If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud.

Subscribe to this newsletter to stay up to date!

THE PERSON THAT TURNS OVER THE MOST ROCKS WINS THE GAME.

– PETER LYNCH

Today we discussed oil and gas markets and Hunt rationalized the perspectives of futures contracts buyers and sellers which has resulted in a high level of backwardation for both oil and gas. For an an oil and gas producer to warrant investment, they must be able to increase or at least maintain production levels by spending less than 2/3 of their cash flow. The companies that can do this are highly capital efficient. Here are a few of the producers mentioned today that we will discuss in further detail after they release Q2 earnings.

On the other side of the coin are technology companies. We discussed a few companies today, one of whom, Tesla, reports this afternoon. We expect weak earnings in Q2 due to Shanghai lockdowns.

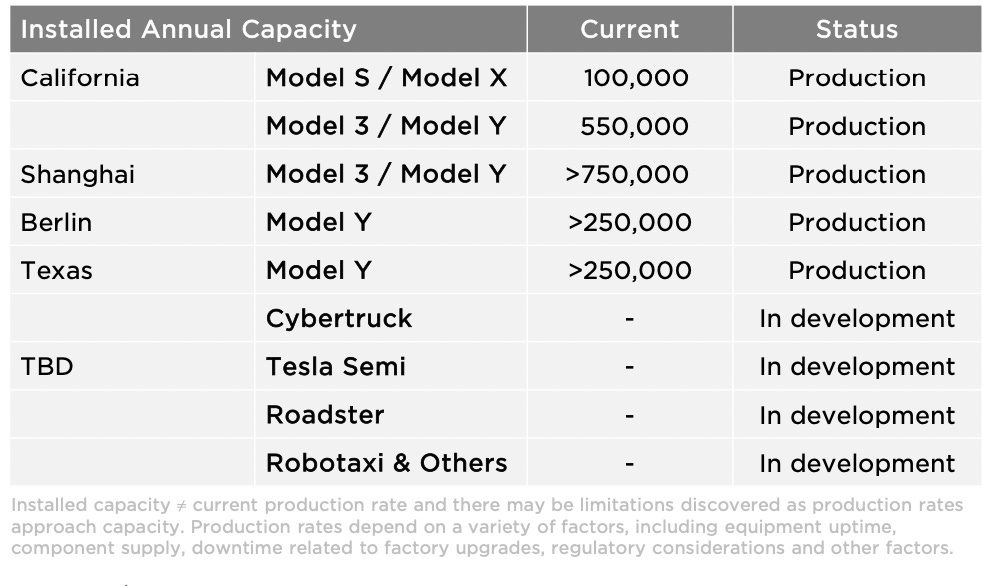

In the next year we think that the company can produce in excess of 2 million cars with its four factories when running at normal capacity. In a previous episode (E2223) we discussed an appropriate valuation given that level of production. That valuation, $500 / share, is well below today’s price.

As I am writing this, Tesla has published an earnings presentation and will be hosting an earning call at 2:30 pacific today. As expected, production is down month over month, but still up by 25% year over year. Furthermore, they have provided more details on production capacity at their new factories. Current capacity is >1.9m.

Tesla did point out that production in Shanghai in June reached a record level while Fremont hit a record this quarter as well.

We will discuss these results and more next week.

Supplemental Data

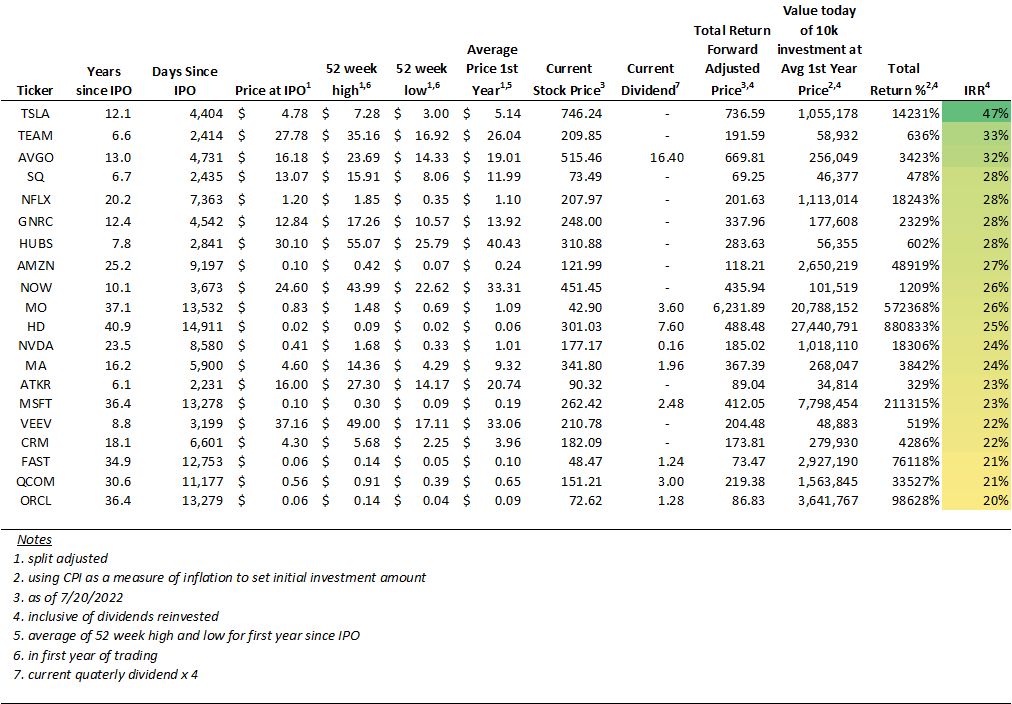

1 SuperCompounders

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

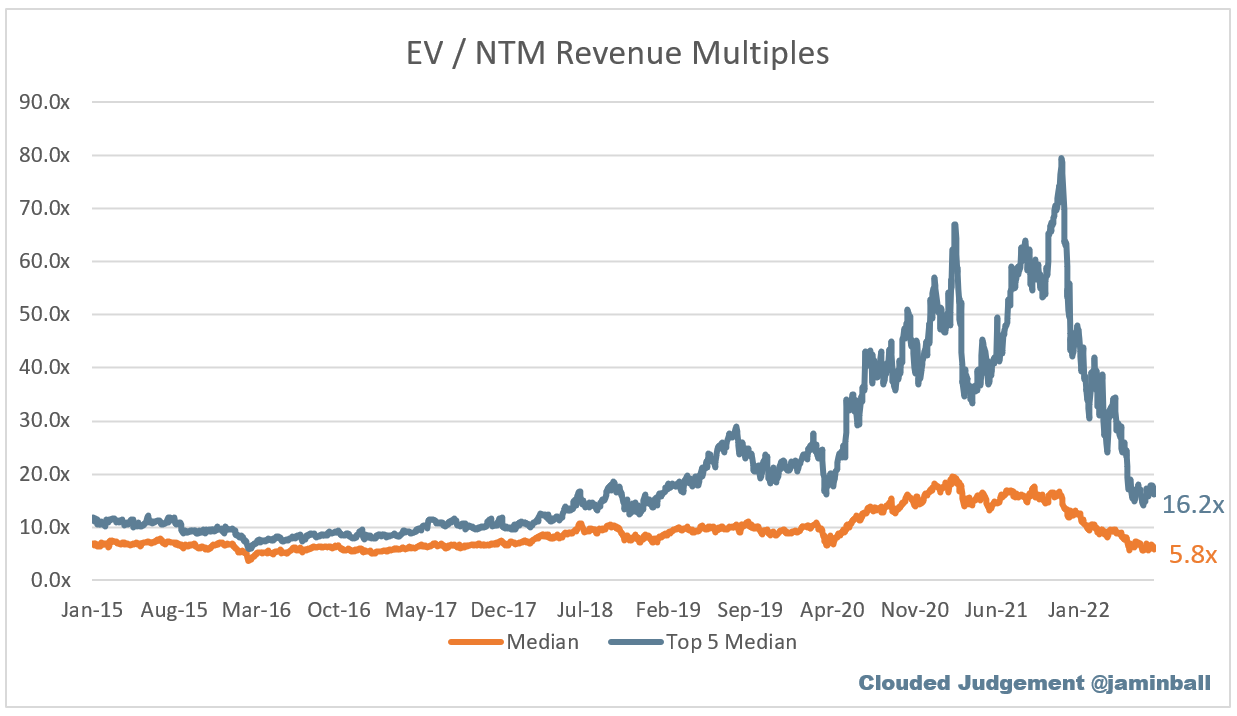

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

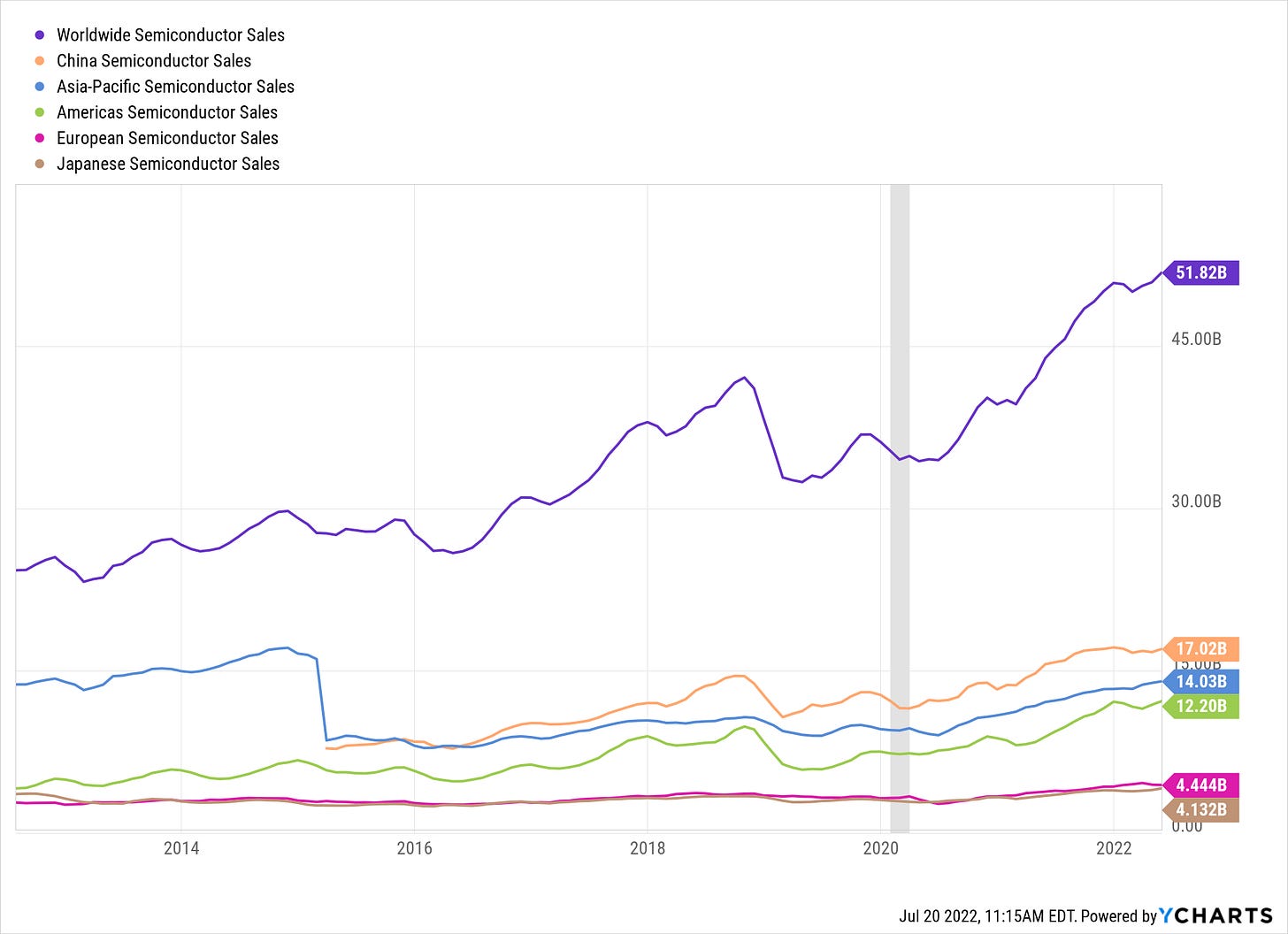

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.