E2213

Next gen Manufacturing & Robotics, SPAC attack, Automotive Semiconductor Problem, China, Threatening USD as World Reserve Currency

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

Here are some of the things I’ve been reading lately….

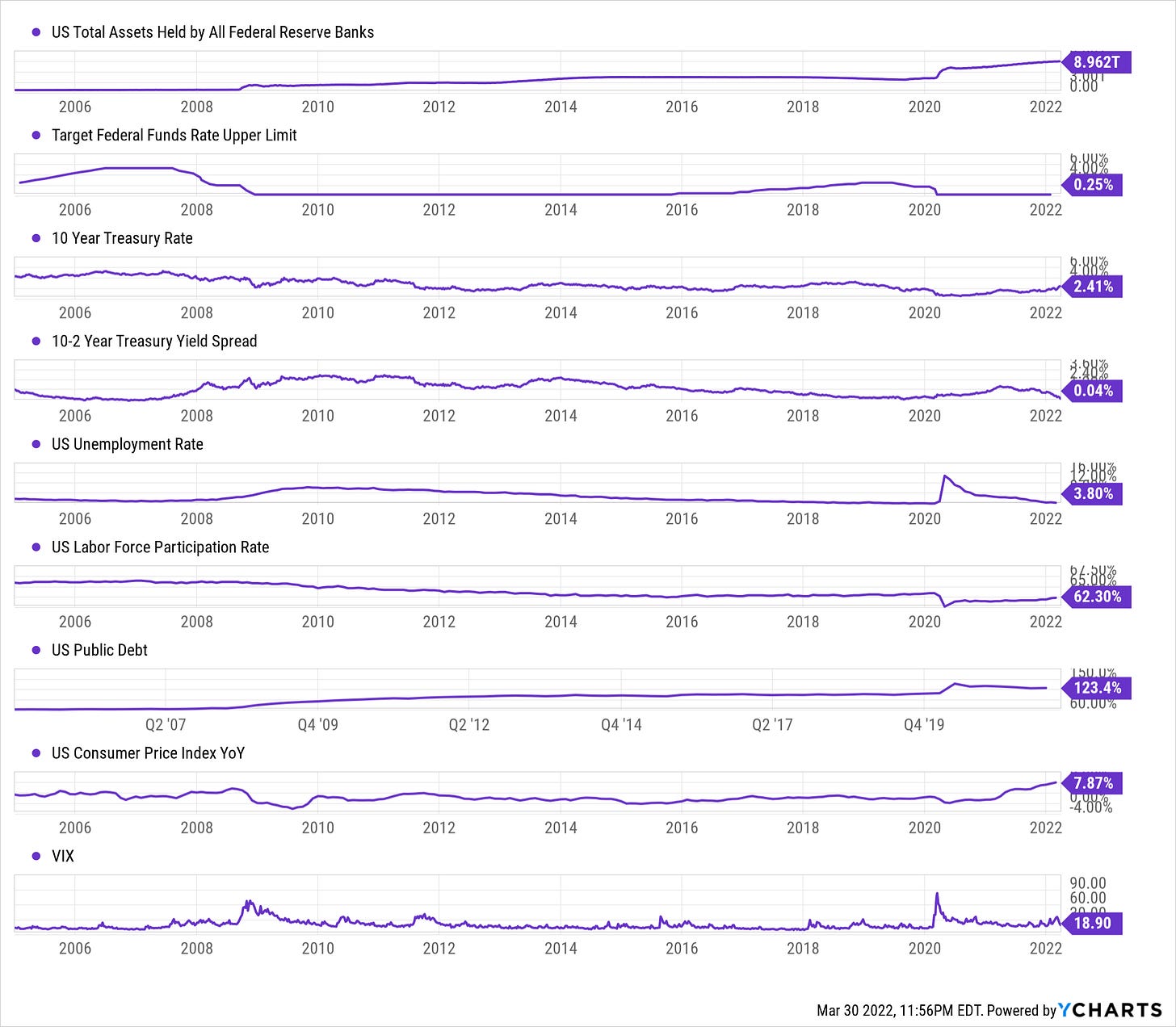

US yield curve inverts in possible recession signal - “Two-year Treasury note yields rose above those of the 10-year for the first time since August 2019, inverting a portion of the yield curve monitored closely by Wall Street and policymakers. Inversions typically signal malaise about the economy’s long-term growth prospects and have preceded every US recession in the past 50 years.” Here are some ideas on where to hide…

An Interview with Nvidia CEO Jensen Huang about Manufacturing Intelligence - this is a Ben Thompson (Stratechery) interview with Nvidia CEO Jensen Huang on the heels of Nvidia’s GTC conference.

SPACs are on the chopping block thanks to the SEC’s latest proposal - Remember all those questionable SPACs last year? They aren’t happening at quite the rate they used to, and now we know SPACs are squarely in the sights of regulators. Investment banks profited handsomely during the pandemic as investors craved risk-on assets which dispropotionately came public via SPACs (because it was easier). The SEC is going to throttle this back and not many people will be pushing back on this. De-SPAC ETF tracks the perfromance of the De-SPAC Index. You can probably bet that this will squeeze banks, as will the flattening yield curve.

The Big Automotive Semiconductor Problem

China

Evergrande: the end of China's property boom | FT Film - The property sector 12% of employment, land sales account for ~1/3 of local government fiscal revenue. Evergrande is going to default, what are the downstream effects? This video proposes that the Evergrande situation may be a sign of the begining of a systemic crash in China, not dissimilar to the collapse of Lehman and the Great Financial Crisis.

China / Russia - A few weeks ago, the news inundated us with the idea that China might feel empowered by Russia to take Taiwan. While there might be similarities in the situation, the reality is that China is very dependent on the west. I think the saying goes… Don’t bite the hand that feeds you.

The worlds reserve currency. The US has an enviable role as the world’s reserve currency. Two moves this week seek to undermine that position.

Supplemental Data

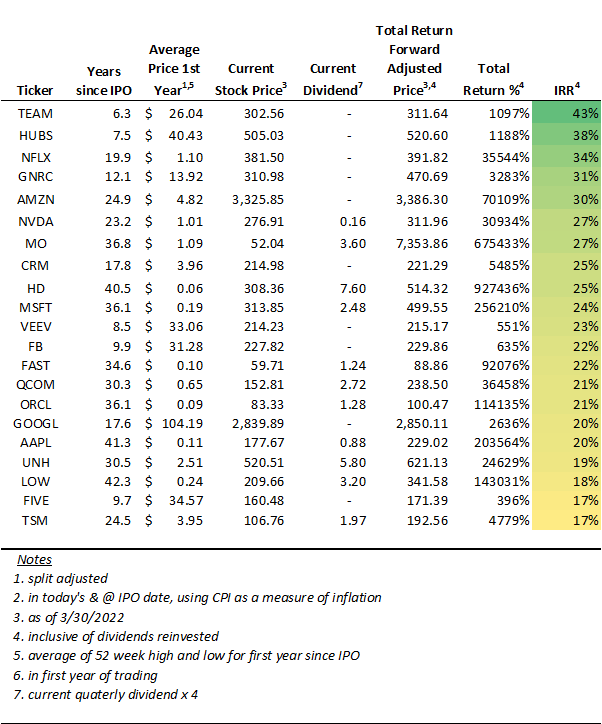

1 SuperCompounders

2 Macro

3 Energy

4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

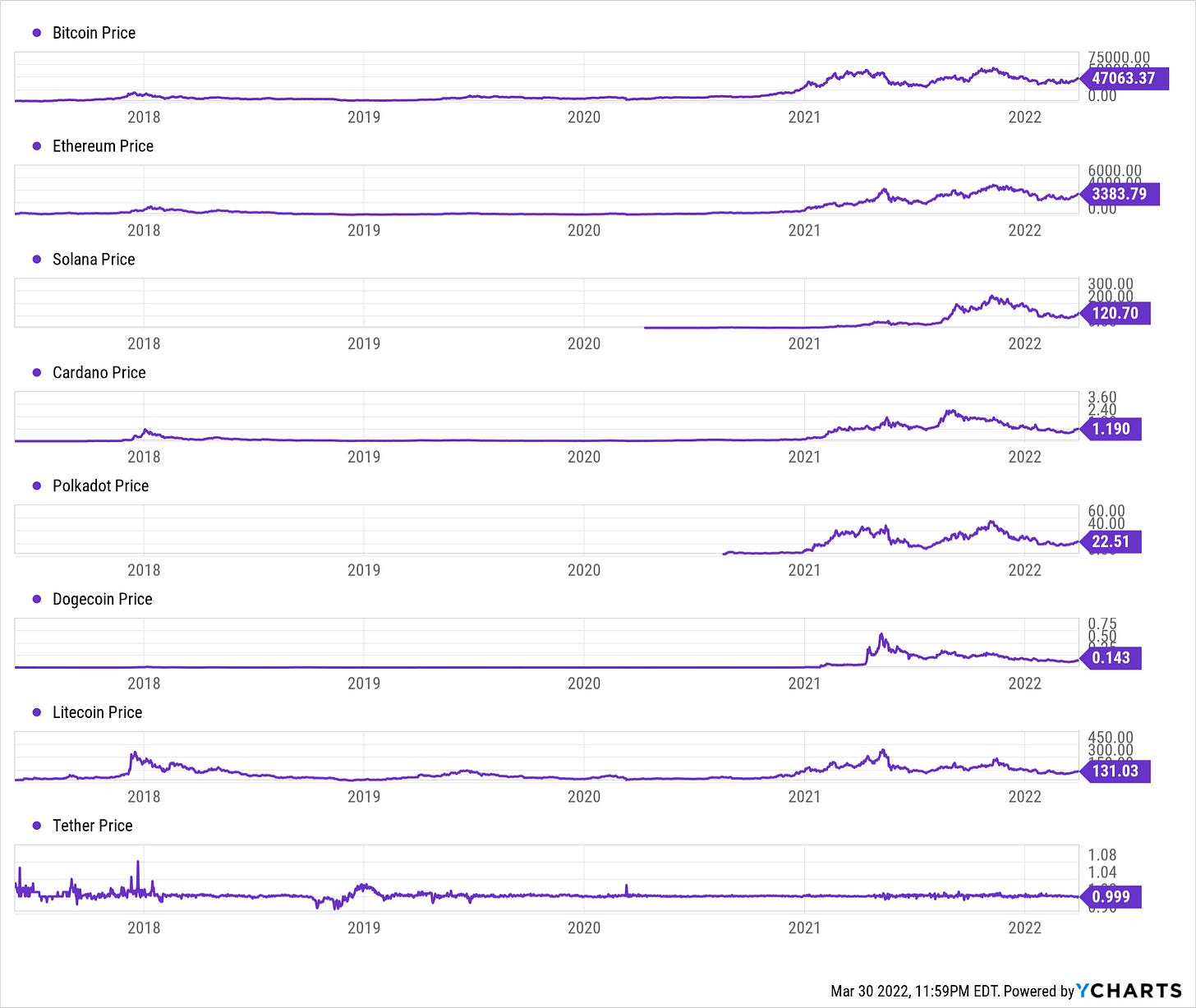

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.