Happy Thanksgiving! Thanksgiving is my favorite holiday. Hope you are able to spend it with the ones you love. If you are new, join the crew subscribing here:

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the call/podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the following posts:

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

Tech Topic: SaaS Correlations to Interest Rates

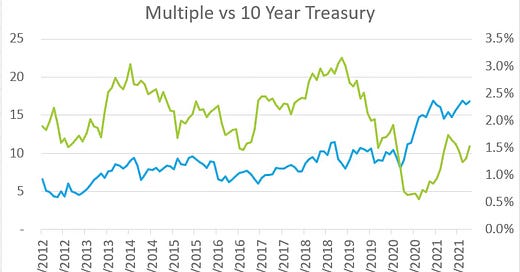

Today we talked a bit about the impact on interest rates on stocks in general, and SaaS businesses specifically. Higher interest rates reduce the value of future cash flows. Many SaaS companies generate low, or even negative, levels of free cash flow. As a result, one would think that SaaS businesses would be particularly susceptible to changes in long term interest rates - namely, we would expect to see a negative relationship monthly change in SaaS Multiple vs monthly change in the 10 year treasury rate. Market movements related to the changes in the 10 year US treasury rate have historically not been very correlated (in fact, slightly positive) as you can see from the charts below.

If you run a regression on these figures, going back to 2012, you will find that changes in interest rates have a small but significant impact on explaining changes in SaaS multiples. However, starting in 2021, the correlation has become extremely negatively correlated.

In the 4.21.21 edition of Clouded Judgement, Jamin Ball observed…

Over long periods of time the 10 Year Treasury and cloud multiples aren’t very correlated. However, there are times of extreme correlation. Since cloud multiples peaked in February the correlation between the 10 Year and cloud multiples is -0.95. This level of correlation is extremely high. Some attribute the start of the correlation to the point in time when the 10 Year started to maintain (and grow) above 1%. Even in the last 2 days you can see the 10 Year dip a bit, and multiples come back up

Whatever the cause, we are seeing extreme negative correlation this year.

Tech Topic: ConstitutionDAO FAIL

So last week I referenced the the crypto consortium of of ‘investors’ (err.. donors) that were building a DAO (Decentralized Autonomous Organization) to attempt to buy the a rare, original copy of the US Constitution.

Unfortunately for the DAO’s supporters, the DAO lost the auction in spite of raising ~$40 million dollars, twice what Sothebys expected the artifact to sell for.

I thought this would be a great opportunity to learn a bit about web3, unfortunately I quickly realized that gas fees would eat up all of my intended contribution ($50) and eliminate any possible redemption.

Doug Clinton, investors at Loup Ventures and author of the Uncomfortable Profit blog provides an overview as to why they lost - hint, it wasn’t because they didn’t raise enough money.

Supplemental Data

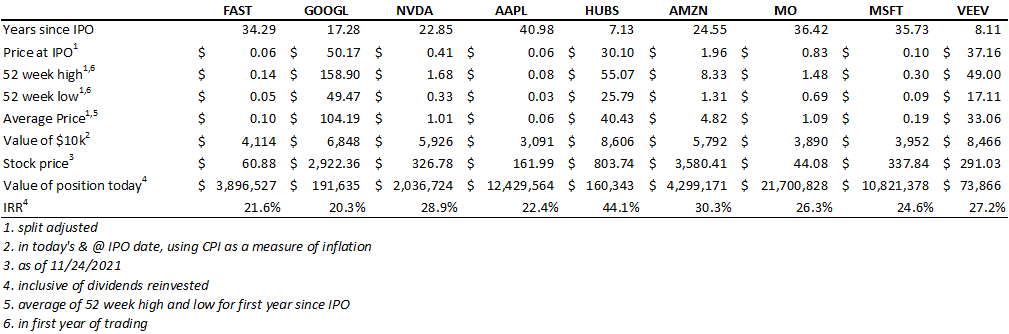

Supercompounders

Energy Data

Macro

Tech

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

Cryptocurrency

Cloud Multiples

Check out the most recent edition of Clouded Judgement for the latest SaaS multiples. Also, this week Ball covers the topic of growth durability - long story short - best in class SaaS companies are seeing long term durable growth at higher rates than ever before.

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.