E2231 - August 3, 2022

China in workout mode, Natural Gas market dynamics, E-commerce return to trend, & Intel cedes more market share to AMD

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Subscribe to this newsletter to stay up to date!

Here’s the cliff notes from this week’s episode:

China is in “workout mode”

~20% of GDP comes from property development which will has ground to a halt

Regional governments are highly dependent on revenues from land sales in order to finance operations

Xi is seeking 3rd term (unprecedented)

How China’s vulnerability impacts

TSMC

Tesla

APPLE

Natural Gas

Market for LNG is determined by European prices because of Russia

LNG rates in China/Korea/Japan ~$1 over Europe due to additional transport cost

Marginal gas demand comes from LNG

US Export capacity is 11 Bcf / day (was 13 prior to Freeport fire), significant additional capacity planned

Other than LNG, demand in the US is flat

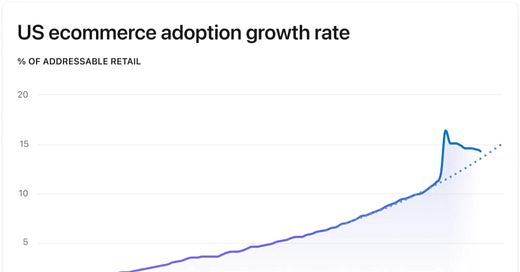

E-commerce

E-commerce adoption went exponential due to COVID-19, but has since come back down to earth

Shopify is laying off workers as it recalibrates its view on e-commerce adoption

X86

Both AMD and Intel were hard hit by the slowdown in PC sales, which in q2 was estimated to be ~15% YOY

In spite of this, analyst figured AMD took 6.6% of Intels market share this Q, largest amount in a single Q

AMD data center sales up 83% y/y

Intel has cut fab expansion and increased the dividend in spite of clear long term underperformance and underinvestment in their core business.

Gelisnger was brought in to provide technical leadership to the company but these recent moves show that Intel is exactly who we thought they were.

Supplemental Data

1 SuperCompounders

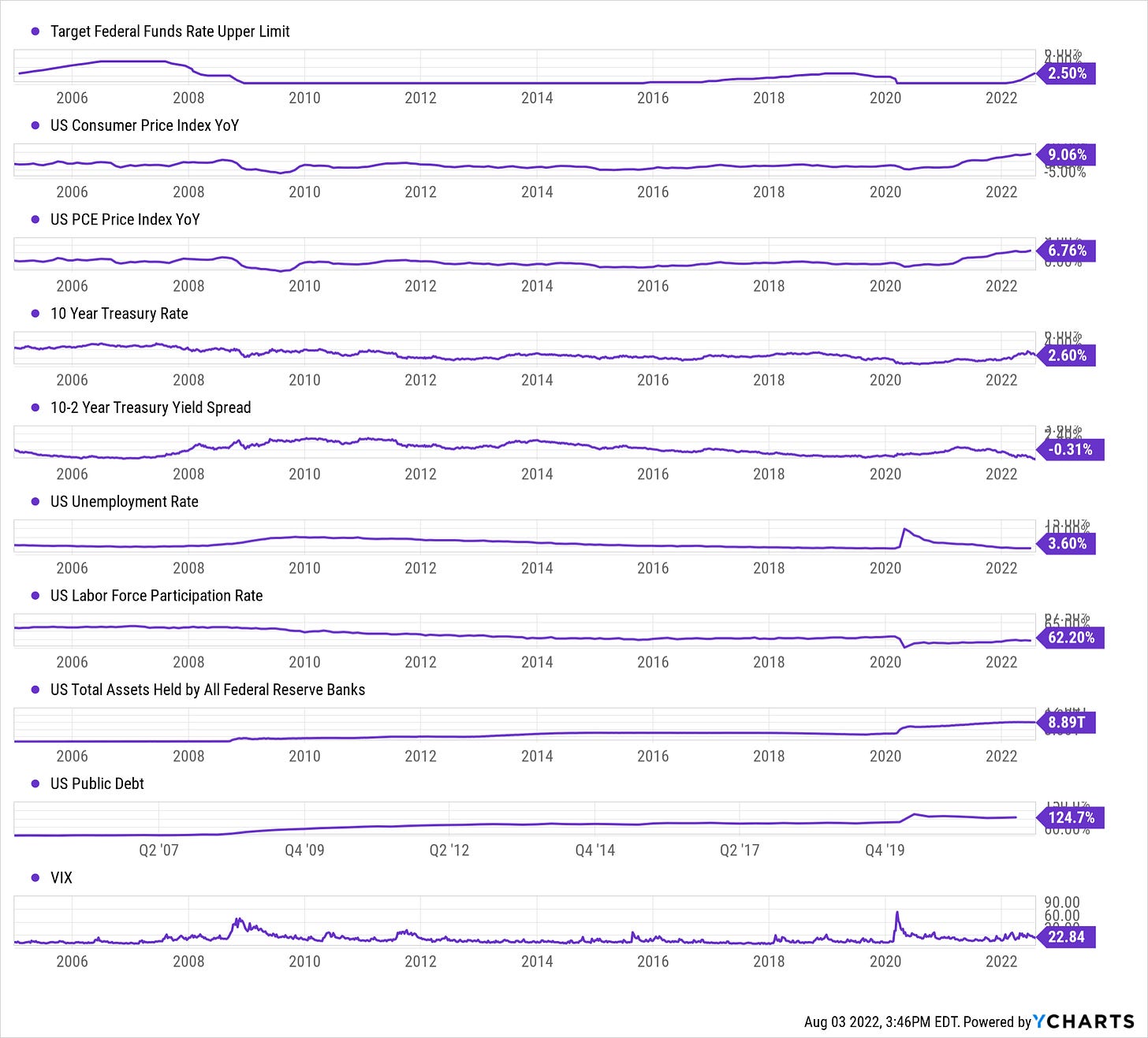

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.