If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

Things from this week

Jamie Dimon. At the end of the podcast this week, Hunt mentioned a Bloomberg interview with Jamie Dimon where he discusses China and Taiwan. Check it out here: JPMorgan CEO Dimon on Fed, Energy Policy, Ukraine War May 4th, 2022, 4:55 AM PDT

Interest Rates. The FOMC raised the fed funds rate by 50 basis points. Two perspectives….

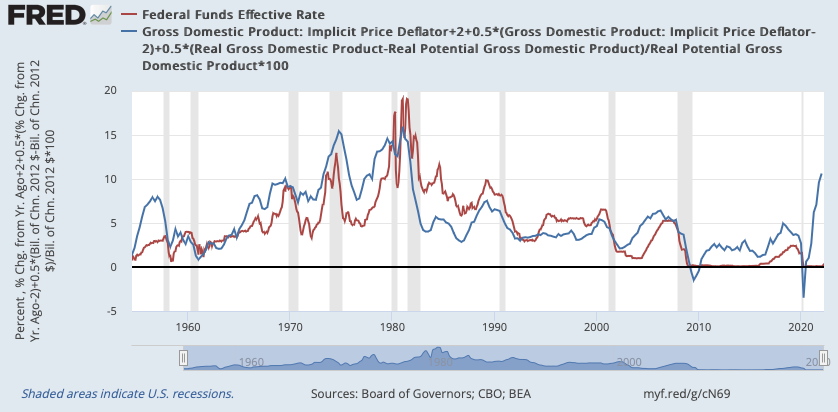

The Fed is way behind, on raising rates. This chart shows the Fed funds rate and the Taylor Rule, sort of an estiamte as to where the Fed funds rate ought to be. The gap between the two has never been higher (except for maybe yesterday, before the hike).

The Taylor Rule - source: FED Alternatively, and I think this is the more likely scenario, the Fed truly believes inflation is transitory. In spite of the fact that J. Powell removed the word “transitory” from the fed lexicon, the Fed is essentially on the same path

Omaha. I went to Omaha for the Berkshire Hathaway annual meeting. It was awesome. You can watch the whole thing on here: Part 1, Part 2. Here are a few takeaways…

There is such thing as too much of a good thing… ETFs have concentrated voting power in the hands of a few companies. These companies are acting at the will of politicians, not because they are bad people, but because they have a lot to lose.

How independent are independent directors? Not very, at least the story Warren told was quite disturbing. Check out the end of Part 2.

The crypto community is up in arms. Charlie and Warren aren’t into crypto. This shouldn’t be a surprise, they like cashflow generating businesses. You’ll also notice that they don’t invest in gold or commodities.

While I was there I got to meet with Bryan R. Lawrence...

Here’s the 2022 Berkshire Hathaway book list →

There are a bunch of books on there I’ve read and some new ones I’ve added to my list. I picked up a copy of Gillian Zoe Segal’s “Getting There” while I was there.

Supplemental Data

1 SuperCompounders

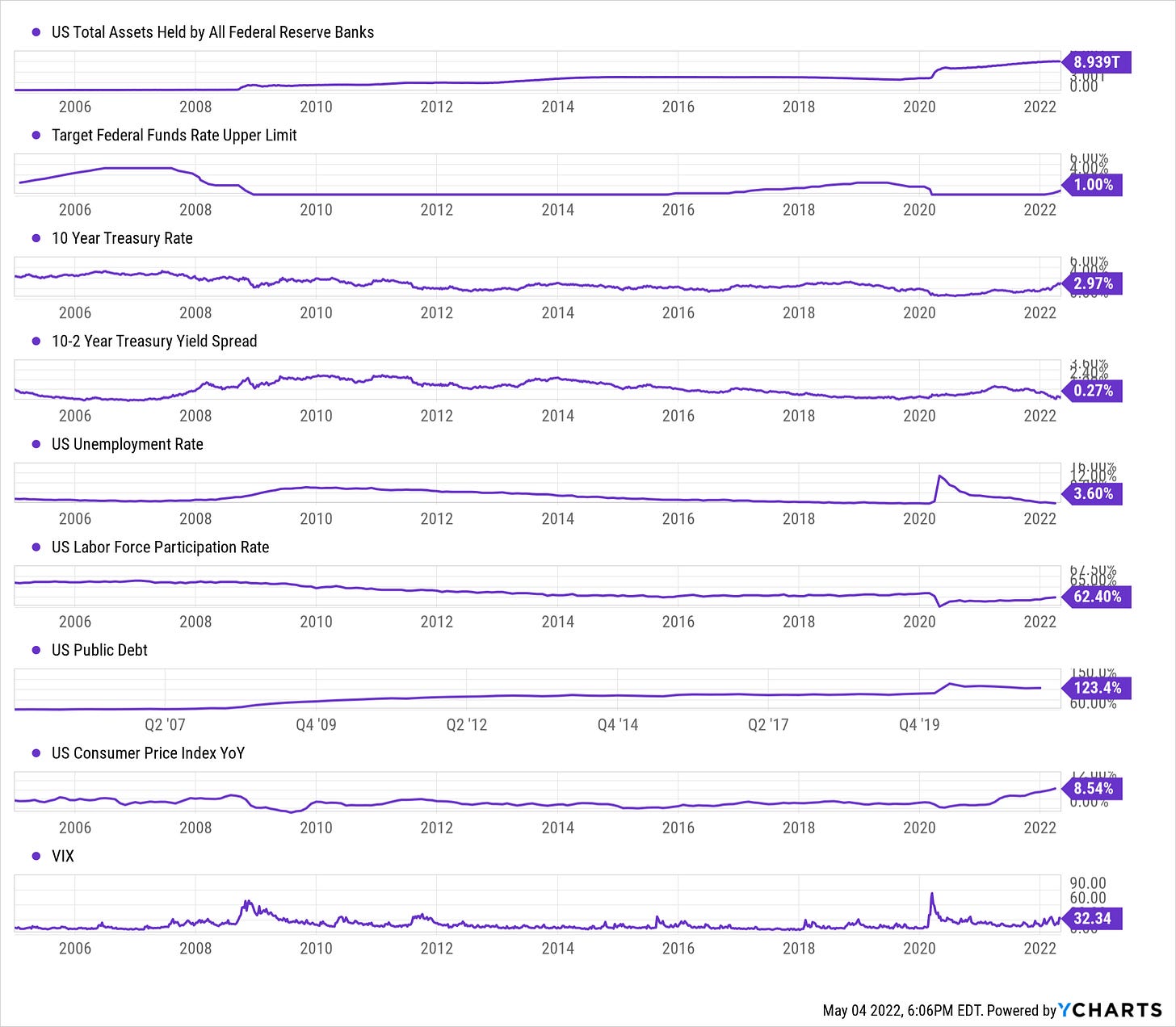

2 Macro

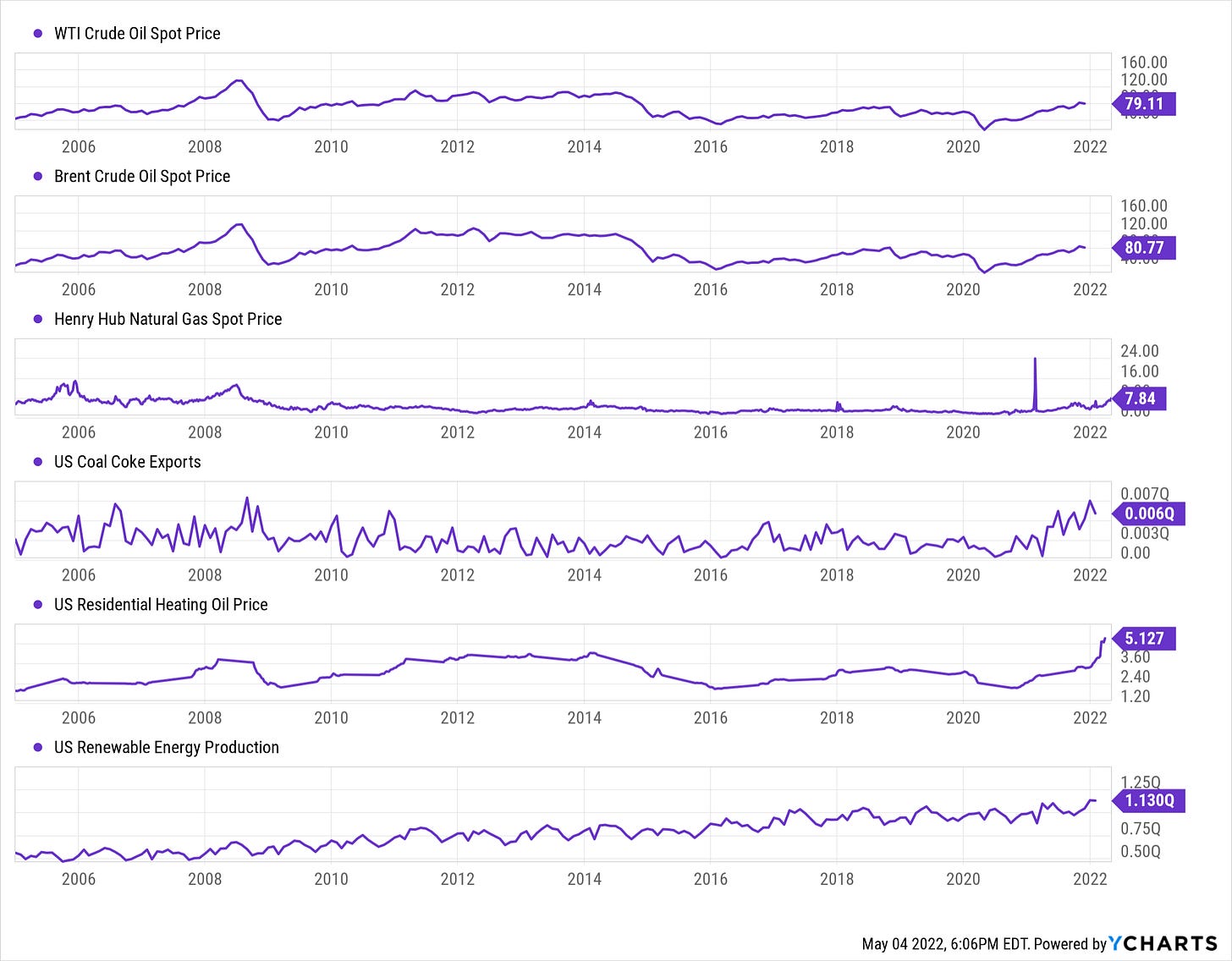

3 Energy

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

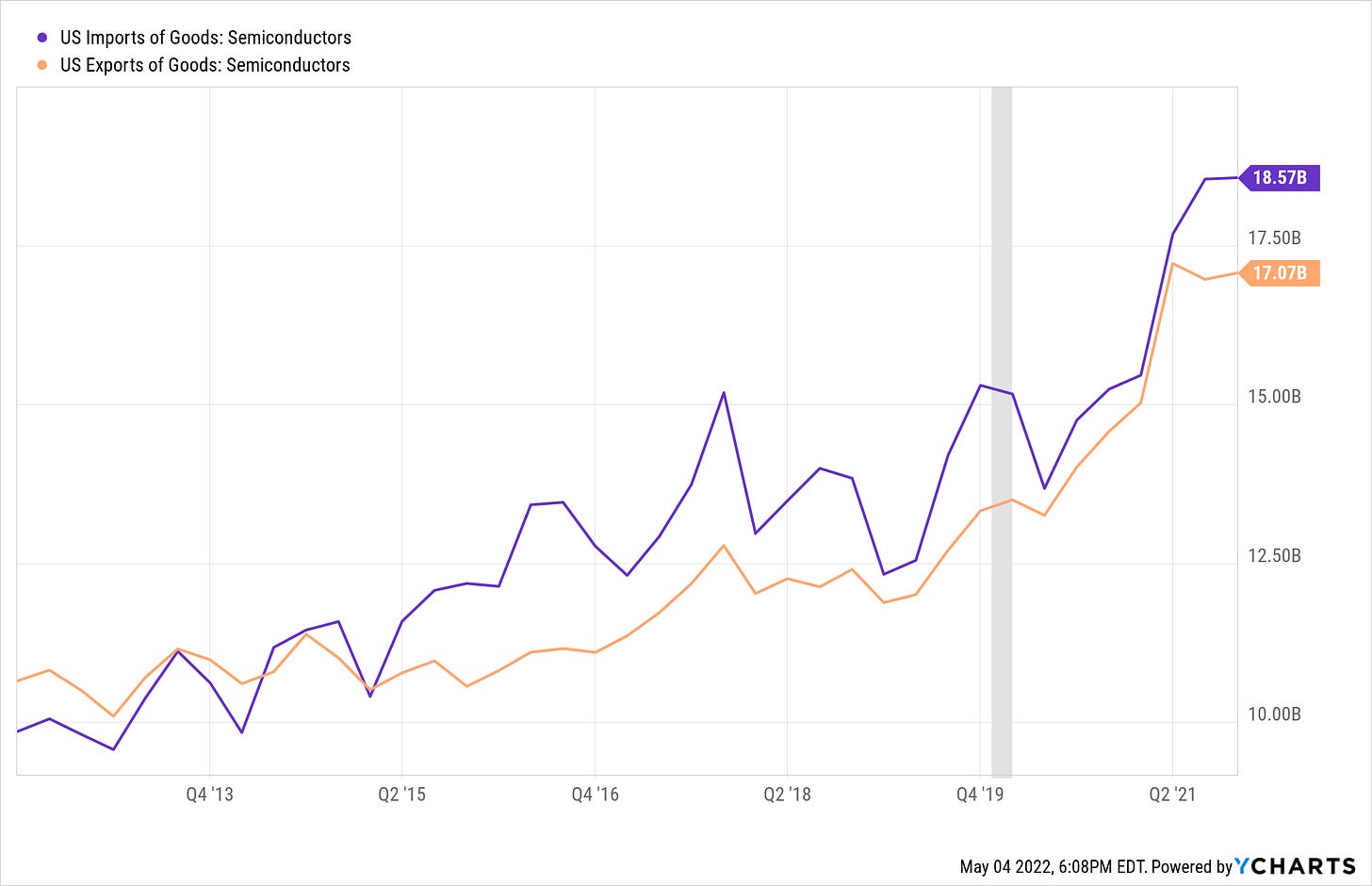

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.