E2220 - May 18, 2022

Recession Looming? Implications of ARM in the data center, streaming wars, Tesla, and lots of charts.

If you are new to Telltales, welcome! It’s great to have you here. This newsletter is designed to complement our weekly call/podcast and ultimately enable you develop your ability to think critically and independently about investments.

Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What is Telltales? post.

Every week I will provide additional data to supplement our weekly Telltales podcast. You can get the podcast on Apple Podcasts, Spotify, or SoundCloud. Follow along with this newsletter to stay up to date!

Recession Looming?

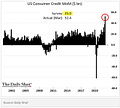

After the Q1 negative GDP read, there has been a lot more talk about the US entering a recession. The chart below implies that a lot of consumer spending is being financed by credit cards. This is a precarious position given inflation. That being said, the job market still appears to be strong and the labor force participation rate (see macro section below) still has room to come up. Will be keeping an eye on this.

ARM in the Data Center

2022 is widely believed to be a big year for data center growth. Chip companies from Intel to AMD to Nvidia are all forecasting big data center quarters. However, ARM based servers are creeping in. Amazon launched its 3rd ARM based cpu on AWS at the end of last year. It is pretty easy to migrate from X86 EC2 instance to an ARM based Gravitron instance. This seems to save customers >20%. Customers appear to be plowing those savings right back into AWS and Snowflake…

Streaming Wars

New data show that people who have been subscribers to Netflix for more than three years accounted for a significantly greater share of cancellations in the first quarter than they did two years earlier.

Over the past couple years, streaming benefited from reduced competition (i.e. going outside and spending time with people). Meanwhile streamers (Netflix, Disney, Hulu, HBO, Discovery, Amazon, etc) poured more resources into content production. This is driving additional competition in an industry where there are very low switching costs. I expect to see reduced content investments by the streamers (especially Netflix), more aggressive pricing, and maybe even a shift back to bundling in the wake of slowing (or negative) growth.

Metals Powered Economy

On the podcast this week we said we’d dig into Tesla, and some other companies that are leading the charge to what we’ve been calling the ‘metals powered economy’. Here are two interviews from the last week with Tesla founder Elon Musk. Both videos have interesting insights on the future of energy, supply constraints, and why Tesla is quite different from other car companies.

Supplemental Data

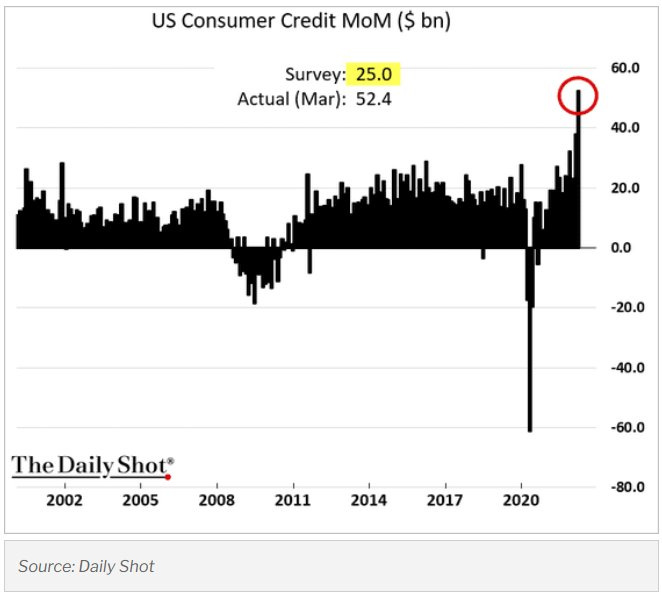

1 SuperCompounders

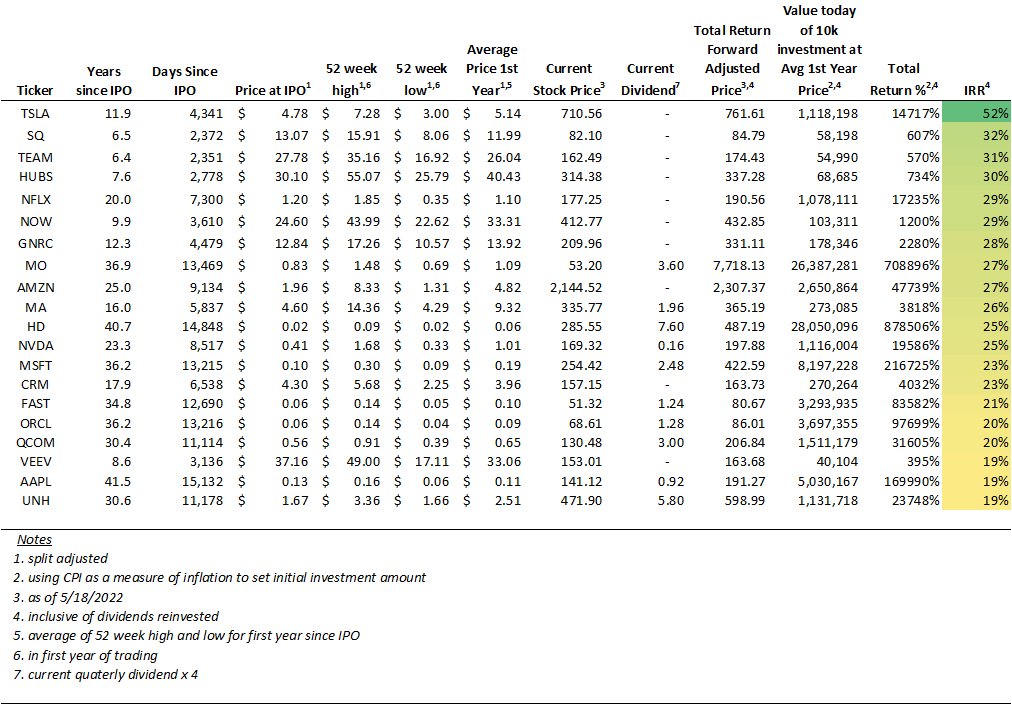

2 Macro

3 Energy

3.1 Oil & Gas

3.2 Metals Powered

4 Tech

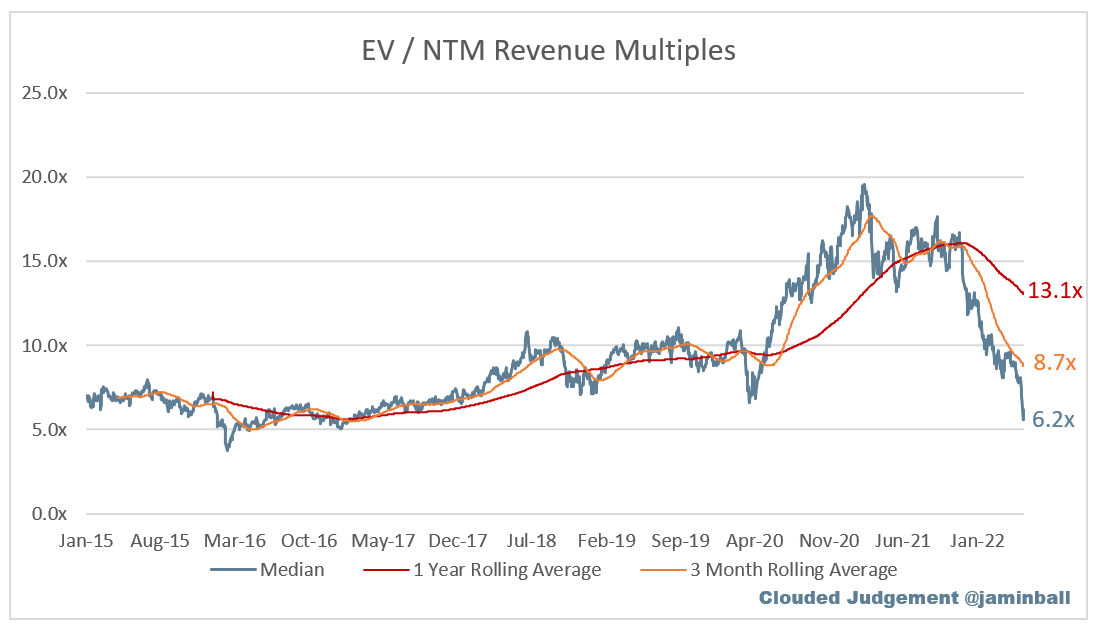

Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples.

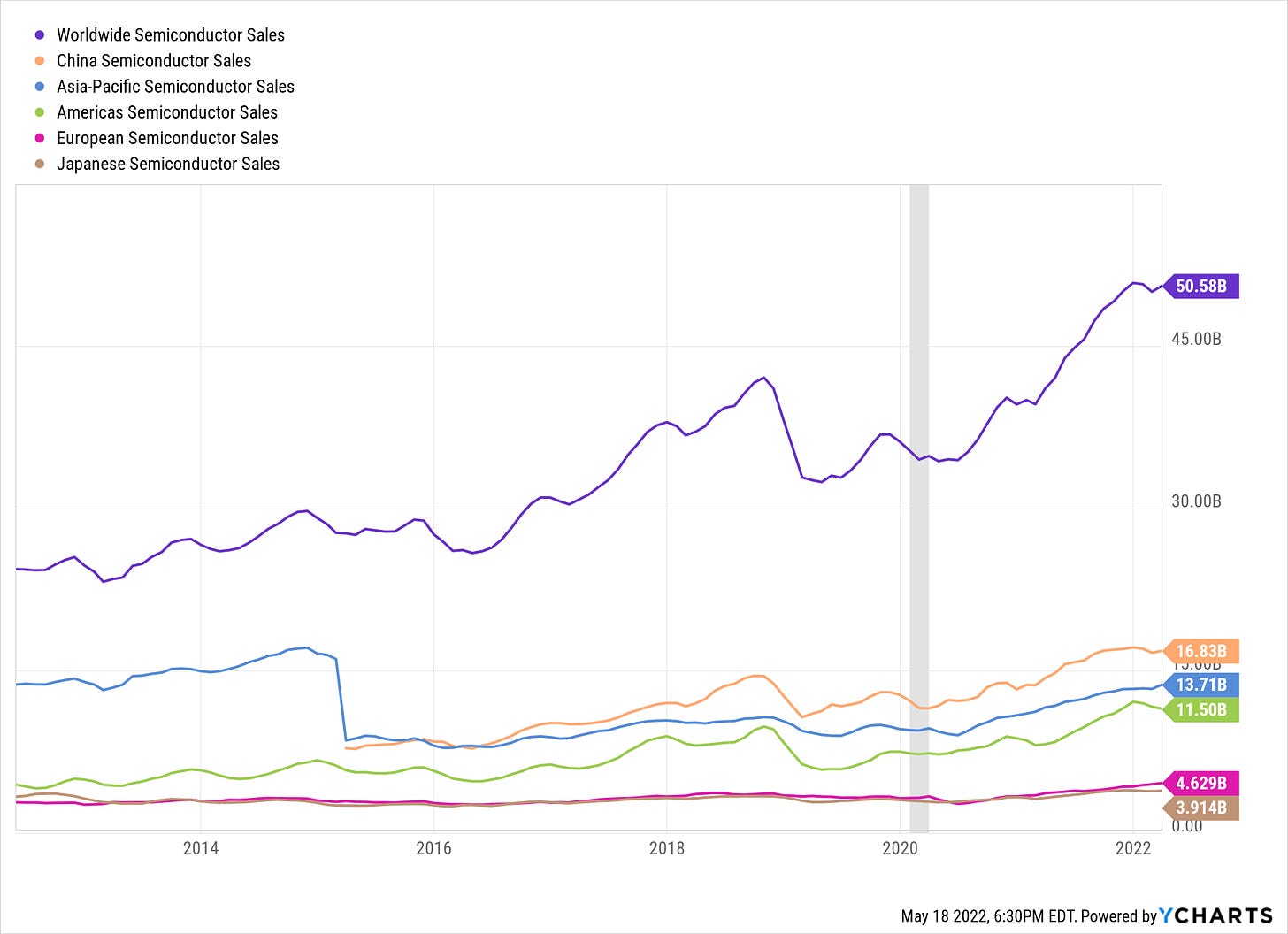

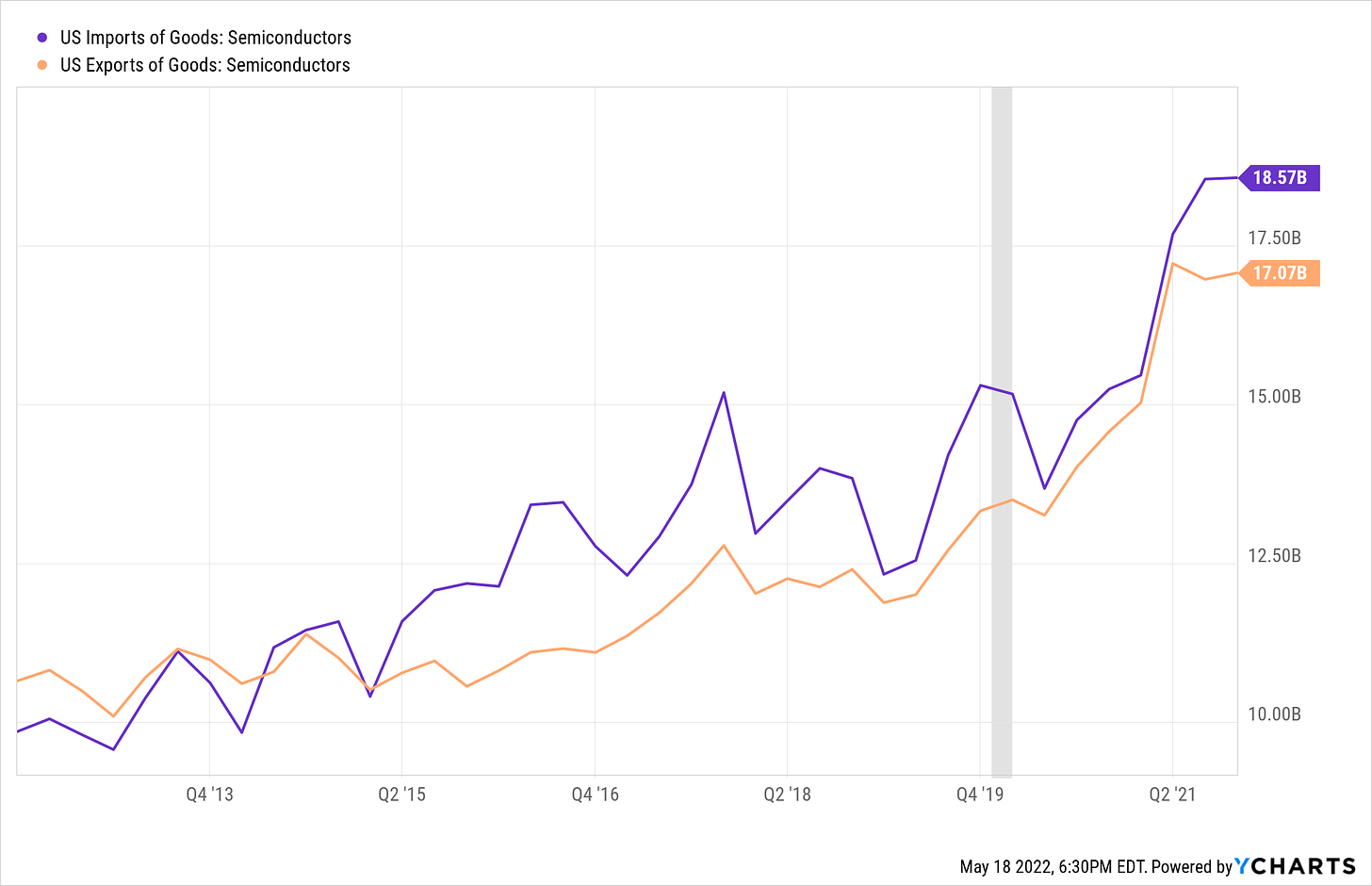

Semiconductors

Semiconductor Industry Association Global Billings Report

Bureau of Economic Analysis Semiconductor Import / Export

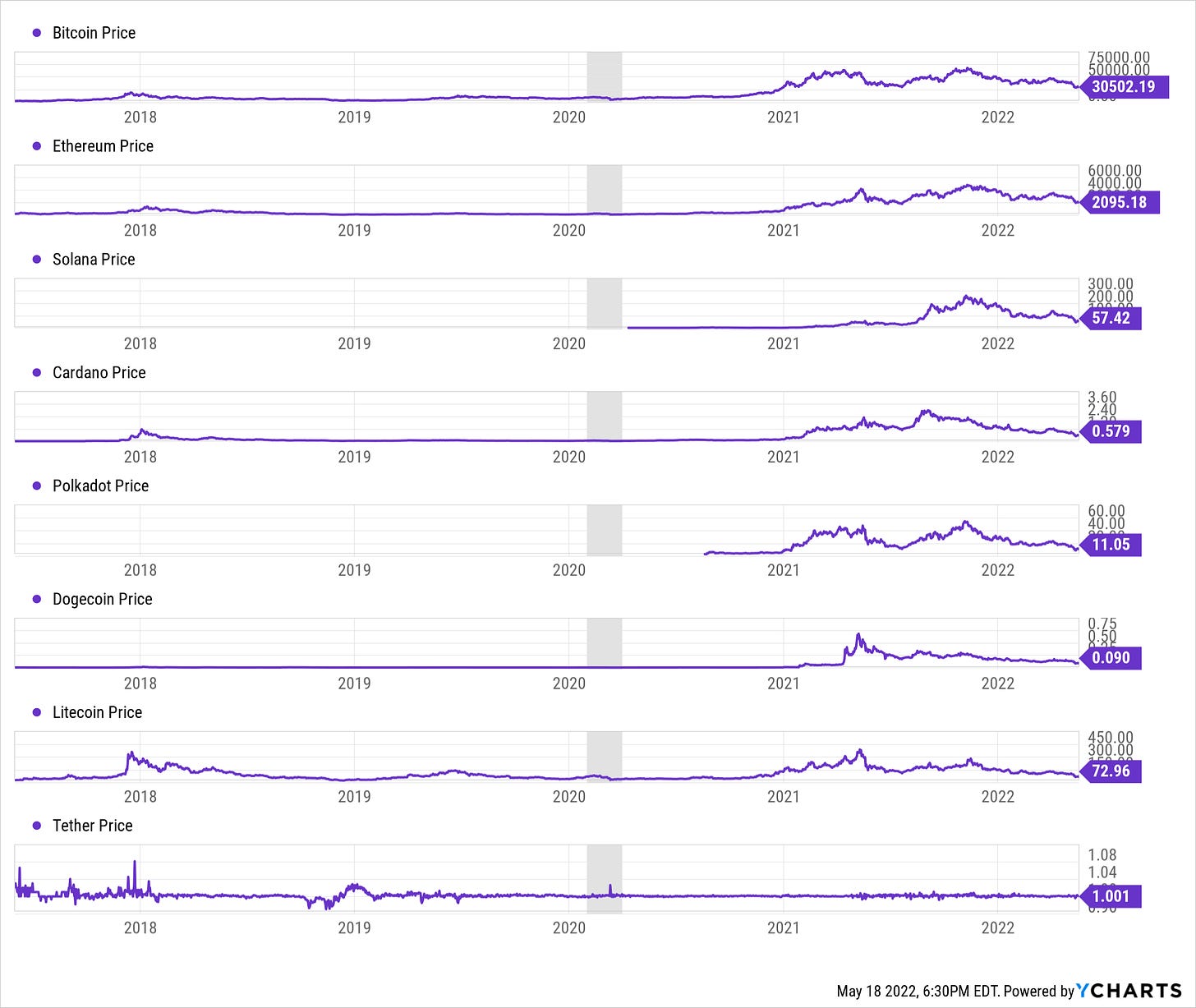

Cryptocurrency

How did you like this week’s Telltales? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?

This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.