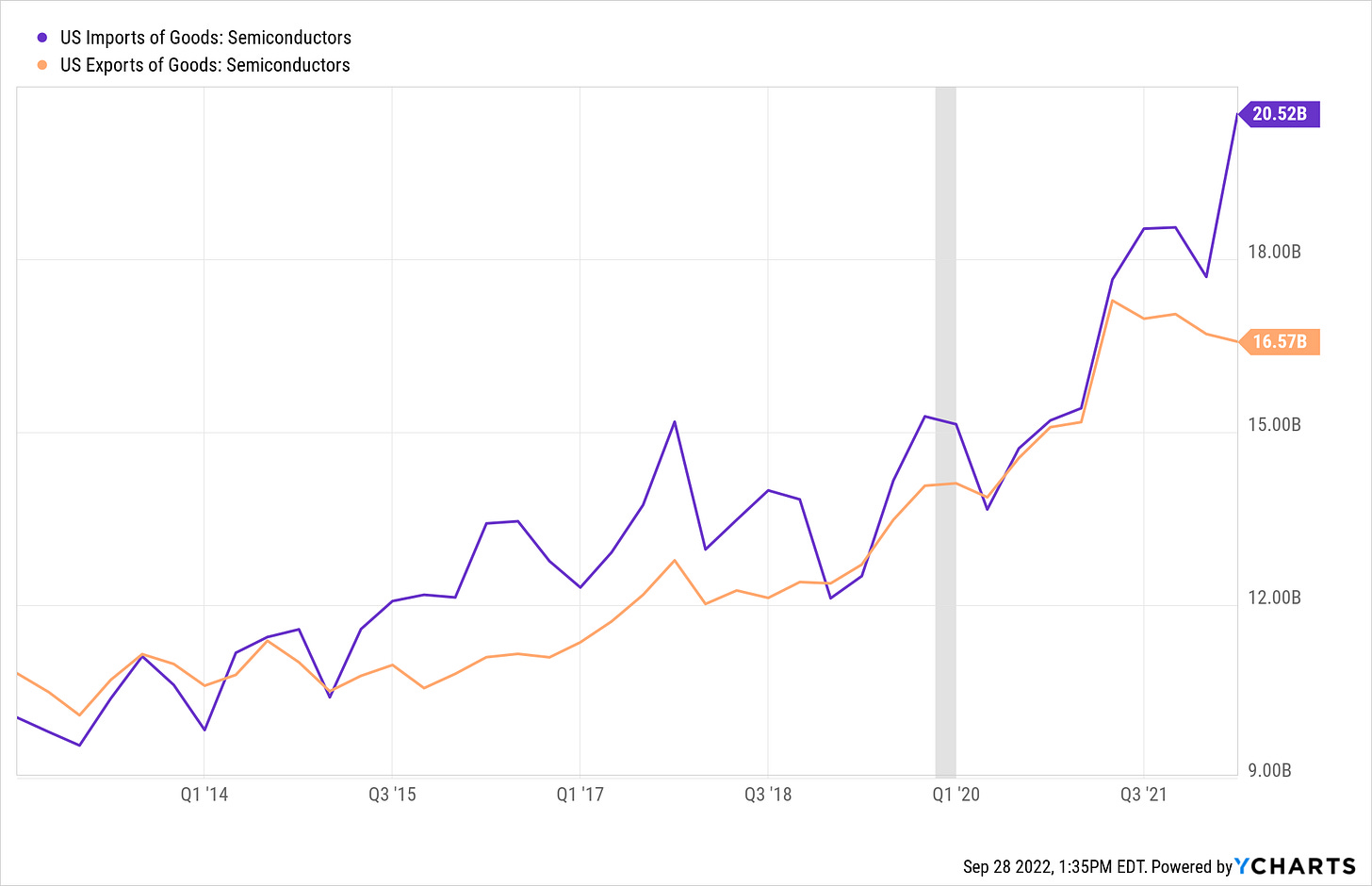

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.