If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

1. Perspectives on investing in abroad

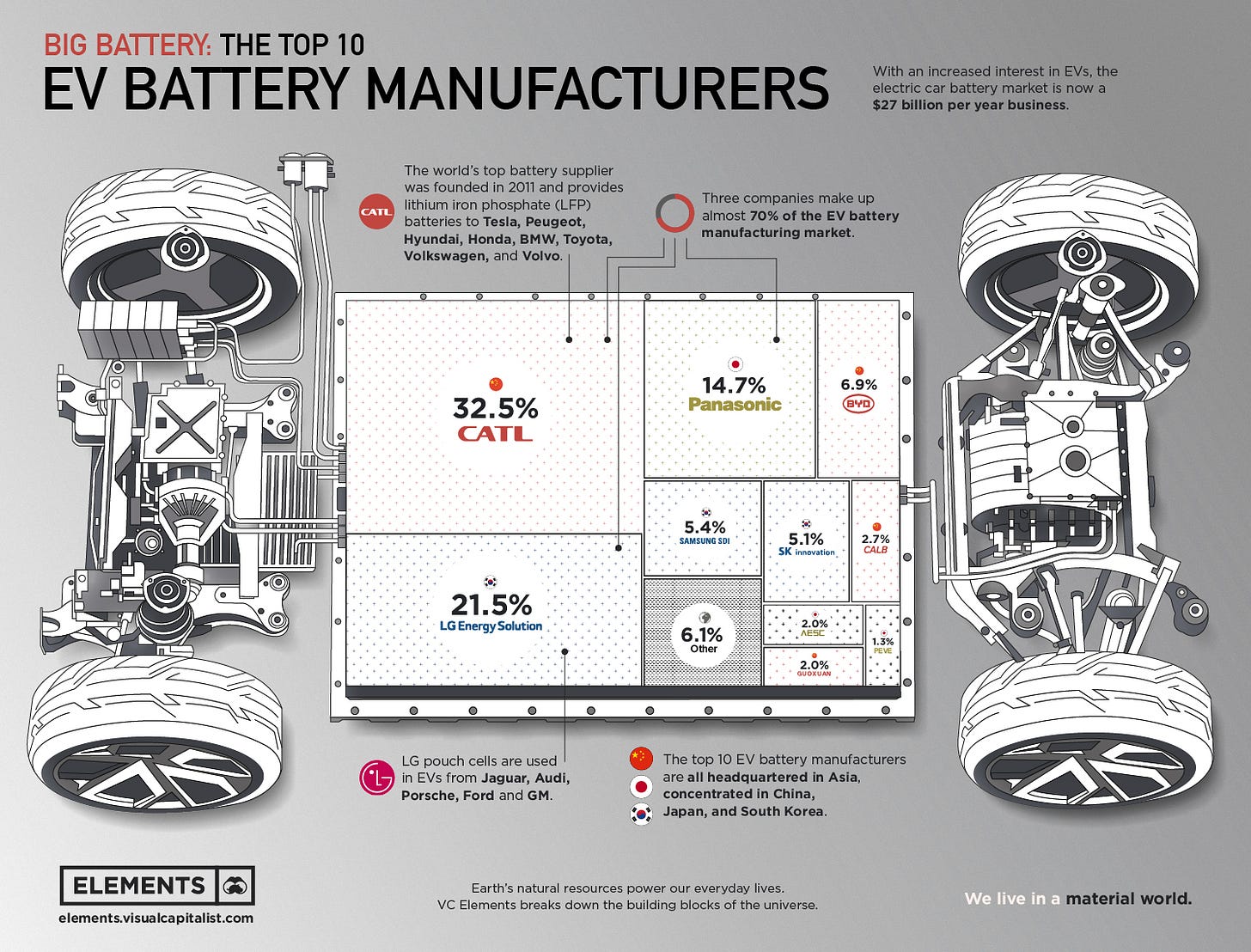

This week we discussed the transition of energy from hydrocarbon to renewable sources. It appears that batteries are going to be the component that makes that transition possible. At the very least, it is clear that over the course of the next couple decades, batteries will be a core component to delivering energy for transportation purposes.

The image below depicts the top 10 battery manufacturers. You will notice that none of them are based in the US or Europe. That is not to say that nothing interesting is happening in the US. There are many venture backed and recently SPACed battery manufactures, and most notably Tesla has developed some of it’s own battery IP. One thing of note is that EV’s are about more than the battery - check out the chart below, Tesla vehicles drastically outperform rivals on a core efficiency basis - which is a measure that captures not only the battery energy density, but also the rest of the vehicle design components that affect efficiency.

With that in mind, if you want exposure to the leading automotive battery manufacturers, you must go overseas. We’ve discussed the challenges with investing overseas in the past. It’s an area I’ve been contemplating for some time now.

Here are two videos you may enjoy that touch on China. The first is Charlie Munger who holds a large position in Ali Baba. The second Cliff Smith, one of my business school professors, and his “10 concerns for 2022”, which touch on China as well.

1.1 Charlie Munger Q&A at daily journal

1.2 Cliff Smith’s top 10 concerns for 2022

2. Supplemental Data

2.1 SuperCompounders

2.2 Macro

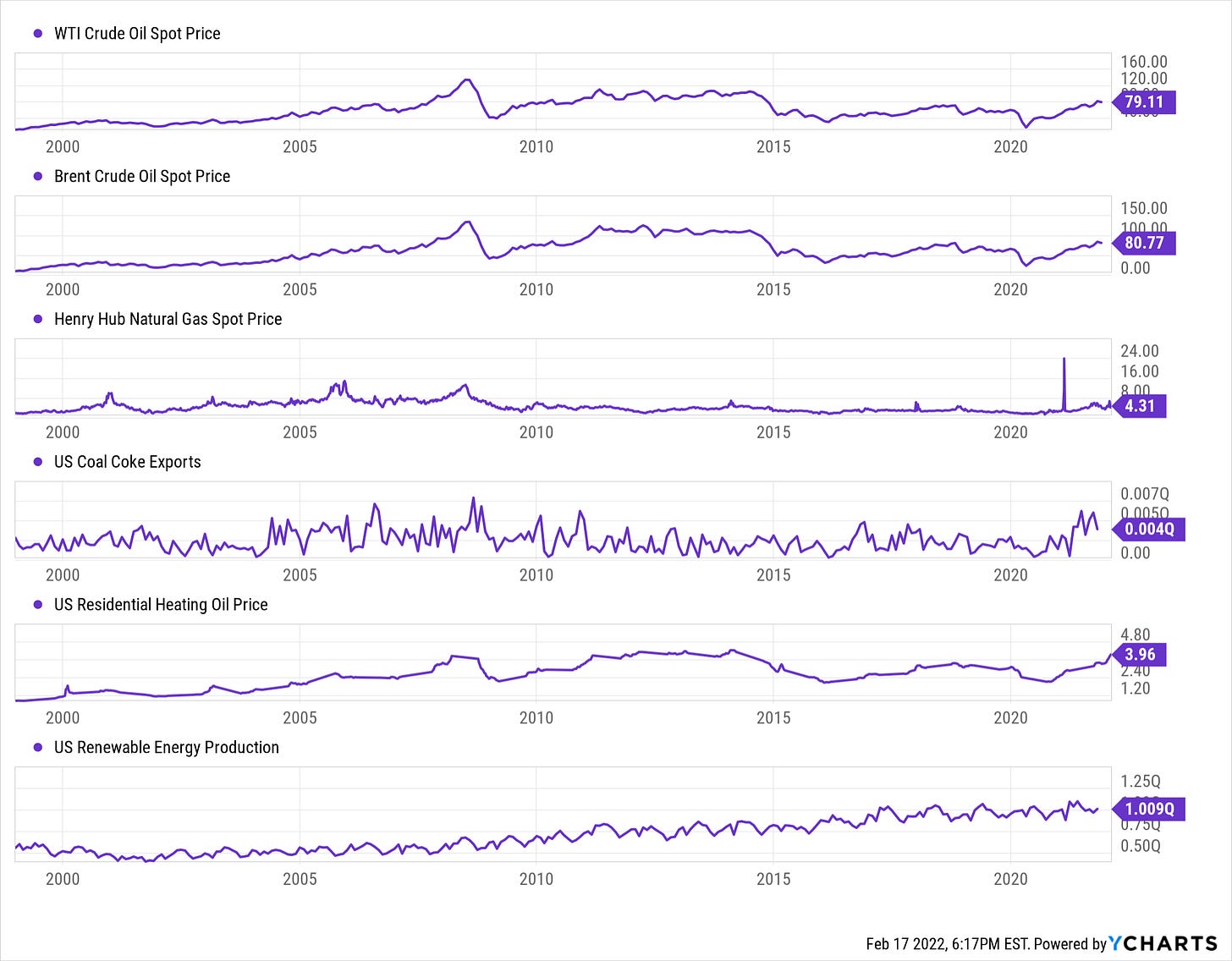

2.3 Energy

2.4 Tech

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.